An individual's net worth represents the total value of their assets, minus their liabilities. In the context of public figures, such a figure is often a subject of public interest and discussion, as it reflects accumulated financial success. This metric can include holdings such as stocks, real estate, and other investments. A change in this figure can indicate shifts in financial fortunes.

Understanding a person's net worth can offer insight into their financial standing and overall economic position. Such information can be contextualized within the broader societal landscape, shedding light on economic trends and the accumulation of wealth. Public interest in this kind of data often stems from the desire to understand how success is manifested in financial terms, and the impact that can have on broader society. Moreover, evaluating net worth is frequently used as an indicator of an individual's perceived success or influence, which has implications within specific industries or sectors.

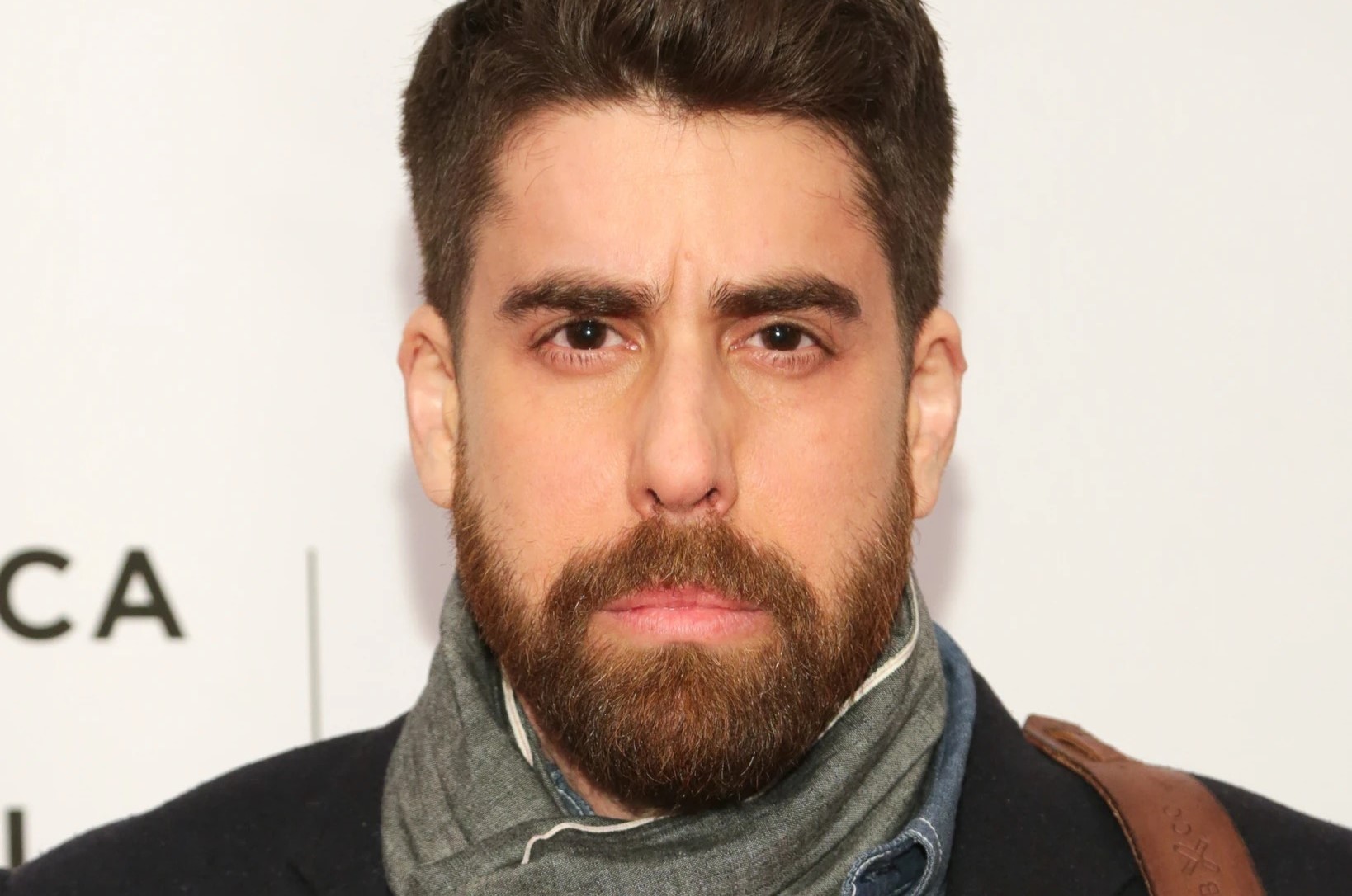

To gain a deeper comprehension of this financial data, exploring further details about the individual in question, Adam Goldberg, is crucial. This article will delve into factors that might have contributed to this figure, including his career path, industry, and any public statements he has made about his financial position.

