Thiel Capital, a powerhouse in the world of venture capital, stands as a testament to strategic investment and innovative foresight. Founded by Peter Thiel, this firm has become a cornerstone in the financial landscape, providing pivotal support to emerging technologies and groundbreaking ideas. With its headquarters nestled in the heart of Silicon Valley, Thiel Capital operates with a keen eye for disruptive potential, setting the stage for transformative ventures to flourish.

Driven by a distinctive investment philosophy, Thiel Capital has carved out a unique niche by backing companies that challenge the status quo. The firm’s approach focuses on identifying visionary entrepreneurs with the ability to create monopolistic businesses that redefine industries. This strategy has not only fueled the growth of numerous startups but has also solidified Thiel Capital’s reputation as a trailblazer in venture capitalism. Its impact is not limited to financial returns but extends to societal advancements through the support of pioneering technologies.

As the digital era continues to evolve, Thiel Capital remains at the forefront, navigating the complex landscape of innovation. Through a combination of strategic investments, expert guidance, and a robust network, the firm leverages its resources to empower the next generation of leaders and innovators. This article delves into the multifaceted world of Thiel Capital, exploring its history, investment strategies, and the visionary leadership that propels it forward. Join us on a comprehensive journey into the heart of one of the most influential venture capital firms of our time.

