Determining the financial standing of an individual, in this case, David Gates, requires accessing publicly available financial information. This might include details from financial disclosures, tax filings, or other publicly accessible documents, depending on the individual's transparency and the jurisdiction in question. A precise net worth figure isn't always readily available for private individuals, particularly if they haven't released formal financial statements.

Information on an individual's financial status, if readily available, can offer insights into their financial health, investment activity, and overall economic position. This knowledge can be relevant for various purposes, such as understanding business operations, investment decisions, or market trends. It's also important to recognize that net worth is a snapshot in time and can fluctuate significantly. Furthermore, the interpretation of such data hinges on understanding the sources and methodology used to calculate it.

This discussion provides the context for understanding a person's financial status. Subsequent sections in the article could delve into specific details about David Gates, if available, offering insight into the factors that might influence their current financial standing.

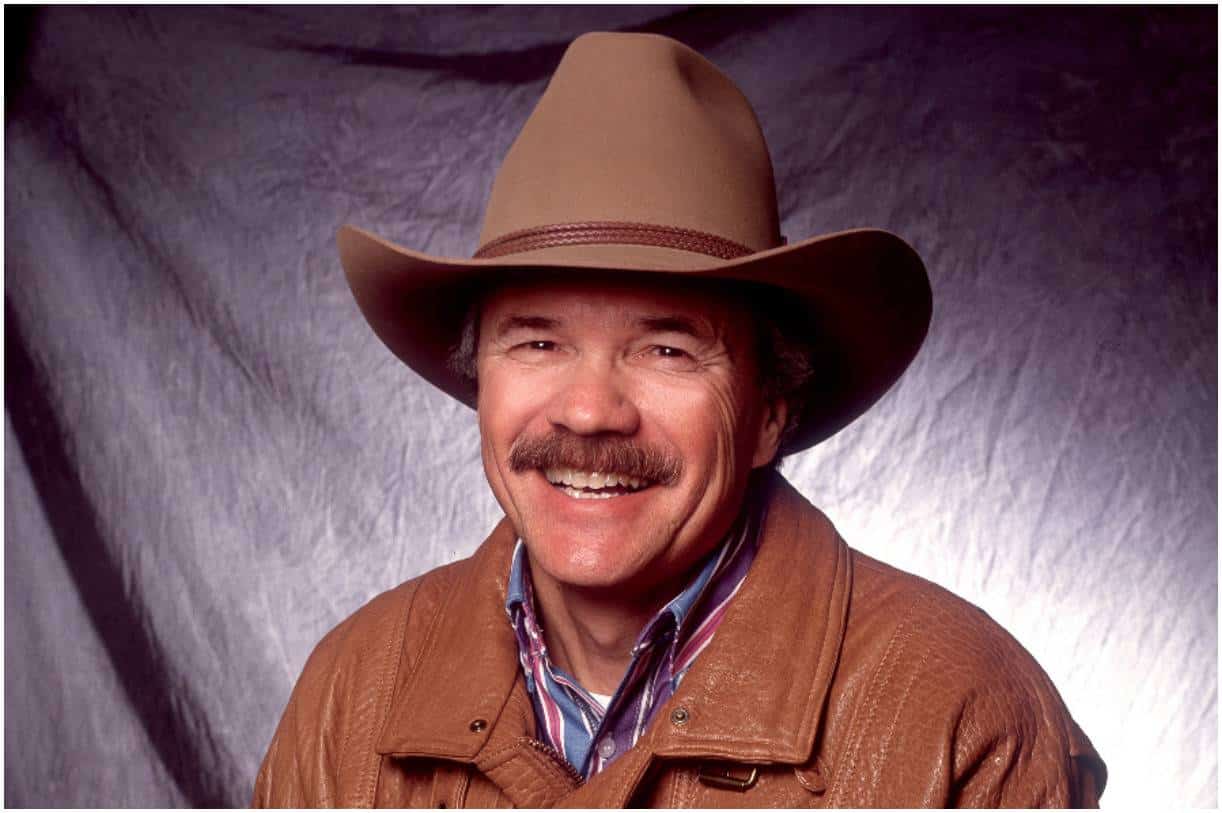

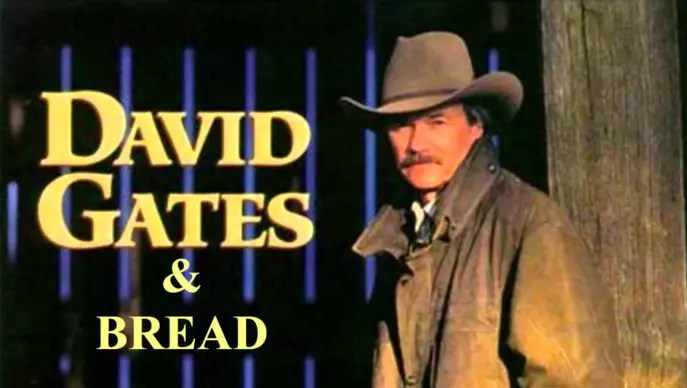

David Gates Bread Net Worth

Understanding an individual's financial standing requires examining various factors. The following eight key aspects offer a framework for such an evaluation.

- Financial Records

- Income Sources

- Investment Portfolio

- Asset Valuation

- Liabilities

- Market Fluctuations

- Public Disclosures

- Transparency

These aspects collectively paint a picture of an individual's financial situation. Financial records provide a baseline; income sources demonstrate earning potential. Investment portfolios showcase risk tolerance, and asset valuation reflects current market conditions. Liabilities represent obligations, and market fluctuations impact asset values. Public disclosures, if available, offer transparency, while understanding transparency is crucial for evaluating the reliability of any financial data. Analysis of these components allows a more holistic understanding of the financial health of any person, as illustrated by how market forces affect the valuation of assets. Consequently, thorough and accurate calculation of an individuals net worth is not only critical to the individual but also for informed decisions in related fields like investments and business.

1. Financial Records

