David Giuntoli's financial standing, often referred to as his net worth, represents the total value of his assets, including property, investments, and cash, minus any outstanding debts. This figure reflects his accumulated wealth and is a common metric used to gauge an individual's financial status. Understanding this value can provide insight into an individual's economic position and potential influence.

Assessing an individual's net worth can be crucial for various reasons. It can provide context to business dealings, financial decisions, or charitable contributions. Public figures, like David Giuntoli, can benefit from transparency surrounding their financial situation in the eyes of investors, fans, or business partners. This transparency allows for a better comprehension of the individual's potential influence or investment capacity.

This information serves as a foundational component for comprehending various aspects of an individual's life and career. A subsequent analysis might investigate the factors contributing to their wealth accumulation, career trajectory, or philanthropic endeavors. Furthermore, a thorough exploration of the factors affecting this figure over time can reveal insights into broader economic trends or industry dynamics.

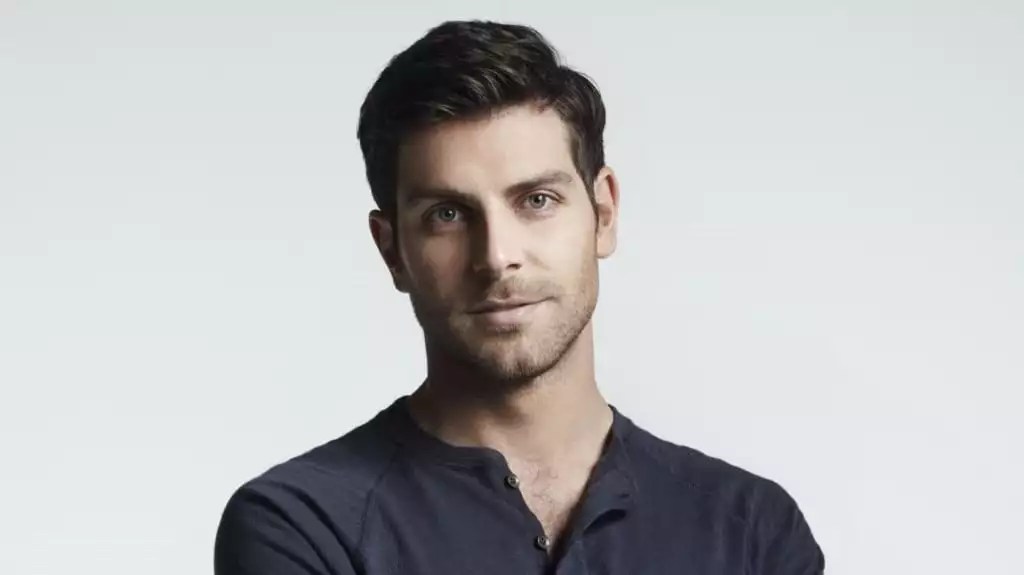

David Giuntoli Net Worth

Understanding David Giuntoli's net worth offers insights into his financial standing and potential influence. Analyzing this figure requires a comprehensive approach encompassing various aspects.

- Financial history

- Career earnings

- Asset valuation

- Investment strategies

- Debt obligations

- Public perception

- Industry trends

- Market fluctuations

These aspects, when considered collectively, provide a more nuanced view of Giuntoli's financial position. For instance, analyzing his career earnings alongside asset valuations reveals potential investment patterns. Understanding the market fluctuations can explain variations in his net worth over time. Public perception of his financial success can also affect his professional standing. A detailed examination of his financial history, earnings, and debt obligations paints a more complete picture of his financial profile. Similar analyses of other individuals in comparable fields or industries can highlight industry-specific trends or patterns, providing valuable context for evaluating Giuntoli's net worth.

1. Financial History

A thorough examination of financial history is essential for understanding the current net worth of any individual, including David Giuntoli. This involves a detailed review of past financial activities, encompassing income sources, investment strategies, and debt management, all of which directly impact the present financial standing.