Table of Contents

Biography of Peter Thiel

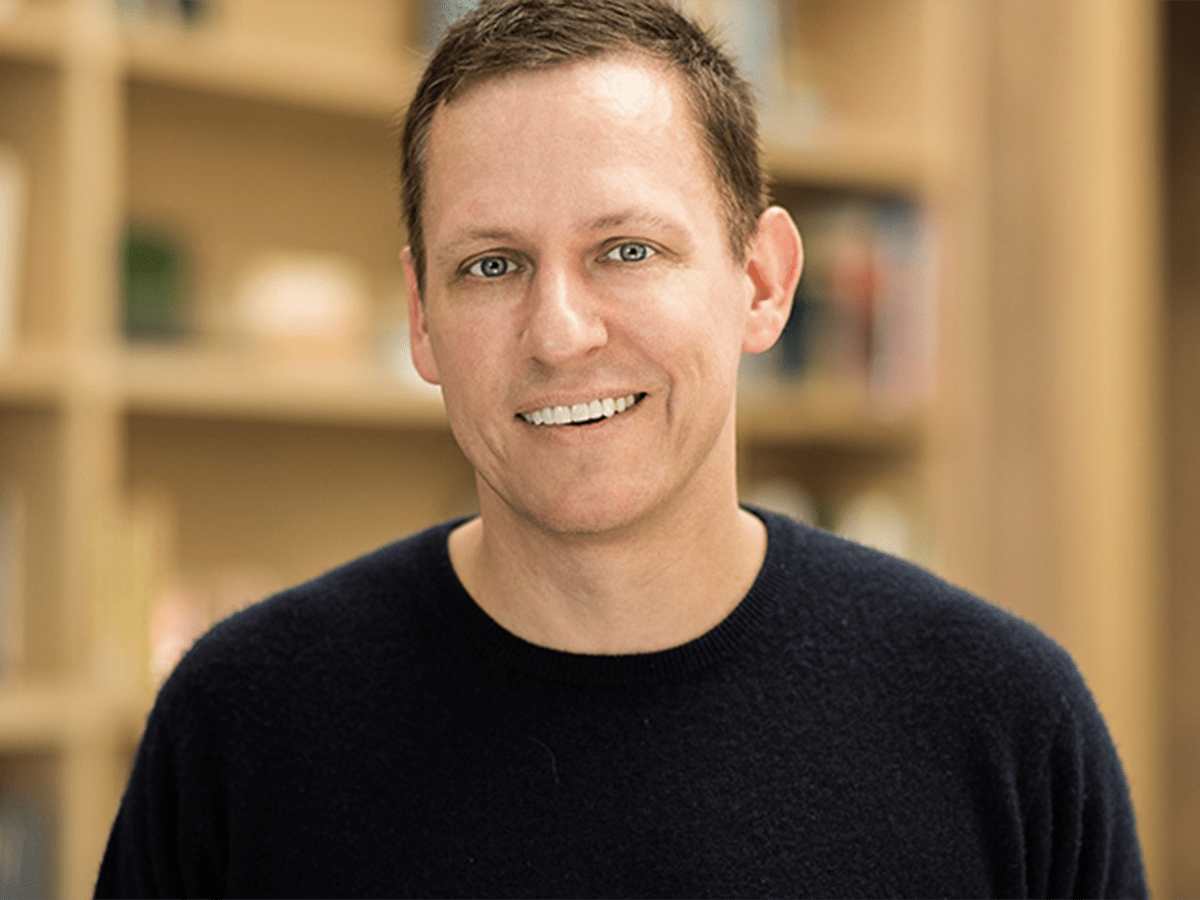

Peter Thiel, the visionary behind Thiel Capital, is a prominent figure in both the tech world and the financial sector. Born on October 11, 1967, in Frankfurt, Germany, Thiel moved to the United States with his family when he was a child. He attended Stanford University, where he earned a Bachelor of Arts in Philosophy and later a Juris Doctor from Stanford Law School. His early career was marked by a series of entrepreneurial ventures, most notably the co-founding of PayPal, which revolutionized online payments and established Thiel as a formidable force in Silicon Valley.

Thiel's career trajectory is characterized by his ability to foresee technological trends and invest in impactful innovations. After PayPal's success, he went on to launch Clarium Capital, a global macro hedge fund, and Palantir Technologies, a big data analytics company that has played a crucial role in government and business analytics. His investment acumen is further demonstrated by his early backing of Facebook, which positioned him as the first outside investor in the social media giant. Through these ventures, Thiel has not only amassed significant wealth but also a deep understanding of the intersection between technology and finance.

Thiel's influence extends beyond his business ventures; he is also a noted philanthropist and author. His book, "Zero to One," co-authored with Blake Masters, provides insights into startup creation and innovation, advocating for the creation of new monopolies rather than competition. Thiel's thought leadership in technology and entrepreneurship continues to inspire aspiring entrepreneurs worldwide, making him a pivotal figure in shaping the future of innovation.

Personal Details and Bio Data

| Full Name | Peter Andreas Thiel |

|---|---|

| Date of Birth | October 11, 1967 |

| Place of Birth | Frankfurt, Germany |

| Education | Stanford University (BA, JD) |

| Notable Ventures | PayPal, Palantir Technologies, Clarium Capital |

| Books | "Zero to One" |

| Philanthropy | Thiel Foundation |

The Founding of Thiel Capital

Thiel Capital was established in 1996 as a multi-stage investment firm that manages the personal investment funds of Peter Thiel and his network of associates. The firm was born out of Thiel’s vision to create a platform that could support and nurture groundbreaking ideas from inception to maturity. Located in San Francisco, the firm operates in the heart of the technology ecosystem, allowing it to remain close to the pulse of innovation.

The founding of Thiel Capital was driven by Thiel’s belief in the transformative power of technology and the potential for startups to change the world. This belief is reflected in the firm’s investment strategy, which prioritizes companies that demonstrate the ability to create monopolies by introducing revolutionary products or services. Thiel Capital’s early investments include successful ventures such as PayPal and Palantir Technologies, which have become industry leaders in their respective fields.

As the firm grew, it expanded its focus to encompass a wide range of industries, including biotechnology, artificial intelligence, and fintech. This diversification allows Thiel Capital to hedge risks while maximizing opportunities for return on investment. Through strategic partnerships and a robust network of industry leaders, the firm has positioned itself as a key player in the venture capital landscape, consistently identifying and supporting the next wave of disruptive technologies.

Investment Philosophy and Strategy

Thiel Capital operates with a distinctive investment philosophy that sets it apart from traditional venture capital firms. The firm’s strategy revolves around the identification and support of companies with the potential to achieve monopolistic success. This approach is grounded in Thiel’s belief that competition is a hindrance to progress, while monopolies drive innovation and growth.

The firm’s investment strategy is characterized by a focus on long-term value creation rather than short-term gains. Thiel Capital seeks out companies with innovative technologies and business models that have the potential to redefine industries. The firm is particularly interested in ventures that operate at the intersection of technology and society, such as those in the fields of artificial intelligence, biotechnology, and fintech.

In addition to financial support, Thiel Capital provides strategic guidance and mentorship to its portfolio companies. The firm leverages its extensive network of industry leaders and experts to offer insights and resources that can help startups navigate the challenges of scaling and market entry. This holistic approach to investment has enabled Thiel Capital to foster the growth of numerous successful startups, many of which have gone on to achieve significant market dominance.