Financial records are fundamental to determining an individual's net worth. Accurate and comprehensive records provide a detailed view of assets, liabilities, and income. Their significance in ascertaining an individual's financial standing is paramount, particularly for evaluating assets and liabilities relevant to determining net worth.

- Income Statements

Income statements detail an individual's income over a specific period. Revenue streams, both employment-based and investment-derived, are crucial components of financial records. Analyzing these statements reveals patterns and fluctuations in income, aiding in assessing earning capacity and potential future financial stability. This data is significant in determining the overall financial standing, including estimations of "david gates bread net worth" where appropriate data points are available.

- Balance Sheets

Balance sheets provide a snapshot of an individual's assets and liabilities at a particular point in time. A detailed list of assets (e.g., property, investments, savings accounts) and liabilities (e.g., debts, loans) is essential. Comparisons between balance sheets across various periods illuminate changes in net worth, offering a clear picture of financial growth or decline. Analysis of balance sheet data helps determine the overall financial standing, including estimations of "david gates bread net worth," provided the data is accessible.

- Tax Returns

Tax returns provide a verifiable record of an individual's income, deductions, and financial obligations. Consistent patterns in tax filings are significant for evaluating the accuracy of reported financial data and for providing external verification of income and asset declarations. This information, in conjunction with other documents, helps estimate an individual's net worth, subject to available information.

- Investment Records

Detailed records of investment holdings, including purchases, sales, and associated transactions, are necessary for evaluating the value of assets within an investment portfolio. These records help determine the actual value of investments, including the growth of investment assets over time. Evaluating investment activity over various periods provides valuable insight into the overall financial position, which can be relevant for estimating "david gates bread net worth," where such information is available.

These components, when combined and analyzed together, provide a comprehensive picture of an individual's financial standing. Accurate financial records are critical in determining the net worth of any individual, especially when public records are involved. Their importance hinges on the accuracy and completeness of information, influencing estimations, but are not definitive proof. Therefore, access to and evaluation of these records is crucial in understanding the financial position of any individual.

