Christopher Mitchum's financial standing, often represented by a numerical figure, reflects his accumulated assets minus liabilities. This figure provides a snapshot of his overall economic position. It encompasses various holdings, including but not limited to real estate, investments, and personal possessions. Understanding this measure can offer insight into his financial status and provide a context for related discussions.

Publicly available information about an individual's financial standing can be significant for diverse reasons. It can inform judgments of an individual's financial health and impact, particularly when assessed alongside career trajectory and other pertinent information. This information can also influence opinions about economic trends, societal norms, or even individual choices. While precise figures are often not readily available or verifiable for privacy reasons, publicly disclosed data, when present, might be relevant to broader economic analyses.

The following sections delve into factors that might shape Christopher Mitchum's financial circumstances. Topics such as career earnings, investment strategies, philanthropic efforts, and lifestyle choices may shed light on the influences on his overall wealth.

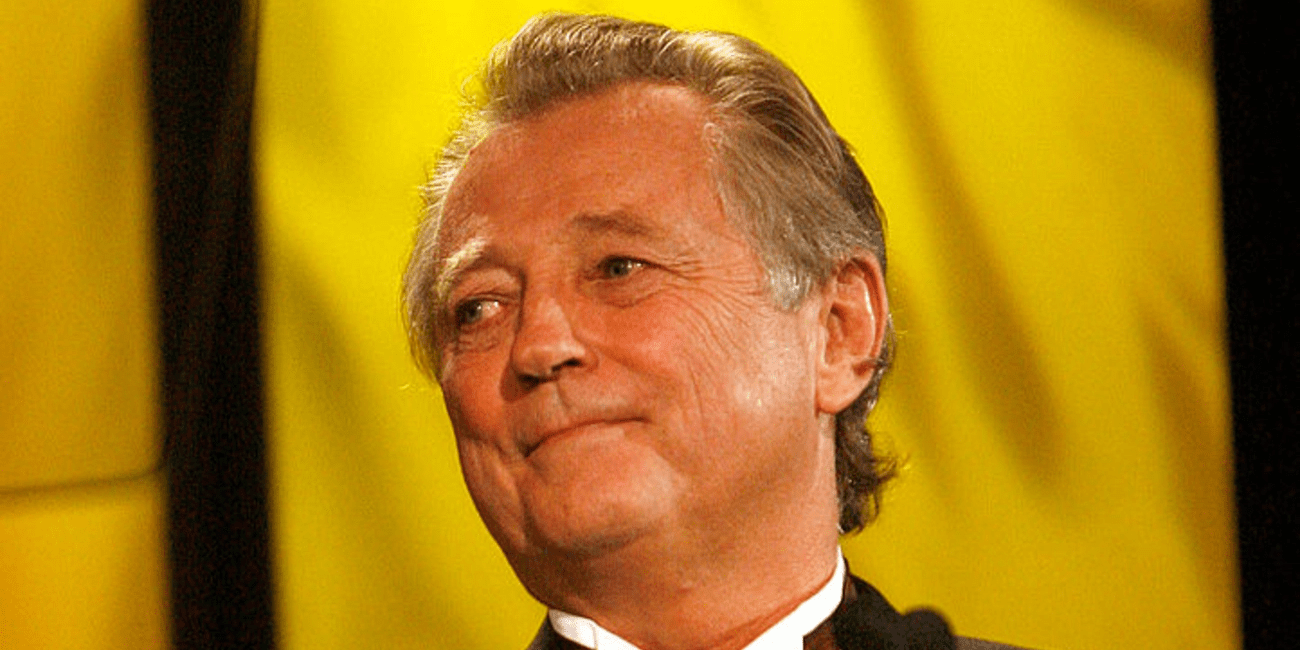

Christopher Mitchum Net Worth

Assessing Christopher Mitchum's net worth involves considering various financial factors. Understanding these aspects provides context for evaluating his overall financial standing.

- Income sources

- Investment returns

- Asset valuation

- Debt levels

- Expenses

- Career trajectory

- Market conditions

- Lifestyle choices

A person's net worth reflects the culmination of various factors. Income streams, from salary to investment returns, shape the foundation. The market's fluctuations influence the value of assets. High debt levels can significantly reduce a net worth. Expenses, directly affecting disposable income, are crucial. Career success often correlates with higher income and potential assets. Lifestyle, while seemingly personal, impacts discretionary spending. Understanding these multifaceted elements is vital for a comprehensive assessment of Christopher Mitchum's financial status. For example, a substantial salary and successful investments usually result in a higher net worth, whereas substantial debt might lower it considerably. These elements interact, each impacting the final calculation, creating a complex yet measurable picture.