Notable Investments and Portfolio

Thiel Capital's portfolio is a testament to its strategic investment approach and its ability to identify companies with transformative potential. The firm has a track record of backing startups that have gone on to become industry leaders, including some of the most well-known names in technology and innovation.

Among Thiel Capital’s most notable investments is PayPal, a pioneering online payment platform that revolutionized digital transactions. As one of the co-founders, Thiel played a crucial role in the company’s early success, which ultimately led to its acquisition by eBay. This investment not only solidified Thiel Capital’s reputation but also provided a blueprint for future investment strategies.

Another significant investment is Palantir Technologies, a big data analytics company that has become a key player in government and business intelligence. Thiel Capital’s early support of Palantir exemplifies its focus on companies that utilize technology to address complex societal challenges. The firm’s investment in Palantir has yielded substantial returns and underscored the importance of data analytics in modern decision-making processes.

Other notable investments include Facebook, where Thiel was the first outside investor, as well as SpaceX, Airbnb, and LinkedIn. Each of these companies has achieved significant market success and transformed their respective industries, demonstrating the effectiveness of Thiel Capital’s investment philosophy.

Impact on the Technology Sector

Thiel Capital’s influence extends far beyond its financial investments; the firm has played a pivotal role in shaping the technology sector as a whole. By backing companies that challenge conventional norms and introduce disruptive technologies, Thiel Capital has contributed to the evolution of industries and the advancement of society.

The firm's impact is particularly evident in the fields of fintech and data analytics. Through its early investments in PayPal and Palantir Technologies, Thiel Capital has helped redefine how businesses and governments approach financial transactions and data-driven decision-making. These companies, supported by Thiel Capital, have set new standards for innovation and efficiency, paving the way for future technological advancements.

Moreover, Thiel Capital’s influence extends to the realm of artificial intelligence and biotechnology. By supporting startups that leverage cutting-edge technologies to address pressing global challenges, the firm has positioned itself at the forefront of technological progress. Thiel Capital’s investments in these areas not only drive financial returns but also contribute to the betterment of society, underscoring the firm’s commitment to positive social impact.

Leadership and Key Figures

Thiel Capital’s success is largely attributed to its leadership team, which is composed of experienced professionals with a deep understanding of technology and finance. At the helm is Peter Thiel, whose vision and strategic insights guide the firm’s investment decisions. Thiel’s leadership is complemented by a team of experts who bring a wealth of experience and knowledge to the table.

The firm’s leadership team includes partners and advisors who have played instrumental roles in the success of Thiel Capital’s portfolio companies. These individuals possess a keen ability to identify emerging trends and assess the potential of new technologies, allowing Thiel Capital to make informed investment decisions. Their expertise is further augmented by a robust network of industry leaders and innovators, providing the firm with access to valuable insights and resources.

Thiel Capital’s leadership is committed to fostering a culture of innovation and collaboration, both within the firm and across its portfolio companies. This approach has enabled the firm to attract top talent and forge strategic partnerships that enhance its ability to drive growth and success. Through its leadership, Thiel Capital continues to set the standard for excellence in venture capital, delivering value to its investors and contributing to the advancement of technology.

Future Outlook and Vision

As the technology landscape continues to evolve, Thiel Capital remains committed to its vision of supporting transformative innovations that have the potential to reshape industries and society. The firm’s future outlook is characterized by a focus on emerging technologies and the identification of new opportunities for investment.

Thiel Capital is particularly interested in the areas of artificial intelligence, biotechnology, and fintech, where it sees significant potential for growth and impact. By investing in startups that leverage these technologies to address global challenges, the firm aims to drive positive change and create long-term value for its investors.

In addition to financial returns, Thiel Capital is committed to making a positive social impact through its investments. The firm seeks to support companies that not only generate profit but also contribute to the betterment of society. This dual focus on financial success and social responsibility underscores Thiel Capital’s commitment to responsible investing and its vision for a better future.

Thiel Capital has garnered significant attention in the media due to its high-profile investments and the influence of its founder, Peter Thiel. The firm’s strategic approach to investment and its support of groundbreaking technologies have made it a frequent topic of discussion in financial and technology publications.