2. Income Sources

Income sources directly influence an individual's net worth. The nature and volume of income streams significantly impact the accumulation of assets. Higher and more stable income generally leads to greater savings and investment opportunities, ultimately contributing to a higher net worth. Conversely, inconsistent or limited income restricts the ability to save and invest, potentially resulting in a lower net worth. The diversification of income sources, such as employment and investment income, can mitigate risks and enhance financial stability, leading to a more resilient financial position. An individual relying solely on a single source of income faces greater vulnerability to fluctuations in that particular source, potentially affecting their overall net worth.

Consider a scenario where an individual experiences a substantial increase in salary. This augmented income allows for increased savings and investments, leading to a faster accumulation of wealth and a higher net worth. Alternatively, if an individual loses a primary source of income due to job loss, the reduced income stream directly impacts the ability to maintain existing financial commitments and potentially accumulate assets, thereby decreasing the net worth. Analyzing income sources not only provides a current financial picture but also a predictive perspective on an individual's potential future financial health. The predictability and stability of income streams are crucial in forecasting an individual's net worth evolution.

Understanding the connection between income sources and net worth is vital. It underscores the importance of a diversified income portfolio and the potential impact of fluctuations in income streams on overall financial well-being. Further, this understanding highlights the significance of consistent, stable income in supporting wealth accumulation and a favorable trajectory for net worth growth. In conclusion, income sources are not merely a component of net worth; they are a foundational driver of its trajectory and magnitude.

3. Investment Portfolio

An investment portfolio significantly influences an individual's net worth. The composition and performance of investments directly impact the overall value of assets. A well-diversified portfolio, with appropriate asset allocation strategies, can generate returns exceeding the rate of inflation, thereby bolstering net worth over time. Conversely, poorly managed or ill-conceived investments can erode accumulated wealth and diminish net worth.

Consider a portfolio heavily invested in a single sector. A downturn in that sector directly affects the portfolio's value, potentially leading to substantial losses and a reduction in net worth. Conversely, a diversified portfolio that includes stocks, bonds, real estate, or other assets can potentially mitigate such risks. The potential for growth within different asset classes allows for greater stability and resilience during market fluctuations. A consistent strategy of prudent investment decisions and regular portfolio rebalancing can lead to sustained net worth appreciation. The returns generated by a proficient investment strategy can considerably influence the magnitude of an individual's net worth.

The influence of an investment portfolio on net worth is undeniable. A well-managed investment strategy, characterized by diversification and a long-term perspective, can be a potent driver of wealth accumulation. Conversely, poor investment choices can erode accumulated wealth, reducing net worth. The importance of understanding investment principles and constructing a suitable portfolio is central to managing and optimizing net worth. The link between investment strategy and financial health underpins the practical significance of understanding how portfolio decisions affect net worth. Strategic portfolio management can significantly enhance wealth creation over time.

4. Asset Valuation

Asset valuation is a critical component in determining net worth. Accurate assessment of an individual's assets is essential to establish a precise net worth figure. The value assigned to various assets, from tangible items like property to intangible holdings like intellectual property, forms the foundation for calculating overall wealth. Understanding the methodologies and factors influencing asset valuation provides a clearer picture of an individual's financial position.

- Market-Based Valuation

Market-based valuation relies on observable market data for comparable assets to determine value. For example, real estate values are often derived from recent sales of similar properties in the same area. Stocks, bonds, and other securities trade on exchanges, where market prices provide a direct reflection of value. Accurate market data and careful analysis of comparable sales or market listings are fundamental to the reliability of such valuations, which are crucial for assessing "david gates bread net worth" accurately. The fluctuating nature of markets must be considered when applying market-based valuation methods.

- Asset-Specific Valuation

Certain assets require specialized valuation methodologies. Intellectual property, such as patents or trademarks, may need expert appraisals based on factors like market demand, potential future revenue streams, and legal protections. Antique or collectible items are evaluated by appraisers experienced in these fields. Each asset class necessitates unique approaches to accurately assess its contribution to overall net worth. Proper evaluation of specific assets is vital for a complete and unbiased "david gates bread net worth" calculation.

- Discounted Cash Flow Analysis (DCF)

This method estimates the present value of future cash flows generated by an asset. Often used for businesses or investments generating income, DCF analysis projects future earnings and discounts them back to the present value based on an appropriate discount rate. This approach considers the potential profitability of the asset, which is vital in assessing the long-term value and contribution to overall wealth, as is evident in the overall valuation of "david gates bread net worth."