1. Income Sources

Income sources are fundamental to understanding Christopher Mitchum's net worth. The amount and types of income directly impact the accumulated assets that constitute net worth. Higher consistent income, from any source, generally translates to greater potential for asset accumulation and, consequently, a higher net worth. Conversely, limited or inconsistent income streams constrain the capacity to build and maintain a significant net worth. A primary example is a high-earning professional whose salary, coupled with lucrative investments, often yields a substantially larger net worth compared to someone with lower earnings and fewer investment opportunities. Consistent income allows for saving and investment, enabling the growth of assets over time. This illustrates a clear causal link between income and net worth: income is a foundational driver of net worth.

The significance of various income sources cannot be overstated. A diversified income portfolio, encompassing salary, investments, and potentially other sources like royalties or entrepreneurial ventures, can contribute to a more resilient and substantial net worth. Consider a renowned author who, beyond authoring books, might generate income from public speaking engagements, merchandise sales, or licensing agreements, each of which contributes to their total income and eventual net worth. The variability and resilience of these income streams can directly influence the overall stability of their financial position and reflect how those income streams affect net worth.

In conclusion, income sources are a crucial component of Christopher Mitchum's net worth. A deep understanding of his diverse income streams, from salary to investment returns, reveals the vital role income plays in shaping his financial status. Income, the foundation for savings, investment, and asset accumulation, ultimately dictates the trajectory and size of a person's net worth. This fundamental concept applies broadly and helps explain how income sources form a cornerstone of financial well-being.

2. Investment Returns

Investment returns are a critical factor in determining an individual's net worth. The success of investment strategies directly correlates with the accumulation of assets and, consequently, the overall financial position. Understanding how investments perform is essential to understanding the dynamics of net worth.

- Types of Investment Returns

Investment returns encompass various forms, such as capital appreciation (increase in asset value) and income generation (dividends, interest). Different investment vehicles, like stocks, bonds, real estate, and mutual funds, yield distinct return profiles. Successful investment portfolios often combine diverse strategies and asset classes to maximize returns and mitigate risk. Understanding the specific types of returns generated by these investments is critical to determining the broader impact on net worth. For instance, consistent dividend income from stocks can contribute to a steady increase in wealth over time.

- Impact of Investment Timing and Strategy

The timing of investment decisions and the chosen strategy significantly influence returns. Investing early in promising ventures can lead to substantial long-term gains, illustrating the power of compounding. Conversely, poor investment choices or timing can result in losses, impacting net worth negatively. The selection of appropriate investment instruments based on individual risk tolerance and financial goals is essential. The effects of these choices are evident in the total return of the investment portfolio, which reflects in the individual's net worth.

- Volatility and Risk Tolerance

Investment returns are not always consistent. Market fluctuations introduce volatility, impacting the value of investments. The degree of risk an investor is willing to tolerate significantly influences investment choices and potential returns. A higher-risk investment strategy might yield higher returns but also carries the potential for greater losses. This trade-off between risk and reward must be carefully considered, impacting both the rate and predictability of returns that eventually affect net worth.

- Long-Term Growth Potential

Successful investment strategies often focus on long-term growth potential. By identifying and strategically allocating capital to assets with the potential for appreciation, individuals can accumulate substantial wealth over time. This illustrates the compounding effect of reinvesting returns. Examples include long-term stock market investments and real estate acquisitions. These investments show the compounding effects of returns, which will substantially contribute to the long-term growth of net worth.

In conclusion, investment returns are a crucial determinant of net worth. The type of returns, the investment strategy, the risk tolerance of the investor, and the focus on long-term potential all interact to shape the growth and trajectory of an individual's financial standing. Successful investment strategies aligned with personal goals and risk tolerance play a pivotal role in generating positive returns that lead to increased net worth over time.