- Income Sources and Trends

Examining the evolution of income streams provides crucial context. Changes in employment, entrepreneurial ventures, or investment returns significantly affect overall wealth accumulation. Analyzing income patterns reveals consistent sources, sudden increases, or periods of reduced income, each influencing the trajectory of accumulating wealth.

- Investment Portfolio Evolution

The nature and timing of investments play a pivotal role. A detailed analysis of investment choices, diversification strategies, and returns over time provides insights into the effectiveness of financial planning. Identifying periods of high growth or substantial losses helps illuminate the dynamics of asset management and risk tolerance.

- Debt Management Practices

Historical debt management strategies are crucial. Understanding the pattern of debt accumulation, repayment methods, and outstanding obligations provides insights into financial prudence and long-term stability. A clear picture of borrowing patterns helps evaluate the impact on available resources and overall financial health.

- Major Life Events and Financial Decisions

Significant life events, such as marriage, divorce, or raising children, can significantly alter financial circumstances. Analyzing decisions made during these periods illuminates choices that shaped the current financial landscape. This includes the financial impact of major purchases, such as property or large investments.

In summary, a comprehensive review of financial history offers a valuable perspective on the factors that have contributed to David Giuntoli's current net worth. This contextual understanding is vital for any comprehensive evaluation of an individual's financial position.

2. Career Earnings

Career earnings directly influence an individual's net worth. Compensation received throughout a professional life, encompassing salaries, bonuses, and other forms of income, constitutes a substantial component of accumulated wealth. The nature and duration of employment significantly impact the overall financial standing. Consistent high earnings over an extended career generally lead to a higher net worth compared to careers with lower compensation or shorter durations.

Consider an individual with a high-earning profession, like a successful entrepreneur or executive. Sustained high income, coupled with prudent investment strategies, can quickly lead to substantial wealth accumulation. Conversely, individuals in low-paying or entry-level jobs may see slower growth in net worth unless complemented by significant investment returns or careful expense management. Earnings from different career stages, including early, mid, and late career, contribute varying degrees to the overall net worth profile.

Understanding the correlation between career earnings and net worth is essential for both individuals and those analyzing financial situations. This knowledge allows for proactive planning and informed decision-making. Individuals can better strategize career paths based on potential financial outcomes. Analysts can evaluate the contribution of professional income to an individual's overall wealth. Ultimately, the relationship between career earnings and net worth highlights the crucial role of financial planning and investment strategies in achieving financial goals.

3. Asset Valuation

Asset valuation is a fundamental component of determining David Giuntoli's, or any individual's, net worth. It involves assigning monetary values to all assets owned. This process is crucial because the aggregate value of these assets, after deducting liabilities, represents the individual's net worth. The accuracy and objectivity of asset valuations directly influence the precision of the net worth calculation.

Various asset types require different valuation methodologies. Real estate, for example, is often valued based on comparable sales in the same area or through professional appraisal methods. Stocks and other securities are valued based on market prices or through discounted cash flow analysis. Personal property items may be assessed using auction records or professional appraisals reflecting current market conditions. Inconsistencies or inaccuracies in these valuations can lead to distortions in the calculated net worth.

The significance of precise asset valuation is evident in its practical implications. Accurate valuations allow for a realistic assessment of an individual's financial standing. This, in turn, facilitates informed decision-making, such as investment strategies, financial planning, and even potential business transactions. A precise valuation, based on thorough market research and professional appraisals, enhances the trustworthiness of financial reports. Overestimation or underestimation of asset values misrepresents an individual's true financial position, potentially leading to significant errors in judgment.

In conclusion, accurate asset valuation is indispensable for determining net worth. Its precision ensures reliable financial assessments and empowers informed decision-making. Variations in valuation methods and market conditions highlight the need for rigorous and up-to-date data for a truly representative picture of an individual's overall financial health. Without careful and thorough valuation, any calculation of net worthand subsequent analysisis inherently flawed.