- Appraisal Methods

Professional appraisals by qualified appraisers play a crucial role in valuing unique or complex assets. Appraisals typically utilize specific methodologies, considering factors relevant to the asset's condition, rarity, or historical significance. The application of specialized appraisal methods is especially important when considering assets beyond commonly traded securities, thus affecting the calculation of "david gates bread net worth." Such valuations require professional judgment and experience.

Accurate asset valuation is paramount in defining an individual's net worth. The diverse methods employed, whether market-based, asset-specific, or analytical, must be implemented consistently and meticulously. Reliable valuation is fundamental to a complete and accurate assessment of "david gates bread net worth." The accuracy of the valuation directly influences the calculated figure and its overall reliability, thereby affecting any conclusions based on this information.

5. Liabilities

Liabilities represent an individual's financial obligations. They directly affect net worth by reducing the overall value of assets. A higher level of liabilities decreases the net worth, signifying a greater financial burden and potentially highlighting areas requiring attention. Conversely, effectively managing and reducing liabilities can increase net worth. The relationship between liabilities and net worth is a fundamental aspect of personal finance, where the management of liabilities is essential for evaluating and improving overall financial health. Debt levels directly impact the ability to invest, save, or pursue other financial opportunities, thus influencing future net worth potential.

Consider a scenario where an individual has substantial outstanding loans and credit card debt. These obligations reduce the available capital for investment or savings, ultimately decreasing the individual's net worth. Conversely, if the same individual effectively manages debt by making timely payments, reducing balances, and optimizing interest rates, they free up capital that can be allocated to asset accumulation and thus increase their net worth. This exemplifies the direct and substantial impact of liabilities on the calculation of net worth.

Understanding the connection between liabilities and net worth highlights the importance of prudent financial planning. Effective debt management strategies, such as budgeting, setting realistic repayment plans, and seeking professional financial advice where necessary, are crucial for maintaining or enhancing net worth. A comprehensive financial plan should incorporate strategies to minimize liabilities and maximize the allocation of resources towards increasing assets, leading to a favorable net worth trajectory. This relationship underscores the significance of responsible financial practices in building lasting financial stability. The prudent management of liabilities is not just a component in calculating an individual's net worth, but rather a driver of its sustained growth.

6. Market Fluctuations

Market fluctuations exert a substantial influence on an individual's net worth, particularly for those with significant investments. Price movements in various asset classes, including stocks, bonds, and real estate, directly affect the overall value of an individual's holdings. Understanding these dynamics is crucial for assessing the potential impact on net worth and for formulating effective strategies to mitigate risks.

- Stock Market Volatility

Fluctuations in stock market indices, such as the S&P 500, directly impact the value of publicly traded companies held in portfolios. Declines in market sentiment or economic uncertainty can lead to significant decreases in stock prices, thereby reducing the overall value of investments and potentially impacting net worth. Conversely, periods of market optimism and economic growth can result in substantial increases in stock prices, enhancing the value of holdings and bolstering net worth. Historical examples, like the dot-com bubble and the 2008 financial crisis, demonstrate the profound impact of stock market volatility on investment portfolios and overall financial well-being.

- Interest Rate Changes

Variations in interest rates affect the value of fixed-income securities, such as bonds. Rising interest rates often lead to decreased bond values, as investors seek higher-yielding instruments. Conversely, falling interest rates can increase bond values. These fluctuations have direct implications for individuals holding bond portfolios, impacting the overall return on investment and potentially affecting net worth. Understanding the correlation between interest rates and bond prices is crucial for managing investment portfolios and mitigating potential risks.

- Real Estate Market Cycles

Real estate markets are susceptible to cycles of expansion and contraction. During periods of high demand and low inventory, property values tend to increase, positively impacting net worth for property owners. Conversely, economic downturns or oversupply can lead to declines in property values, resulting in losses in net worth for those owning real estate. The interaction between economic conditions and real estate market dynamics profoundly shapes an individual's financial standing and net worth.