Media coverage of Thiel Capital often highlights the firm’s role in shaping the technology landscape and its impact on various industries. Articles and reports frequently explore the firm’s investment philosophy and its success in identifying companies with monopolistic potential. Thiel Capital’s influence extends to thought leadership, with Peter Thiel often sharing his insights on innovation and entrepreneurship through interviews and public appearances.

The firm’s presence in the media is further amplified by its involvement in philanthropic initiatives and social impact projects. Thiel Capital’s commitment to responsible investing and its focus on positive societal change are recurring themes in media coverage, reflecting the firm’s dedication to making a difference through its investments.

Challenges and Controversies

Like any influential entity in the venture capital space, Thiel Capital has faced its share of challenges and controversies. The firm’s involvement in high-profile investments and its strong presence in the technology sector have occasionally attracted scrutiny and debate.

One area of controversy has been Thiel Capital’s investment in companies that operate in sensitive industries, such as data analytics and surveillance. Critics have raised concerns about privacy and ethical considerations, prompting discussions about the role of technology in society and the responsibilities of investors in supporting ethical business practices.

Despite these challenges, Thiel Capital has maintained its commitment to its investment philosophy and continues to support innovative companies with the potential to drive positive change. The firm’s leadership remains focused on navigating these challenges with integrity and transparency, ensuring that its investments align with its values and vision for the future.

Philanthropy and Social Impact

Thiel Capital’s commitment to philanthropy and social impact is exemplified by its support of initiatives that address pressing global challenges. The firm, through the Thiel Foundation and other philanthropic efforts, seeks to make a positive difference in areas such as education, scientific research, and human rights.

The Thiel Foundation, founded by Peter Thiel, is dedicated to promoting innovation and supporting breakthrough technologies that have the potential to improve the world. The foundation’s initiatives include the Thiel Fellowship, which provides funding and mentorship to young entrepreneurs, and Breakout Labs, which supports early-stage scientific research with the potential to lead to significant advancements.

Thiel Capital’s philanthropic efforts extend to partnerships with organizations that focus on social impact, including those that address issues such as poverty alleviation and access to education. Through these initiatives, the firm aims to contribute to the betterment of society and support the development of solutions that address critical global challenges.

Frequently Asked Questions

1. What is Thiel Capital's investment focus?

Thiel Capital focuses on investing in companies with the potential to achieve monopolistic success by introducing innovative technologies and business models that redefine industries. The firm is particularly interested in fields such as artificial intelligence, biotechnology, and fintech.

2. Who founded Thiel Capital?

Thiel Capital was founded by Peter Thiel, a prominent entrepreneur and investor known for his role in co-founding PayPal and his early investment in Facebook.

3. What are some notable investments made by Thiel Capital?

Thiel Capital has invested in several high-profile companies, including PayPal, Palantir Technologies, Facebook, SpaceX, Airbnb, and LinkedIn. These investments have contributed to the firm's reputation as a strategic and influential venture capital firm.

4. How does Thiel Capital contribute to social impact?

Thiel Capital contributes to social impact through its philanthropic initiatives, including the Thiel Foundation, which supports innovation and breakthrough technologies. The firm is committed to supporting projects that address global challenges and make a positive difference in society.

5. What is the Thiel Fellowship?

The Thiel Fellowship is an initiative by the Thiel Foundation that provides funding and mentorship to young entrepreneurs who are pursuing innovative projects and startups. The fellowship aims to support the next generation of leaders and innovators.

6. How does Thiel Capital address ethical concerns in its investments?

Thiel Capital is committed to responsible investing and supporting companies that align with its values and vision for the future. The firm navigates ethical concerns by ensuring transparency and integrity in its investment decisions and supporting ethical business practices.

Conclusion

Thiel Capital stands as a formidable force in the venture capital landscape, driven by a unique investment philosophy and a commitment to supporting transformative innovations. Through strategic investments and a focus on long-term value creation, the firm has played a pivotal role in shaping the technology sector and advancing societal progress. With a strong leadership team and a dedication to responsible investing, Thiel Capital continues to empower the next generation of entrepreneurs and innovators. As it looks to the future, the firm remains committed to driving positive change and contributing to the betterment of society through its investments and philanthropic efforts.

For more in-depth insights on venture capital and investment strategies, you can visit Investopedia, a comprehensive financial education resource.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJuforKltcJmqK6dlaPAcMDHopylZZOWvarAwKVloaydoQ%3D%3D