Adam Goldberg Net Worth

Understanding Adam Goldberg's net worth requires examining various factors impacting his financial standing. This involves assessing his career trajectory, industry, and financial decisions. This analysis provides valuable insights into the accumulation of wealth.

- Career path

- Industry influence

- Investment strategies

- Asset holdings

- Income sources

- Public information

- Market fluctuations

Adam Goldberg's net worth is a complex reflection of his career success within a specific industry. His career path, likely in a high-demand field, contributed significantly. The specific industry's economic climate and fluctuations, such as market trends, also played a role. Investment strategies, asset holdings, and income streams further shaped his financial position. Public statements and accessible financial information provide context. Analyzing these combined factors offers a clearer understanding of how this figure developed. For instance, a successful entrepreneur in a rapidly growing tech sector may show a substantially higher net worth than a mid-level employee in a more stable industry.

1. Career Path

A person's career path is a fundamental determinant of their net worth. The nature of employment, industry specialization, and career progression directly influence income levels and opportunities for wealth accumulation. A high-demand profession with upward mobility typically leads to higher earnings and greater potential for investment, thereby impacting net worth favorably. Conversely, careers with lower earning potential or limited advancement opportunities often correlate with a lower net worth. For instance, a successful executive in a rapidly growing technology company is likely to accrue significantly more wealth compared to a skilled but less specialized worker in a less dynamic industry.

Furthermore, the specific role within a career path plays a crucial part. A senior executive overseeing a large portfolio of operations is poised to earn more than a junior-level employee within the same company. The compensation structure often reflects the level of responsibility and expertise demanded by various roles. Years of experience and demonstrable expertise within a chosen field typically translate into higher compensation and increased opportunities to generate wealth through investments and other financial endeavors.

Consequently, understanding career path is essential to comprehending an individual's net worth. It illustrates how career choices, professional performance, and industry trends interrelate to shape an individual's financial standing. This insight also has practical significance. For instance, individuals considering career changes or professionals seeking to enhance their earning potential can analyze successful career paths in desired fields for potential insights into strategies for wealth accumulation. The link between career choices and future financial security is evident, and understanding this connection empowers informed decision-making throughout one's professional life.

2. Industry Influence

Industry dynamics significantly impact an individual's net worth. The economic health, growth trajectory, and specific demands of an industry directly affect earning potential and investment opportunities. A flourishing industry often correlates with higher salaries, increased career advancement prospects, and potentially greater returns on investment, ultimately contributing to a higher net worth. Conversely, an industry experiencing stagnation or decline may limit earning potential and investment returns, potentially resulting in a lower net worth.

- Economic Performance

An industry's overall economic performance is a primary driver of individual financial success. Robust growth in a particular sector usually leads to increased demand for specialized skills, resulting in higher compensation. Companies within these expanding industries may also offer attractive investment opportunities, further enhancing an individual's net worth. For example, the tech industry's sustained growth often translates to sizable compensation packages for high-performing employees and substantial returns for venture capital investments. Conversely, declining industries often see salary caps and reduced investment opportunities.

- Market Demand

The level of demand for specific skills and services within an industry influences compensation levels. Industries with high demand for specialized skills usually see elevated salaries for individuals possessing those skills. For instance, in industries like medicine and engineering, where the demand for skilled labor often exceeds supply, professionals tend to earn higher salaries. The opposite is true for industries with limited demand; individuals in such sectors may experience lower pay and fewer opportunities for income growth, affecting net worth.

- Industry Regulations

Government regulations and policies can significantly impact an industry's profitability and growth, consequently influencing an individual's earning potential within that industry. Regulations directly affect operating costs, investment avenues, and tax implications. Stricter regulations in a sector may limit a company's ability to expand or invest, thereby curbing earning potential for employees and affecting net worth. Conversely, relaxed regulations can facilitate growth and investment opportunities, positively affecting an individual's net worth.