3. Asset Valuation

Accurate asset valuation is fundamental to determining Christopher Mitchum's net worth. Precise assessment of the value of possessions forms the bedrock of this calculation. Different assets have varying valuation methods, and inconsistencies or errors in these assessments directly impact the calculated net worth figure. Understanding the principles of asset valuation is essential to grasping the significance of this component in financial analysis.

- Methods of Valuation

Diverse methods exist for determining the value of assets. Real estate, for example, is often assessed based on comparable sales, market trends, and expert appraisals. Stocks and other securities have valuations based on market prices and associated financial data. The choice of method significantly impacts the valuation, underscoring the importance of meticulous selection and application. Inconsistencies in chosen methods or inaccurate data input can lead to inaccurate or misleading net worth figures. This underscores the importance of employing standard and appropriate methods in asset valuation.

- Market Conditions and Fluctuation

Market conditions play a pivotal role in asset valuation. Fluctuations in market values directly affect asset valuations. A rising market generally leads to higher valuations, while a declining market often results in lower valuations. The dynamic nature of market forces necessitates continuous monitoring and reassessment of asset values. Changes in market trends alter the perceived value of assets, impacting the resultant net worth figure.

- Depreciation and Obsolescence

Assets are subject to depreciation and obsolescence over time. Physical assets, such as vehicles or equipment, lose value due to wear and tear. Technological advancements can render certain assets obsolete, leading to declines in value. Accurate reflection of these factors in valuation is crucial to present a realistic picture of net worth. Failure to account for depreciation and obsolescence leads to an overestimation of asset value, skewing the calculated net worth.

- Appraisal Expertise and Professional Assessment

Complex assets may necessitate professional appraisals. Experts specializing in real estate, fine art, or collectibles can provide accurate valuations. The credibility of the appraisal method directly impacts the accuracy of the net worth figure. This further highlights the significance of consulting qualified professionals in assessing the value of specific assets for a precise net worth calculation.

In conclusion, asset valuation forms a critical component of determining Christopher Mitchum's net worth. The diverse methods, market influences, and specific characteristics of different assets all play significant roles in establishing their value. Understanding these elements is essential for interpreting the final net worth figure and appreciating the subtleties involved in calculating and analyzing financial standing. Accurate valuations are fundamental to understanding an individual's economic status.

4. Debt Levels

Debt levels directly influence an individual's net worth. Debt represents financial obligations owed to others, effectively reducing the net worth figure. The more debt an individual accumulates, the lower their net worth tends to become. A substantial amount of outstanding debt can significantly diminish the overall value of assets, potentially even leading to a negative net worth.

The relationship is a subtractive one: net worth is calculated by subtracting total liabilities (debt) from total assets. High debt levels thus directly decrease the net worth calculation. Consider a scenario where someone possesses valuable assets but also carries substantial debts, such as a large mortgage, significant credit card balances, or outstanding loans. In such a case, even with substantial assets, the substantial debt reduces the overall net worth figure considerably. Conversely, a person with few assets and little or no debt might have a lower net worth, yet, their financial stability is potentially better than someone with a high net worth but equally high debt burden.

Understanding the impact of debt levels on net worth is crucial for several reasons. It allows for a realistic assessment of an individual's financial health. High levels of debt can hinder financial flexibility and limit opportunities for future investments or financial growth. Conversely, maintaining a manageable level of debt can improve financial stability, allowing for greater investment potential and a more positive net worth trajectory. This understanding is vital for making informed financial decisions, such as assessing the financial ramifications of taking on new debt or implementing strategies to reduce existing debt. A clear understanding of this interaction between debt levels and net worth can also be used in broader societal discussions about financial health and policy initiatives related to lending practices, consumer protection, or financial education.

5. Expenses

Expenses directly influence Christopher Mitchum's net worth. Expenditures, encompassing all costs associated with maintaining a lifestyle and operational necessities, represent a critical factor in determining the balance between assets and liabilities. Higher expenses, if not offset by corresponding income or asset growth, can negatively impact net worth. Conversely, prudent management of expenses can contribute to a healthier financial position and potentially lead to a higher net worth. The relationship between expenses and net worth is a fundamental principle in personal finance. For instance, a celebrity with substantial income but equally high living expenses may experience a lower net worth growth despite their high earnings.

