An individual's net worth represents the total value of their assets, minus any liabilities. In the context of public figures, this figure reflects accumulated wealth from various sources, such as investments, income, and property holdings. Assessing this figure can offer insights into an individual's financial standing and overall success in their chosen endeavors.

Determining and tracking the net worth of notable individuals, including those in the public eye, can be important for various reasons. It allows for comparisons across individuals in similar fields or industries, potentially illuminating trends, challenges, or successes. It can also offer a glimpse into the impact of personal choices and career decisions on financial outcomes. Furthermore, understanding wealth accumulation can serve as an illustration of economic principles at play. However, it's crucial to remember that net worth figures are snapshots in time, not necessarily indicative of current or future financial stability.

This information provides context for a comprehensive understanding of [Specific aspect related to Bobby Byrd]. Further exploration of specific details regarding his career, investments, and financial decisions would be necessary to delve deeper into this topic. This serves as a foundational overview, which can be helpful for readers interested in [Specific topic area, for example: understanding the dynamics of wealth accumulation in the entertainment industry].

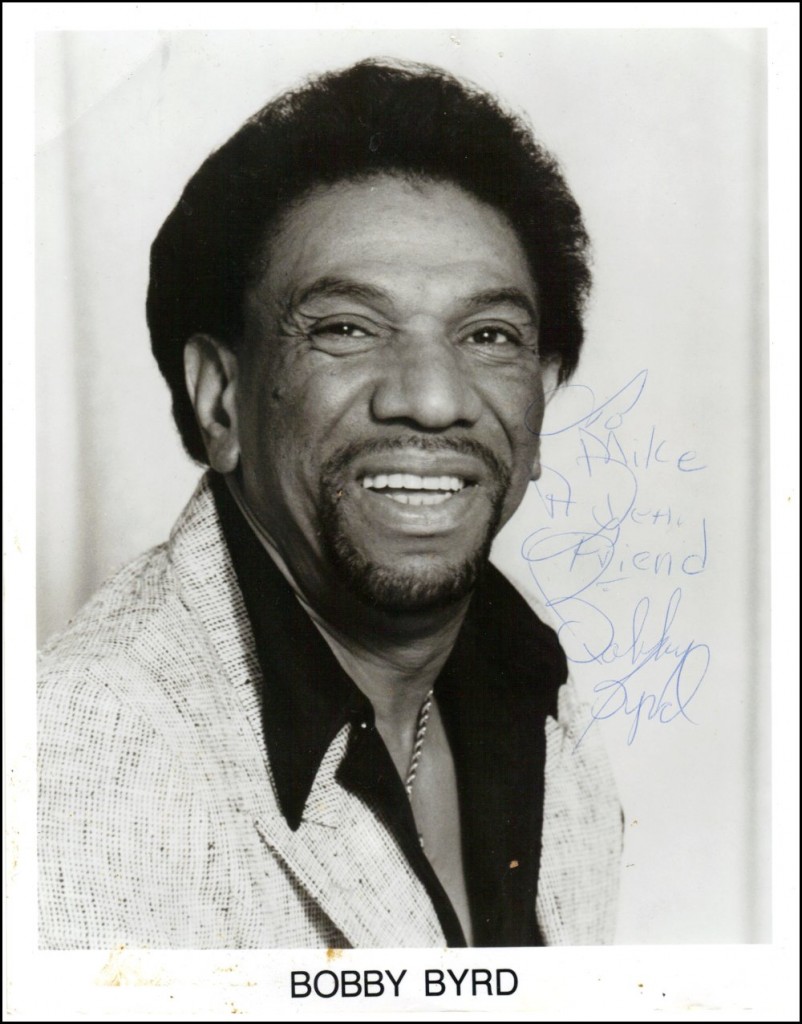

Bobby Byrd Net Worth

Understanding Bobby Byrd's net worth provides insight into his financial standing and success. Analyzing key aspects illuminates the factors contributing to this figure.

- Assets

- Income Sources

- Investments

- Liabilities

- Financial Decisions

- Career Impact

- Public Perception

Bobby Byrd's net worth, a measure of his financial standing, is influenced by various factors. Assets, such as property and investments, contribute significantly. Income sources, including earnings from his career, also play a crucial role. Liabilities, like outstanding debts, reduce the net worth figure. His career choices and financial decisions undoubtedly impacted the accumulation (or not) of assets. Public perception might affect his worth in the market or public image, although indirectly. A comprehensive understanding necessitates further research into the specifics of these categories. For example, analyzing specific investment strategies or the impact of career choices can reveal more about the complexities of accumulating wealth.