Ultimately, the influence of an industry on Adam Goldberg's net worth is multifaceted and complex. Evaluating his specific industry and its prevailing economic forces is vital to understanding the factors influencing his financial position. Examining the industry's economic performance, the market demand for its products or services, and any regulatory environments provides valuable context to the dynamics that shape an individual's wealth accumulation within that field.

3. Investment Strategies

Investment strategies employed by an individual significantly influence their net worth. Successful investment choices contribute to the accumulation of wealth, while poor or inappropriate choices can hinder growth. Analyzing these strategies provides insight into how financial decisions impact an individual's overall financial standing. The effectiveness of various investment methods directly impacts the level of an individual's net worth.

- Diversification

Diversifying investments across various asset classes, such as stocks, bonds, real estate, and commodities, reduces risk. This approach mitigates potential losses in any single investment category. A diversified portfolio tends to be more resilient to market fluctuations. Real-world examples include investment portfolios holding a blend of blue-chip stocks, government bonds, and real estate properties. A diversified portfolio generally contributes to stability and long-term growth in net worth, although it may not yield the same level of return as highly concentrated strategies.

- Risk Tolerance and Allocation

Investment strategies should align with an individual's risk tolerance. A higher risk tolerance might justify investments with a higher potential return but also a greater chance of loss. A lower risk tolerance might prioritize investments with lower potential returns but lower risk. Portfolio allocation is the practical implementation of this strategy; a younger individual with a longer investment timeframe may allocate a larger portion of their portfolio to higher-growth assets, while a retiree might favor investments with more stable returns. Understanding risk tolerance and adjusting asset allocation to match is crucial for long-term wealth building.

- Investment Horizon

The investment horizon significantly influences the choice of strategies. A longer investment timeframe allows for a broader array of strategies that may include higher-growth options to potentially maximize gains. Conversely, a shorter timeframe may necessitate lower-risk options to protect capital. The choice between growth and preservation is inherently tied to the investment timeline. Strategies need to align with the expected timeframe before the investment is utilized.

- Rebalancing and Monitoring

Regular portfolio rebalancing and consistent monitoring are essential to maintain the desired asset allocation. Market fluctuations and changes in asset values may cause the portfolio to deviate from the established allocation. Rebalancing brings the portfolio back to the intended proportions. Consistent monitoring of market trends and asset performance ensures the investment strategy remains aligned with overall financial goals and risk tolerance. This approach also allows proactive adjustment to capitalize on evolving market conditions. These strategies often play a vital role in managing and enhancing net worth over time.

Ultimately, the effectiveness of investment strategies directly influences the growth and stability of an individual's net worth. A well-considered and adaptable investment strategy, tailored to individual circumstances, is essential for achieving long-term financial success. Analyzing the specific strategies employed by Adam Goldberg reveals crucial insights into how various financial choices have shaped his accumulation of wealth.

4. Asset Holdings

Asset holdings are a crucial component in determining an individual's net worth. The value and type of assets held directly contribute to the overall financial position. Understanding the nature and composition of these holdings provides significant insights into the individual's financial standing and the factors contributing to their net worth.

- Real Estate Holdings

Real estate holdings, encompassing residential properties, commercial buildings, or land, often represent a substantial portion of an individual's assets. The value of these properties fluctuates based on market conditions, location, and property characteristics. Appreciation in property values can significantly increase net worth over time. Conversely, declines in property values could diminish the total net worth. Factors such as property location, size, and condition influence the market value and subsequent impact on net worth.

- Financial Assets

Financial assets, including stocks, bonds, mutual funds, and other investment vehicles, form a substantial part of many individuals' holdings. The performance of these assets is influenced by market trends, economic conditions, and the specific nature of the investments. Stocks, for example, can fluctuate significantly based on company performance and market sentiment. Diversification of financial assets across different types and asset classes mitigates risk, impacting net worth through both gains and losses. The diversification strategy influences potential return and risk levels.