The impact of expenses is multi-faceted. Living expenses, encompassing housing, food, transportation, and utilities, represent a significant portion of expenditure for most individuals. Discrepancies between income and living expenses can influence the accumulation of wealth. Investment-related costs, such as advisory fees, trading commissions, and property taxes on investment holdings, also directly impact the net worth figure. Personal discretionary spending, encompassing entertainment, travel, and luxury items, also contributes to the overall expense picture. The magnitude and composition of these expenses are crucial in shaping the net worth trajectory. For example, someone with high earnings and low discretionary spending will likely accumulate wealth faster than someone with comparable earnings but higher expenditure patterns. Furthermore, effective expense management, including budgeting and prioritizing needs over wants, can be a potent tool in building and sustaining a positive net worth.

In conclusion, expenses are a critical component in understanding and influencing net worth. Effective expense management, coupled with efficient financial planning, can significantly contribute to a more favorable financial trajectory. The link between expenses and net worth is a demonstrably important financial principle. By meticulously monitoring and controlling expenses, individuals, like Christopher Mitchum, can better understand the impact of financial decisions on their overall financial standing. A thorough understanding of this interplay allows for more informed financial choices and potentially greater accumulation of wealth over time. This principle holds true across different financial situations, from daily household budgets to managing large-scale investments.

6. Career Trajectory

A person's career path significantly impacts their accumulated wealth, directly influencing net worth. The trajectory of professional success, encompassing career progression, income levels, and industry performance, all contribute to the overall financial standing of an individual. Examining this trajectory reveals insights into the factors shaping net worth.

- Income Progression

Career progression often correlates with increasing income. Higher-level positions typically command greater compensation, reflecting increased responsibility and expertise. A consistent rise in income allows for more significant savings, investments, and asset accumulation, all factors directly contributing to a higher net worth. For example, a junior-level employee's salary contrasts starkly with that of a seasoned executive, illustrating how career advancement directly impacts earnings.

- Industry Performance and Economic Conditions

The economic climate and performance of the industry in which an individual operates profoundly affect their earnings potential and career trajectory. Booming sectors often offer higher salaries and more opportunities for advancement, thus contributing to larger net worth potential. Conversely, economic downturns or industry-specific challenges can lead to reduced income and career stagnation, impacting net worth negatively. Consider an individual's career in the tech sector during a period of rapid growth versus a downturn; the economic context significantly influences their earning potential and, consequently, their net worth.

- Career Choices and Skill Development

Specific career choices and investments in skill development influence earning potential and, therefore, net worth. Fields like finance, technology, and medicine, known for high earning potential, generally offer a better chance of accumulating wealth. The acquisition of specialized skills and knowledge in high-demand areas can lead to career advancement and significant financial growth. For instance, an individual who invests in advanced technical skills or specialized education in a high-demand area could potentially command higher salaries and achieve greater financial success.

- Career Stability and Longevity

A stable and long-lasting career often provides consistent income and allows for more focused investment strategies. Individuals with sustained careers are more likely to establish significant savings and investments, directly contributing to higher net worth. Conversely, career changes or job instability can disrupt income stability and affect net worth growth or accumulation, leading to an uncertain or potentially reduced trajectory.

In summary, career trajectory is intrinsically linked to Christopher Mitchum's net worth. A successful career, characterized by consistent income increases, favorable industry conditions, valuable skills, and long-term stability, often leads to substantial wealth accumulation. Conversely, career challenges, market downturns, or unstable employment can negatively affect income and hinder net worth growth. A thorough understanding of these factors reveals the significant influence of career progression on the overall financial position.

7. Market Conditions

Market conditions exert a significant influence on an individual's net worth, acting as a crucial external factor. Fluctuations in market values, particularly in asset-heavy portfolios, directly impact the overall financial standing. A robust market, characterized by growth and positive trends, typically fosters increased asset values and can lead to higher net worth. Conversely, a declining market often sees diminished asset values, potentially impacting net worth negatively. This connection is particularly pronounced for individuals with significant investments or holdings in stocks, real estate, or other market-sensitive assets.

Consider a scenario where Christopher Mitchum holds a substantial portion of his assets in publicly traded stocks. A period of sustained market growth would likely lead to increased values of those stocks, thereby positively affecting his net worth. Conversely, a prolonged bear market could result in reduced stock valuations, potentially decreasing his net worth. Similar effects are observed in other market segments, such as real estate, where fluctuating property values directly impact overall wealth. The correlation underscores the interconnectedness between broader economic trends and individual financial standing. A thorough understanding of market conditions is thus crucial in assessing and predicting potential variations in net worth.