- Global Economic Conditions

Global economic conditions often act as a significant driver of market fluctuations. Events such as recessions, geopolitical instability, or pandemics can trigger widespread uncertainty and volatility in financial markets. Such external factors influence various asset classes, impacting both individual investment portfolios and overall market sentiment, which significantly affects the valuation of holdings, thus influencing net worth.

In conclusion, market fluctuations are an inherent aspect of the financial landscape. Understanding the mechanisms behind these fluctuations and their potential impact on various asset classes is critical for effective portfolio management and safeguarding an individual's net worth. By recognizing the interconnectedness of various market dynamics, individuals can make informed decisions, potentially mitigating potential losses and optimizing returns on their investments, thus ensuring long-term stability.

7. Public Disclosures

Public disclosures, when available, play a significant role in understanding an individual's financial standing, including a potential figure for "david gates bread net worth." These disclosures, often mandated by legal or regulatory frameworks, provide insights into financial activities and holdings. Their relevance stems from the transparency they offer, allowing for a more informed perspective on an individual's economic position. The absence of such disclosures can limit the ability to assess the accuracy of potential estimates related to net worth.

- Financial Statements (if available)

Formal financial statements, when publicly accessible, provide a structured overview of an individual's financial position. These documents detail assets, liabilities, and income, providing a direct method of calculating net worth. Examples include annual reports, balance sheets, and income statements. The accuracy and completeness of these statements are critical to assessing the reliability of the information and its implications for estimates of "david gates bread net worth." Comparability with similar individuals' disclosures aids in understanding the broader context.

- Tax Filings (where permissible)

Tax filings, while often containing sensitive data, can provide public insights into an individual's income, deductions, and overall financial obligations. This data allows for analysis of income levels and can be compared to publicly available information on income to gain perspective on how income contributes to net worth estimates. The interpretation of tax filings is subject to relevant tax regulations and personal disclosures. Data extraction and analysis require appropriate methodology to avoid misinterpretations of the data. The public availability and nature of tax filings affect the possible insights into "david gates bread net worth."

- Investment Holdings (if disclosed)

Public disclosure of investment holdings provides direct information about an individual's investment portfolio, which is a significant component of net worth calculation. Disclosure may include specific asset allocations, types of investments, and values (if available). Analyzing these details helps estimate the overall value of investments and their contribution to the estimated "david gates bread net worth." The granularity and frequency of these disclosures affect the precision and reliability of such estimates.

- Regulatory Filings and Disclosures

Specific regulatory bodies may require individuals to disclose certain financial information for compliance purposes. These filings are critical for verifying an individual's financial activities in compliance with regulatory standards. They provide transparency, particularly in professional settings like public companies, and influence the calculation of "david gates bread net worth" based on the details reported. The scope and nature of these filings vary according to regulations and the subject matter of the required disclosures.

In summary, public disclosures, where available, offer valuable insights into an individual's financial activities and holdings. Such data, when properly analyzed, assists in a more accurate estimation of "david gates bread net worth." The absence of such disclosures can limit the ability to form comprehensive assessments, particularly given the variability in the availability and scope of these disclosures between individuals and industries. The importance of these disclosures is not only about numerical accuracy but also about the transparency and verifiable nature of the reported data in the context of calculating "david gates bread net worth."

8. Transparency

Transparency in financial matters is crucial when evaluating an individual's financial standing, including estimations of net worth. The availability and reliability of publicly accessible information significantly influence the accuracy and validity of any such assessment. The degree of transparency impacts the trustworthiness and comprehensiveness of the data used for calculating net worth. The lack of transparency often introduces uncertainty and limits the ability to form a definitive picture.

- Public Disclosure Requirements

Legal and regulatory frameworks often mandate certain financial disclosures, particularly for publicly traded companies and high-profile individuals. These requirements, when adhered to, allow for greater scrutiny and validation of financial information, improving the accuracy of net worth calculations. Conversely, a lack of public disclosure can hinder a clear understanding of an individual's financial position, making estimations of net worth less reliable. The specifics of these regulations and their enforcement mechanisms influence the level of transparency, directly affecting the ability to assess "david gates bread net worth."