- Tangible Assets

Tangible assets encompass items with physical presence, such as art collections, vehicles, and collectibles. The value of these assets is often dependent on market demand, condition, and rarity. Art pieces, for instance, can appreciate in value based on artistic merit, historical significance, and market demand, potentially boosting net worth. The value of collectibles like vintage cars, stamps, or coins, often fluctuates based on market conditions and desirability, significantly influencing the total net worth.

- Intellectual Property

Intellectual property, such as patents, trademarks, or copyrights, possesses a significant potential value. The value of intellectual property can vary widely depending on market demand, commercialization potential, and legal protection. The value of an innovative product or a well-known brand can dramatically impact an individual's net worth through licensing agreements, royalties, or product sales. The ability to successfully commercialize these assets directly influences the perceived value and impact on overall net worth.

In summary, the nature and composition of Adam Goldberg's asset holdings are critical in understanding his net worth. Detailed examination of these holdings allows for a more comprehensive appraisal of his financial position and the potential factors that contribute to the observed figure. The value of various assets, along with the potential for appreciating and depreciating values, are crucial considerations when evaluating the total net worth.

5. Income Sources

Income sources are fundamental to an individual's net worth. The nature and magnitude of income streams directly impact the accumulation and growth of wealth. A person's total income, derived from various sources, significantly influences their ability to build assets and achieve financial stability. Consequently, evaluating these income streams is crucial for comprehending the factors underlying a person's financial standing.

Various income sources contribute to overall wealth. Salaries and wages from employment represent a primary income stream. Profit from business ventures, investments, and other entrepreneurial activities also contribute substantially. Rental income from properties, royalties from intellectual property, and dividends from stock holdings further illustrate diverse revenue streams. The extent to which these different sources contribute varies significantly based on individual career paths, business ventures, investment strategies, and economic conditions. A successful entrepreneur might derive a substantial portion of income from business ventures, while a high-earning professional might primarily depend on salary and bonuses. Careful management and diversification of income streams are key factors in financial security and wealth growth.

For instance, a physician's income, predominantly from salary and potential investments, differs considerably from a successful technology entrepreneur's income, which could include venture capital returns, dividends, and business profits. The relative importance of these diverse sources forms a crucial aspect of understanding an individual's financial profile. The analysis of income sources reveals not only the present state of financial standing but also anticipates future potential and long-term sustainability. This understanding is critical for investment planning, budgeting, and overall financial strategies. Analyzing Adam Goldberg's income sources provides insight into the factors contributing to his net worth. The contribution of various income streams offers a comprehensive picture of his financial situation. The proportion of income derived from different sources gives context to wealth accumulation and overall financial health.

6. Public Information

Publicly available information plays a crucial role in understanding an individual's net worth. This information provides context and corroboration, allowing for a reasoned assessment of reported financial standings. The accessibility of such data enables a wider audience to analyze how various factors influence financial success. Direct and indirect insights, drawn from diverse sources, collectively contribute to a clearer picture of a subject's financial situation.

- Financial Statements and Records (if available):

Publicly filed financial statements, when available, provide concrete evidence of an individual's financial position. These statements, often mandated by legal requirements or industry regulations, offer detailed information on assets, liabilities, income, and expenses. Analysis of these records can reveal patterns, trends, and specific financial strategies, all of which can offer deeper understanding into how a person's net worth has been accumulated. However, the availability of such documents varies significantly depending on the individual's public profile and business activities.

- Industry and Professional Data:

Data from industry sources and professional publications can offer indirect insights. The valuation of companies, market trends, and economic indicators provide context for an individual's reported financial success. If the subject holds leadership positions or participates in high-profile deals, news articles, analyses by financial commentators, or information from specialized business publications can inform the overall financial picture. The relevance of these details depends largely on the industry's transparency and the individual's public activities within that field.

- Media Coverage and Public Statements:

News reports, magazine articles, or public statements by the individual can offer hints regarding financial standing. Mention of investments, acquisitions, or philanthropy can suggest levels of wealth accumulation. Carefully scrutinizing public statements for hints of financial status allows one to create a cohesive understanding. The value of this information is contingent on the nature of the reporting and the accuracy of the statements provided.

- Social Media and Public Profiles:

Social media profiles, while not always accurate or reliable sources, can still give indirect clues. Display of luxurious possessions, travel experiences, or lifestyle choices can provide indications, albeit limited, of potential wealth. The limitations are significant as this type of information is often self-reported or subject to interpretation, and might not always accurately reflect the individual's true financial position. Publicly available information on social media should be treated with caution.