1. Assets

Assets are crucial components in determining an individual's net worth. They represent ownership of valuable items and resources. In the case of Bobby Byrd, assets could include real estate holdings, investments in stocks, bonds, or other financial instruments, and personal possessions of significant value. The total value of these assets, considered in relation to liabilities, directly impacts the calculation of net worth. For example, a substantial property portfolio contributes significantly to a high net worth, while extensive investment holdings can also increase net worth substantially.

The nature and value of assets are vital indicators of financial well-being. Real estate, a common asset, offers tangible value and potential for appreciation. Similarly, diversified investment portfolios can generate returns over time. The types and quantity of assets held reflect choices made regarding investment strategies and risk tolerance. Analyzing the composition of Bobby Byrd's assets can provide insight into his financial strategies and priorities, which in turn might illuminate patterns or trends in wealth accumulation. Examining details such as asset diversification and the historical performance of those investments is valuable for understanding potential influences on his net worth.

In summary, assets play a definitive role in defining net worth. The type, quantity, and value of assets held offer valuable insights into an individual's financial decisions and strategies. Understanding the relationship between assets and net worth is essential for assessing financial health, evaluating investment choices, and ultimately providing a comprehensive overview of financial standing.

2. Income Sources

Income sources directly influence an individual's net worth. The nature and volume of income streams determine the amount available for investment, savings, and ultimately, the accumulation of assets. A consistent and substantial income stream allows for greater wealth accumulation. Conversely, limited or fluctuating income hinders the growth of net worth. This relationship is fundamental to understanding financial well-being.

The specific sources of income are crucial. High-paying employment, investments generating returns, or income from business ventures each contribute to the overall financial picture. For instance, a professional athlete with substantial contracts and endorsements will likely have a higher net worth than a similarly situated individual with limited additional income sources. The diversity of income streams also plays a critical role. Individuals with revenue from multiple sources, potentially with varying levels of volatility, are often better positioned to weather economic fluctuations. Examples of such diverse income streams can include salary, interest from investments, royalties, or other passive income streams.

Understanding the connection between income sources and net worth is practical. It allows individuals to assess potential financial outcomes based on career choices and investment strategies. This understanding helps individuals plan for the future, manage finances effectively, and make informed decisions concerning various life stages, from early career to retirement. By analyzing past and current income streams, individuals can develop a more accurate picture of their financial health and make necessary adjustments to financial goals or strategies.

3. Investments

Investments play a significant role in shaping an individual's net worth. The nature and performance of these investments directly impact the overall financial standing. Analyzing investment strategies employed can provide insights into the factors contributing to the accumulation of wealth or lack thereof. This exploration examines various aspects of investments in relation to a person's overall financial status.

- Portfolio Diversification

Diversification is a key strategy in investment management. Spreading investments across different asset classes, such as stocks, bonds, real estate, or commodities, helps mitigate risk. A diversified portfolio is often less vulnerable to fluctuations in the value of a single asset class. For example, if stock prices decline, the value of other assets in the portfolio might offset some of the losses, providing a more stable long-term investment strategy. Understanding the role of diversification allows for a more informed assessment of the overall investment strategy employed, providing further context to the calculation of net worth.

- Investment Timing and Market Cycles

Investment timing and market cycles significantly influence the performance of investments. Entering the market during favorable periods or making adjustments based on market cycles can optimize returns. Conversely, poor timing can result in losses or missed opportunities. Economic conditions and market trends often impact investment performance. Historical data on market performance and investment timing can reveal insights into an investor's decision-making processes and risk tolerance, ultimately shaping the evolution of their overall net worth.

- Investment Returns and Growth

Investment returns and growth are fundamental to the accumulation of wealth. High-return investments, if managed effectively, can lead to substantial growth over time. The rate of return on different investments, as well as the consistency of those returns, are crucial indicators of an individual's investment success and the potential impact on net worth. Examples of significant investment returns in particular sectors provide context for analyzing the potential for overall wealth generation.