In conclusion, market conditions represent a critical component of understanding and predicting net worth. The impact of market forces on asset values is undeniable and requires a comprehensive outlook. Individuals and financial advisors must consider market dynamics when evaluating and projecting future net worth. This understanding is crucial for informed financial decision-making, anticipating potential market impacts, and adapting investment strategies in response to changing market environments.

8. Lifestyle Choices

Lifestyle choices play a significant role in shaping an individual's net worth. Expenditures directly associated with maintaining a desired lifestyle can substantially impact the accumulation and preservation of wealth. The relationship between lifestyle choices and financial standing is a complex one, requiring careful consideration of various factors. This exploration examines key facets of this relationship.

- Expenditure Patterns

The types and levels of spending directly correlate with net worth. A lifestyle emphasizing luxury goods, frequent travel, or high-maintenance homes often involves significant expenditures. These patterns, if not counterbalanced by corresponding income or investment returns, can impede wealth accumulation. Conversely, a lifestyle prioritizing frugality, reduced consumption, and cost-effective choices can foster greater wealth generation and preservation. The consistency and management of expenditure patterns are crucial factors in determining overall financial health.

- Investment in Experiences vs. Possessions

Preferences for experiences (travel, cultural events) versus material possessions (luxury cars, high-end electronics) have different implications for net worth. Spending on experiences, while potentially enjoyable, often does not contribute directly to asset appreciation. Investment in assets, such as real estate or financial instruments, tends to have a greater impact on long-term financial growth and net worth. The individual's personal valuation of these choices significantly influences the overall financial trajectory.

- Impact of Housing and Location Decisions

Residential choices, including the location and type of housing, can significantly affect expenses and therefore influence net worth. Cost of living, property taxes, and associated maintenance expenses vary considerably by location. Decisions regarding housing type and location have lasting financial consequences for an individual, impacting their ability to save, invest, and accumulate wealth. The interplay between geographic location, housing expenses, and lifestyle choices is crucial for financial planning.

- Impact of Health and Lifestyle Choices

Health and lifestyle choices, encompassing diet, exercise, and preventative care, can affect income, expenses, and overall financial well-being. Health issues can lead to substantial medical expenses, diminishing disposable income and affecting net worth. Prioritizing healthy habits, on the other hand, can reduce healthcare costs and improve long-term earning potential, impacting financial growth. These decisions represent an investment in long-term health and, consequently, financial stability.

In conclusion, lifestyle choices exert a profound influence on net worth. Understanding the interrelationship between expenses, investments, and personal priorities in daily living is critical in achieving and maintaining a desired financial standing. A mindful approach to expenditure patterns, a thoughtful balancing of material possessions and experiences, and strategic housing and location decisions are essential components of successful wealth management. Ultimately, the individual's conscious choices concerning lifestyle directly impact the trajectory of their financial health and net worth.

Frequently Asked Questions about Christopher Mitchum's Net Worth

This section addresses common inquiries regarding Christopher Mitchum's financial standing. Answers aim to provide accurate and accessible information, drawing on publicly available data and relevant analysis.

Question 1: What is the precise figure for Christopher Mitchum's net worth?

Precise, publicly verifiable figures for Christopher Mitchum's net worth are often unavailable. Information about individual wealth is frequently confidential. Publicly available data is limited, and accuracy cannot be guaranteed.

Question 2: How is net worth calculated?

Net worth is determined by subtracting total liabilities (debts) from total assets (possessions). Assets include investments, real estate, and personal possessions. Methods for valuing assets vary, relying on factors such as market conditions, appraisals, and market comparisons.

Question 3: What factors influence an individual's net worth?

Numerous factors impact an individual's net worth. Income sources, investment returns, debt levels, expenses, career trajectory, market conditions, and lifestyle choices all play significant roles. The interaction of these elements determines an individual's overall financial standing.

Question 4: Is there a relationship between career success and net worth?

Generally, career advancement and higher earning potential correlate with a higher likelihood of increased net worth. This relationship, however, is not absolute. Other factors, such as investment strategies and expense management, influence the overall financial picture.