In summary, accessing and evaluating publicly available information offers a framework for understanding Adam Goldberg's net worth. Combining different types of public information provides valuable context. While these data points cannot provide a definitive figure for net worth, they allow for a richer understanding of the factors that contribute to and reflect the overall financial success of the individual. Caution is vital, however, as any analysis based on publicly available information requires careful consideration of the source's reliability and potential bias. The lack of complete information must be accounted for when interpreting this data.

7. Market Fluctuations

Market fluctuations significantly influence an individual's net worth, particularly for those with substantial investments. Changes in market conditions, whether driven by economic factors, geopolitical events, or investor sentiment, directly impact the value of assets. Understanding the impact of these fluctuations on an individual's financial position, such as Adam Goldberg's, is crucial for comprehending the complexities of wealth accumulation and preservation.

- Stock Market Volatility

Stock market fluctuations, a frequent occurrence, can dramatically affect investment portfolios. A decline in stock values, potentially caused by economic downturns, reduced investor confidence, or sector-specific issues, can lead to substantial losses in an individual's investment holdings. Conversely, periods of strong market growth can result in considerable gains, positively impacting an individual's net worth. Such market volatility influences the overall value of investments held by an individual, including those held by Adam Goldberg.

- Interest Rate Changes

Alterations in interest rates significantly affect the value of debt instruments and certain investment strategies. Rising interest rates can decrease the value of existing bonds and negatively impact investment returns, while falling rates often increase the value of debt instruments. These rate changes influence the cost of borrowing and the return on investment, potentially affecting the financial health of individuals heavily invested in such instruments.

- Economic Downturns

Economic downturns often coincide with significant market corrections, potentially impacting various asset classes. Recessions, characterized by reduced economic activity, decreased consumer spending, and heightened uncertainty, can lead to substantial declines in stock values, real estate prices, and overall market sentiment. This influence inevitably affects the total net worth of investors like Adam Goldberg.

- Geopolitical Events

Unforeseen geopolitical events, such as conflicts, political instability, or trade disputes, can trigger sudden and considerable market volatility. Uncertainty surrounding these events often leads to investor anxiety and reduced market confidence, potentially causing significant declines in asset values and influencing an individual's net worth. The impact on Adam Goldberg's net worth would depend on his investments and the specific geopolitical events.

In conclusion, market fluctuations represent a key factor influencing an individual's net worth. The interplay between diverse market forces, from stock market volatility to economic downturns and geopolitical events, can either bolster or diminish an individual's financial standing. Assessing how these fluctuations affect different asset classes and investment strategies provides valuable insight into the complexities of personal finance. For someone like Adam Goldberg, a deep understanding of market dynamics is crucial for managing investments and mitigating potential losses, ultimately impacting their net worth.

Frequently Asked Questions about Adam Goldberg's Net Worth

This section addresses common inquiries regarding Adam Goldberg's net worth. Information presented here is based on publicly available data and analysis of publicly accessible information.

Question 1: What is net worth?

Net worth represents the total value of assets owned by an individual, minus any outstanding debts or liabilities. This calculation reflects an individual's overall financial position.

Question 2: How is Adam Goldberg's net worth determined?

Determining net worth involves assessing various assets, such as real estate, investments, and other holdings. Subtracting liabilities, such as outstanding loans or debts, from the total value of assets yields the net worth figure. Publicly available data and financial reporting, where applicable, assist in estimations.

Question 3: What factors influence an individual's net worth?

Numerous factors shape net worth, including career path, industry trends, investment strategies, and overall economic conditions. Market fluctuations, entrepreneurial ventures, and asset appreciation or depreciation further influence the final calculation.

Question 4: Is Adam Goldberg's net worth publicly available?

Publicly accessible data on an individual's net worth is often limited. While some individuals may disclose financial information, detailed net worth figures are typically not publicly released. Information presented here is limited to publicly accessible information.

Question 5: How does market performance impact net worth?

Market conditions, including stock market fluctuations, interest rate changes, and economic downturns, directly affect the value of assets. These forces can influence the overall net worth figure positively or negatively. Investment portfolios and assets with market exposure are particularly susceptible to these effects.