The specifics of an individual's investment portfolio, including diversification strategy, timing choices, and overall returns, directly impact their net worth. Understanding these aspects allows for a more comprehensive assessment of the financial health and success of individuals. Further examination of the historical context of investment performance in conjunction with broader economic conditions is crucial to fully understanding the contribution of investments to net worth and understanding investment decisions.

4. Liabilities

Liabilities represent financial obligations owed by an individual. In the context of Bobby Byrd's net worth, understanding these obligations is crucial for a complete picture of his financial standing. Liabilities, when considered alongside assets, provide a more accurate assessment of his true financial position, reflecting the financial responsibilities that impact his overall net worth. A careful analysis of liabilities can reveal insights into financial health and potential risks.

- Outstanding Debt

Outstanding debts, including loans, mortgages, credit card balances, and other outstanding financial commitments, directly impact net worth. High levels of outstanding debt reduce the net worth figure significantly. Examples include mortgages on properties, personal loans, or substantial credit card balances. The impact on Bobby Byrd's net worth would be a reduction, as these obligations represent amounts that must be repaid, thus diminishing the overall value of his assets. The size and terms of these debts influence the overall financial picture and highlight the portion of his assets allocated towards these obligations. Analyzing the nature and scale of these debts provides a clearer understanding of their influence on his financial position.

- Tax Liabilities

Tax obligations are crucial components of financial planning. Unpaid or underpaid taxes represent a liability impacting net worth. Specific tax liabilities, such as income tax, property tax, or sales tax, must be considered. The amount of unpaid taxes reduces the net worth figure and signifies potential financial risks. Analyzing tax liabilities helps identify any potential financial strain or risks associated with these obligations.

- Legal Obligations

Legal obligations, such as lawsuits or settlements, can represent substantial liabilities that reduce net worth. The existence and potential magnitude of these liabilities are important considerations when evaluating net worth. The ongoing nature of these obligations might signal broader financial risks and their impact on asset valuation. For instance, pending or outstanding legal obligations impact the overall financial outlook, showcasing a degree of uncertainty that must be acknowledged when assessing net worth.

In conclusion, considering liabilities alongside assets is crucial to a complete understanding of Bobby Byrd's net worth. The nature and magnitude of these financial obligations provide valuable insights into his financial health and potential risks. Examining the specific types of liabilities and their influence on net worth offers a comprehensive overview, enabling a more accurate assessment of his overall financial standing. This perspective enhances the understanding of the complexities associated with financial evaluations.

5. Financial Decisions

Financial decisions significantly impact an individual's net worth. The choices made regarding investments, spending, and saving directly influence the accumulation or depletion of assets. Effective financial decisions tend to correlate with increased net worth, while poor choices can lead to decreased wealth. This relationship holds true for individuals across various professions and socioeconomic backgrounds. For example, prudent investment strategies often result in higher returns, thereby bolstering net worth. Conversely, excessive spending or poor investment choices can diminish accumulated wealth, impacting the overall net worth.

The importance of financial decisions as a component of net worth cannot be overstated. A deep dive into Bobby Byrd's financial journey would involve examining specific choices regarding investments, asset management, and spending habits. Did he prioritize long-term growth or short-term gains? Were his spending patterns aligned with income levels, or did debt accumulation emerge as a consequence of certain financial decisions? Analysis of these details reveals how individual choices shape financial outcomes. Understanding these decisions is crucial for assessing the drivers behind his net worth.

Practical significance stems from the ability to learn from successes and failures. By examining historical patterns, it becomes possible to recognize potential pitfalls or identify effective strategies. The choices made by Bobby Byrd, as with any prominent figure, offer insights into general financial principles. A broader understanding of how financial decisions influence net worth can lead to more informed personal choices, enabling better resource management and potentially contributing to increased financial security. This understanding applies across varied professional sectors, enabling individuals to build financial literacy, develop strategies for building wealth, and adapt to changing market conditions.

6. Career Impact

A person's career significantly influences their net worth. The nature of employment, income levels, and career trajectory all contribute to the accumulation of wealth. A successful and lucrative career generally leads to higher income, providing more resources for savings, investments, and asset accumulation. Conversely, careers with lower earning potential or unstable employment often result in lower net worth. This correlation is evident in various professions and illustrates the practical link between career choices and financial outcomes. For example, high-earning professionals in demanding fields often demonstrate substantial net worth due to their higher salaries and potential for investment growth.