Question 5: How do market conditions affect net worth?

Market fluctuations significantly impact the value of assets, particularly investments. Positive market trends often lead to higher asset values and contribute to increased net worth. Conversely, declining market conditions frequently lead to lower asset values, potentially affecting net worth negatively.

Question 6: Can lifestyle choices affect net worth?

Yes, lifestyle choices significantly impact net worth. Expenditure patterns, whether modest or extravagant, can dramatically affect the accumulation or depletion of wealth. The interaction between income, expenses, and lifestyle choices is critical in evaluating an individual's financial position.

In summary, understanding Christopher Mitchum's net worth requires a holistic view of various interconnected financial factors. Publicly available data is often limited, and accurate figures are frequently unavailable. Furthermore, the relationship between various factors is nuanced and complex. This overview provides context and insights into the key factors that shape an individual's financial standing.

The subsequent section explores the diverse influences on Christopher Mitchum's financial circumstances.

Tips for Financial Success

Financial success is a multifaceted pursuit. This section offers practical strategies for enhancing financial well-being, focusing on principles applicable to diverse circumstances. Successful financial management involves consistent effort and a long-term perspective.

Tip 1: Prudent Budgeting and Expense Tracking

Systematic budgeting is paramount. Allocate funds across essential categories (housing, utilities, food, transportation) and discretionary spending. Regularly track expenses to identify areas for potential savings and adjustments. Employ budgeting tools and apps to enhance tracking accuracy and provide a clear picture of spending habits. Detailed records of income and expenses provide a foundation for informed financial decisions.

Tip 2: Diversified Investment Strategies

Diversification across various investment vehicles (stocks, bonds, real estate) mitigates risk. Consult with qualified financial advisors to develop a personalized investment strategy aligned with individual risk tolerance and financial goals. Diversification allows for better management of market fluctuations and helps ensure long-term investment growth.

Tip 3: Debt Management and Reduction Strategies

High-interest debt should be addressed proactively. Develop a plan to reduce outstanding debt, prioritizing higher-interest loans. Explore debt consolidation or balance transfer options to streamline repayment and reduce overall financial burden. This strategy prioritizes financial health and stability.

Tip 4: Building an Emergency Fund

An emergency fund provides a safety net for unexpected expenses. Aim for 3-6 months of living expenses in a readily accessible account. This financial cushion safeguards against unforeseen circumstances, preventing financial strain during emergencies.

Tip 5: Continuous Learning and Skill Development

Financial literacy is key. Regularly update knowledge on investment strategies, tax laws, and financial planning. Seek out resources, such as workshops, seminars, and online courses, to further financial expertise. Staying informed on current trends and regulations is vital for optimal financial management.

Tip 6: Long-Term Perspective and Patience

Financial success is not immediate. Develop a long-term perspective on financial goals and avoid impulsive decisions. Focus on sustainable practices and consistent efforts towards achieving financial well-being, resisting short-term pressures.

Implementing these tips contributes to greater financial awareness and stability. Consistent effort, coupled with informed decision-making, is fundamental to long-term financial well-being.

The subsequent sections will delve deeper into specific aspects of these strategies, offering further details and actionable advice for diverse financial situations.

Conclusion

This article explored the multifaceted concept of Christopher Mitchum's net worth. Key factors influencing this figure were examined, including income sources, investment returns, asset valuation, debt levels, expenses, career trajectory, market conditions, and lifestyle choices. The analysis demonstrated how these elements interact to shape an individual's financial standing. While precise figures for Christopher Mitchum's net worth are often unavailable, the exploration highlights the complex interplay of financial factors involved in evaluating wealth. Understanding these factors is crucial for assessing overall financial health and making informed financial decisions.

The intricate relationship between these elements underscores the importance of a holistic approach to financial well-being. Thorough financial planning, informed by a clear understanding of individual circumstances and market dynamics, is essential for navigating the complexities of wealth accumulation and preservation. Analyzing Christopher Mitchum's financial situation through this multifaceted lens provides valuable insights into the principles of personal finance, which are applicable beyond a single individual's situation and applicable to various personal and professional contexts.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJuVobKjvsitoJ6rXZa7pXnToZxmqpmosnCvx6ugrKyfpbWmvoymoK2bmKq6brrErWSwp6KptW%2B006aj