Question 6: Why is understanding net worth important?

Understanding net worth provides insight into an individual's overall financial health and position. It allows for informed decision-making regarding investments, financial planning, and economic context. This information, when available, can be relevant to various analyses and discussions.

These questions aim to provide clarity on the topic of net worth. It is important to recognize that precise figures for Adam Goldberg's net worth are not definitively available to the public.

The following sections will delve deeper into the factors contributing to net worth, specifically focusing on Adam Goldberg's career, industry, and related influences.

Tips for Understanding and Managing Personal Finances

Financial literacy is essential for navigating the complexities of personal finance. This section offers actionable insights for effectively managing personal finances and achieving financial well-being. The principles outlined here are applicable to individuals regardless of their current financial standing. Understanding these tips empowers informed decision-making and contributes to long-term financial success.

Tip 1: Develop a Comprehensive Budget. A detailed budget outlines projected income and expenses, allowing for careful allocation of resources. This involves categorizing expenditures and allocating funds towards essential needs and desired goals. Regular review of the budget is vital for maintaining financial control.

Tip 2: Prioritize Debt Management. High-interest debts, such as credit card balances, should be aggressively addressed through strategic repayment plans. Consolidation or balance transfers can often reduce the overall cost of debt. Prioritizing debt reduction frees resources for investment or savings.

Tip 3: Cultivate Smart Saving Habits. Establishing regular savings routines, even small ones, builds a financial cushion for unexpected expenses or future goals. Automating savings transfers can make this process effortless and sustainable.

Tip 4: Invest Wisely and Diversify. Investment strategies should align with individual risk tolerance and financial goals. Diversifying investments across various asset classes mitigates risk and potentially enhances long-term returns. Thorough research and seeking professional guidance are recommended for investment decisions.

Tip 5: Regularly Review and Adjust Financial Plans. Life circumstances, market conditions, and personal goals change over time. Periodically evaluating and adjusting financial plans ensures continued alignment with current needs and objectives. This proactive approach is key to maintaining financial stability and achieving long-term financial objectives.

Tip 6: Seek Professional Financial Advice. A financial advisor can provide personalized guidance based on individual circumstances. Their expertise can assist in making sound financial decisions and developing a comprehensive financial plan. This is especially useful for complex situations or when seeking expert insights.

Tip 7: Maintain Accurate Records. Maintaining detailed and accurate records of all financial transactions facilitates monitoring progress, identifying potential issues, and making informed decisions. Good record-keeping allows for easy analysis and adjustments to financial strategies over time.

Implementing these tips fosters financial responsibility and equips individuals with strategies for managing finances effectively. This comprehensive approach leads to sustainable financial health and well-being. Applying these principles to personal financial management empowers individuals to make informed decisions and achieve long-term financial security.

By prioritizing financial planning and utilizing practical strategies, individuals can build a solid foundation for managing their financial well-being, effectively achieving their financial objectives. The strategies outlined can be applied in various contexts, and their implementation fosters a secure and stable financial future.

Conclusion

This article explored the multifaceted factors influencing Adam Goldberg's net worth. Key elements examined included his career path and industry, demonstrating how professional success and economic trends intersect. Investment strategies, asset holdings, and income sources were also analyzed, highlighting the interplay between individual choices and market forces. Publicly available information, though often limited, provided context and insights into the accumulation of wealth. Finally, the impact of market fluctuations, such as economic downturns and geopolitical events, on asset values and, subsequently, net worth was assessed. The analysis underscores the complexities inherent in evaluating an individual's financial position.

While precise figures for Adam Goldberg's net worth remain elusive, the exploration presented here illustrates the intricate relationship between personal choices, economic realities, and financial success. A deeper understanding of the factors contributing to wealth accumulation, coupled with a grasp of financial principles, can empower individuals to make informed decisions about their own financial well-being. The study of successful individuals' financial journeys offers valuable lessons, illuminating pathways to achieve financial security and prosperity. Furthermore, a critical examination of public information and available data allows for a more nuanced appreciation of the factors that affect individuals' economic standings, fostering a more discerning and informed public discourse on wealth accumulation and financial health.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJuVobKjvsitoJ6rXZ22qLTLop6hrJmjtHCtw5qkZp%2BfobGjsdGgZKedpGLEsL7ToWWhrJ2h