Bobby Byrd's career likely played a substantial role in shaping his net worth. The specifics of his profession, income levels throughout his career, and potential investment opportunities directly impact the total value of his assets. Analysis of his income trajectory over time, considering factors such as promotions, raises, and changes in industry trends, is critical. Did career progression coincide with increases in wealth? Were there any periods of career transitions or industry shifts that might have affected his earnings and subsequent savings potential? These details provide a framework for understanding the causal relationship between career choices and financial standing.

Understanding the connection between career impact and net worth is practically significant. For individuals and aspiring professionals, understanding this connection can inform career choices. Individuals can evaluate various career paths, considering potential income streams and future financial stability. For example, a student considering higher education might explore different career paths based on anticipated salary expectations and investment opportunities. Furthermore, this understanding can highlight the value of professional development and skills acquisition. Continuous learning and skill enhancement can lead to better career prospects and, consequently, a stronger financial foundation. Recognizing this relationship empowers informed decision-making and helps build a sound financial future.

7. Public Perception

Public perception, while not a direct financial metric, can influence an individual's net worth. Positive public image can enhance perceived value, leading to increased opportunities for business ventures, endorsements, and investment. Conversely, a negative reputation can deter potential investors, partners, or customers, affecting the market value of assets. This indirect but significant connection between public image and financial standing is illustrated in various industries, from entertainment to business.

Consider a celebrity whose public image deteriorates. This might result in lost endorsement deals, decreased demand for merchandise, and potential negative media coverage impacting the overall market value of their holdings. Similarly, a professional athlete with a strong public image often sees increased endorsements and merchandise sales, which can enhance their perceived net worth. The value of assets, such as a company's stock or a celebrity's image rights, can fluctuate based on the public's perception of their worth or standing. Public perception plays an important role in shaping investor confidence and overall valuation. For example, a company's stock price can dramatically increase or decrease based on news stories or public sentiment regarding the company. This illustrates the profound influence public opinion can have on a companys valuation and ultimately, its net worth.

Understanding the interplay between public perception and net worth is crucial for individuals in the public eye. A well-managed public image can be a significant asset, fostering opportunities and increasing perceived value, which in turn affects the valuation of investments and assets. Conversely, poor handling of public perception can potentially lead to diminished value, impacting future opportunities and income potential. By recognizing this connection, individuals can adopt strategies to maintain or enhance their public image, potentially strengthening their overall financial standing. Furthermore, understanding how public opinion impacts valuation allows for strategic adaptation and risk mitigation.

Frequently Asked Questions About Bobby Byrd's Net Worth

This section addresses common inquiries regarding Bobby Byrd's financial standing. Accurate information about net worth relies on publicly available data, and interpretations can vary. Specific figures are not always readily available.

Question 1: What is net worth, and how is it calculated?

Net worth represents the total value of assets minus liabilities. Assets include possessions of value, such as real estate, investments, and personal property. Liabilities represent outstanding financial obligations, including loans and debts. The calculation involves quantifying the total value of all assets and subtracting the total value of all liabilities.

Question 2: Where can I find publicly available data on Bobby Byrd's net worth?

Publicly available, detailed data regarding an individual's net worth is often limited. Reliable financial reporting usually involves verified sources such as financial publications or legal documents. However, estimates based on credible sources may be available from various financial publications or news outlets.

Question 3: How does Bobby Byrd's career impact their net worth?

A person's career directly influences their income and earning potential, which directly correlates to accumulating or depleting wealth. Higher-earning professions often allow for greater savings and investment opportunities, increasing net worth. Income fluctuations and industry trends during a career affect how wealth is accumulated.

Question 4: Can public perception affect Bobby Byrd's net worth?

Public image can indirectly impact financial valuation. A positive image can attract investment opportunities and endorsements, potentially enhancing net worth. Conversely, negative perceptions might reduce opportunities or affect asset valuations.

Question 5: Are there reliable sources to estimate Bobby Byrd's net worth?

While precise figures are often not available, credible financial publications and news outlets may provide estimated net worth figures based on available information. These estimates should be viewed as approximations rather than definitive values.

Question 6: Why is it important to understand net worth?