- Financial Reporting Practices

Sound financial reporting practices, including the consistent use of accounting principles and the provision of detailed information, build trust and enhance transparency. Accurate and complete financial statements provide a clear picture of assets, liabilities, and income, aiding in more precise net worth calculations. Conversely, misleading or incomplete information can distort the picture of an individual's financial standing, impacting the accuracy of estimates related to "david gates bread net worth." Careful analysis of financial statements is necessary when evaluating the degree of transparency in relation to financial data.

- Information Accessibility

The accessibility of financial information plays a critical role in transparency. If public records are readily available and comprehensible, individuals and analysts can scrutinize the information, allowing for greater verification of the figures related to "david gates bread net worth." Conversely, the inaccessibility or complexity of financial data can hinder a thorough evaluation, potentially leading to inaccurate or incomplete estimations. Access to information, therefore, is a key factor in determining the transparency of financial reporting.

- Motivations for Transparency or Lack Thereof

The motivations behind an individual's willingness to share financial information influence the overall transparency and trustworthiness of the data. Factors like legal obligations, reputation concerns, or strategic objectives can shape public disclosures. The reasons for transparency or a lack thereof impact the reliability of any estimations related to "david gates bread net worth," thus impacting the overall reliability of the net worth figure. The analysis should consider motivations and biases.

In conclusion, transparency is a critical factor in estimating an individual's financial standing, specifically "david gates bread net worth." The presence or absence of public disclosures, sound reporting practices, and readily available information significantly impacts the validity and accuracy of any calculated or estimated figure. Thorough evaluation of the available data, considering potential motivations for transparency or opaqueness, is essential for a nuanced understanding and informed conclusion. Ultimately, transparency enables more credible assessments of an individual's financial position and plays a crucial role in building trust and informed decision-making, particularly when estimating net worth.

Frequently Asked Questions about David Gates Bread Net Worth

This section addresses common inquiries regarding the financial standing of David Gates. Accurate information about an individual's financial status requires careful consideration of available data and methodologies, as such estimations are not always precise and depend heavily on verifiable information. The following questions and answers aim to provide a clearer understanding of the complexities surrounding such evaluations.

Question 1: How is net worth calculated?

Net worth is calculated by subtracting total liabilities from total assets. Assets include items with a market value, such as investments, property, and other holdings. Liabilities represent financial obligations, including debts and loans. Precise calculations often depend on accurate valuations of assets, a process that can be complex and reliant on market conditions and professional appraisals.

Question 2: What sources of information are used to determine net worth?

Various sources may be consulted. Publicly available financial statements, tax filings, and regulatory disclosures, if available, can provide significant insights. Investment records, if accessible, offer further details about the composition of the investment portfolio. However, the availability and comprehensiveness of such information can vary greatly, significantly impacting the accuracy of any estimations.

Question 3: Why is precise net worth information sometimes unavailable?

Precise net worth figures are not always publicly accessible. Privacy considerations, lack of publicly mandated disclosures, or the absence of readily available financial records can hinder obtaining precise estimations. The nature of the individual's business activities and the specific jurisdiction involved also play a significant role in the availability of information.

Question 4: How do market fluctuations affect net worth estimations?

Market fluctuations, particularly in investments, directly impact the value of assets. Changes in interest rates, stock market performance, and real estate values influence the total value of holdings and, thus, the calculated net worth. Any estimated figure is a snapshot in time, susceptible to changes in market conditions.

Question 5: Can liabilities impact net worth estimations?

Yes, liabilities significantly influence net worth. Outstanding debts, loans, and other financial obligations decrease the net worth by reducing the overall value of assets. Careful management of liabilities is vital for maintaining or improving one's financial health and the potential for future net worth growth.

Question 6: What role does transparency play in determining net worth?

Transparency in financial matters enhances the accuracy and reliability of net worth estimations. Publicly accessible financial information allows for scrutiny and validation. Conversely, the lack of transparency often leads to uncertainty and limits the ability to form a definitive picture of an individual's financial position. The level of transparency is directly related to the comprehensiveness and accuracy of publicly accessible information.