Understanding net worth, in the context of a public figure, offers insights into the accumulation of wealth, financial strategies, and the interplay between career decisions and financial outcomes. This kind of analysis can be helpful in understanding the influence of economic trends or career factors on financial security and success.

In summary, exploring net worth involves understanding the calculation of assets and liabilities, and acknowledging the indirect influence of public perception. While precise figures may be unavailable, reliable reporting can provide estimations of an individual's financial standing.

This concludes the FAQ section. The following section will delve deeper into [Specific Aspect of Bobby Byrd's life, e.g., his career details].

Tips on Understanding Net Worth

Understanding net worth involves a multifaceted approach, encompassing various factors that influence an individual's financial standing. This section offers practical guidance on analyzing and interpreting net worth, crucial for evaluating an individual's overall financial health and success.

Tip 1: Define "Net Worth" Clearly. Net worth represents the difference between an individual's total assets and total liabilities. Properly defining and understanding this concept is essential for any analysis. Assets include items of value, such as real estate, investments, and personal property. Liabilities represent debts, including loans, mortgages, and outstanding financial obligations. A clear definition ensures accurate calculation and interpretation.

Tip 2: Scrutinize Asset Composition. The types and values of assets held provide crucial insights. Real estate holdings, for example, often represent substantial wealth but come with varying levels of liquidity. Diversified investments across different asset classes, such as stocks, bonds, and real estate, can reduce risk. Analysis of asset diversification reveals risk tolerance and potential vulnerabilities.

Tip 3: Evaluate Income Sources. The consistency and volume of income streams impact an individual's ability to accumulate wealth. High-income earners with steady employment and stable income sources often have greater opportunities to save and invest. Analyzing income sources illuminates potential financial resilience and wealth accumulation strategies.

Tip 4: Assess Investment Strategies. Investment strategies, including diversification and risk tolerance, significantly impact net worth. Historical investment performance, adjusted for market conditions, provides insights into the effectiveness of choices made. An understanding of the chosen investment approach reveals the investment philosophy of the individual or entity and associated risk profiles.

Tip 5: Account for Liabilities Thoroughly. Liabilities represent financial obligations and should be considered critically. Outstanding debts, loans, and tax obligations all diminish net worth. Accurate identification and valuation of liabilities are crucial for an accurate assessment of financial health.

Tip 6: Consider the Role of Career. A person's career significantly influences their income and potential for wealth accumulation. High-earning professions often offer greater opportunities for savings and investments. Career stability and earning potential directly correlate with net worth.

Tip 7: Recognize the Impact of Public Perception (if applicable). In cases of public figures, public perception can indirectly influence net worth. A favorable public image may lead to increased opportunities (such as endorsements), potentially raising the perceived value of assets. Conversely, a negative image might deter opportunities, affecting asset valuation.

By employing these tips, individuals can gain a deeper understanding of net worth, its components, and the factors influencing its accumulation. This knowledge enhances the evaluation of financial standing and facilitates informed financial decisions.

Further analysis of specific cases, such as Bobby Byrd's, would require in-depth research into his particular career, investments, and financial history. A comprehensive understanding of such a case necessitates scrutinizing all relevant factors to assess the individual's financial health and stability.

Conclusion

Assessing Bobby Byrd's net worth necessitates a comprehensive examination of various factors. Analysis of assets, income sources, investments, liabilities, career trajectory, and even public perception provides crucial context. The accumulation of wealth is not solely a function of income but also hinges on prudent investment strategies, effective financial management, and the skillful navigation of economic cycles. Determining a precise net worth figure often proves challenging due to the inherent complexity of these factors. The availability of publicly accessible data on such figures is often limited and may not fully reflect the totality of one's financial situation.

While a definitive numerical answer remains elusive, exploring these diverse elements paints a richer picture of how personal choices, professional endeavors, and market conditions influence financial outcomes. This analysis underscores the dynamic interplay of various contributing factors in shaping an individual's overall financial standing. Further research into specific aspects of Bobby Byrd's financial history would be beneficial for a more complete understanding. Understanding the interplay of these factors not only provides insight into a particular case but also offers a broader perspective on the elements that influence the accumulation and preservation of wealth, applicable to individuals across various backgrounds and professions.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKuklr%2B0ecOiqpyto6i2r7OMsKaro12htqexjpumm5qpYq%2B6vsNmpZ6sXay8s8DHZ5%2BtpZw%3D