In conclusion, understanding net worth involves a complex interplay of assets, liabilities, market conditions, and transparency. While estimation is possible based on available information, a precise calculation often remains elusive. Subsequent sections in this article will delve deeper into relevant details about David Gates, if applicable, and consider the factors affecting any estimations made concerning "david gates bread net worth."

Moving forward, the article will delve into specific details about David Gates, if information is available, and will further explore the various factors affecting net worth estimations.

Tips for Understanding and Managing Financial Standing

Understanding financial standing, encompassing elements like net worth, requires a multi-faceted approach. This section provides actionable strategies for gaining insights into one's financial situation and making informed decisions. A thorough comprehension of these tips is instrumental in navigating personal finances effectively and building a strong financial future.

Tip 1: Prioritize Financial Transparency. Openly examining financial records, including income statements, balance sheets, and tax returns, is foundational. This transparency fosters a clear understanding of income sources, expenses, and asset valuations. Reviewing investment portfolios regularly provides insights into the performance of various investments and their contributions to overall net worth.

Tip 2: Diversify Income Streams. Reliance on a single income source exposes individuals to financial risks. Diversifying income through multiple employment opportunities, investments, or side hustles can mitigate the impact of economic fluctuations on overall financial health. This diversification also creates a more resilient financial position.

Tip 3: Manage Liabilities Strategically. Effective debt management is crucial. Creating and adhering to a budget, establishing realistic repayment plans for loans and credit card debt, and exploring options like debt consolidation can significantly reduce financial burdens and potentially increase net worth.

Tip 4: Invest Wisely and Diversify Investments. Investments play a vital role in building wealth and potentially growing net worth. Diversifying investments across various asset classes, like stocks, bonds, real estate, and alternative investments, can help mitigate risk and potentially generate higher returns over time. Professional financial advice can aid in developing a well-structured portfolio.

Tip 5: Regularly Review and Adjust Financial Strategies. The financial landscape is dynamic. Economic conditions, personal circumstances, and market fluctuations necessitate periodic reviews of financial strategies and adjustments to ensure continued financial health and optimal asset growth, ultimately impacting net worth.

Tip 6: Seek Professional Financial Advice When Necessary. Engaging financial advisors and seeking counsel from qualified professionals can offer guidance on portfolio management, investment strategies, debt reduction plans, and other essential aspects of personal finance. Expert guidance can provide tailored solutions to address specific financial goals and circumstances, leading to better decision-making and improved financial outcomes.

Implementing these strategies fosters a proactive and informed approach to managing finances, offering a path towards greater financial stability and wealth building. Regular evaluation and adjustments based on individual circumstances remain essential.

These tips offer a foundational framework for managing personal finances. The following sections delve into more nuanced aspects of financial planning and investment strategies, providing a broader context for understanding financial standing and long-term financial goals.

Conclusion Regarding David Gates Bread Net Worth

This article explored the multifaceted aspects of determining an individual's financial standing, exemplified by the hypothetical case of David Gates. Key components considered include financial records, income sources, investment portfolios, asset valuations, liabilities, market fluctuations, public disclosures, and the critical role of transparency. The analysis highlighted the complexity of calculating net worth, emphasizing the significance of accurate data and appropriate methodologies. The inherent limitations of estimations without complete and verifiable information were also underscored. While estimations of "David Gates Bread Net Worth" are possible based on available data, the absence of comprehensive public disclosures often necessitates acknowledging the inherent uncertainties involved.

Ultimately, understanding an individual's financial standing requires a holistic approach that considers the interplay of various economic factors. Accurate assessment hinges on the availability of reliable, transparent information. The importance of sound financial practices, effective debt management, and strategic investment decisions cannot be overstated in maintaining and growing financial well-being. The pursuit of accurate information remains paramount for informed financial decision-making, whether regarding "David Gates Bread Net Worth" or any other financial evaluation. This framework, encompassing thorough analysis and a commitment to transparency, ultimately provides a more robust foundation for evaluating financial health.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKSVlrGqusZmq6GdXZi1orrGnmadmaaesW6zwK2crGWSp7KisIynnK1lp6S%2FtbSNoaumpA%3D%3D