4. Investment Strategies

Investment strategies significantly influence an individual's net worth, including that of David Giuntoli. The choices made in allocating capital across various investment vehicles directly impact the growth and overall value of accumulated assets. Understanding the strategies employed allows for a deeper comprehension of the factors contributing to financial success or challenges.

- Diversification

Diversification, the practice of spreading investments across different asset classes (stocks, bonds, real estate, etc.), mitigates risk. By not concentrating capital in a single investment, returns are potentially stabilized. Losses in one area are often offset by gains in another. For example, a portfolio that includes both stocks and bonds can demonstrate resilience during market downturns, providing stability to an individual's investment portfolio. Diversification is crucial in maintaining the stability and growth of long-term wealth.

- Risk Tolerance

Risk tolerance guides investment decisions. An individual with a high risk tolerance may favor stocks with the potential for greater returns but also higher volatility. Conversely, those with a lower tolerance might prefer more stable investments, like bonds. Matching investment strategy with risk tolerance is fundamental for aligning investments with personal circumstances and goals. It prevents undue risk or a reluctance to capitalize on potential gains.

- Time Horizon

The time horizon for investment plays a key role. Individuals with longer time horizons (e.g., retirement planning) can afford to take on more risk, potentially investing in assets with higher growth potential. Shorter-term goals, on the other hand, might favor more conservative strategies to preserve capital. Investment strategies are directly influenced by the timeframe within which the investment is intended to be utilized. This factor affects the level of risk considered acceptable.

- Market Timing and Analysis

Market timing and analysis involve forecasting future market trends to make informed investment decisions. While it is a complex endeavor, understanding market dynamics and potential fluctuations can influence the allocation of funds in a portfolio. Strategies may include evaluating economic indicators or researching specific sectors. However, past success in market timing does not guarantee future results. Incorrect predictions and miscalculations can have negative impacts on an investment portfolio.

These investment strategies, when combined, contribute significantly to the overall net worth. The effectiveness of these strategies shapes the individual's financial trajectory over time. Careful planning and adaptations to changing market conditions and personal circumstances are crucial to maximizing the potential of investment strategies in achieving financial goals.

5. Debt Obligations

Debt obligations represent a critical component in the calculation of net worth. Debt obligations, encompassing various forms of loans and outstanding financial commitments, directly affect the overall financial position. A significant amount of debt can reduce the net worth figure, while a low or nonexistent debt load can indicate a strong financial position.

- Types of Debt

Debt encompasses a wide range of financial commitments. Mortgages on property, outstanding credit card balances, personal loans, and even student loans are examples of different debt obligations that can impact net worth. The types and amounts of these obligations provide insights into financial choices, risk tolerance, and potential financial pressures.

- Impact on Net Worth Calculation

Debt obligations are subtracted from an individual's total assets to arrive at net worth. The size of the debt directly reduces the net worth figure. For instance, a large mortgage reduces the net worth of a homeowner compared to a similar property owner with a smaller mortgage or no mortgage. High-interest debt, due to accruing interest costs, can further diminish net worth over time. The presence and magnitude of debt obligations are a crucial indicator of an individual's financial health.

- Debt Management Strategies

Debt management strategies significantly affect net worth. A well-defined strategy for reducing debt, such as prioritizing high-interest debt or negotiating lower interest rates, can positively impact the net worth. Conversely, poor management, such as failing to make timely payments, can negatively affect net worth by adding interest and penalties. Effective debt management contributes to building a stronger financial position.

- Debt-to-Asset Ratio

The debt-to-asset ratio provides a crucial perspective on an individual's financial leverage and risk. A higher ratio indicates a greater proportion of assets financed by debt. This often signifies a higher risk level compared to an individual with a lower debt-to-asset ratio. It reveals an individual's reliance on borrowed funds to finance assets, offering valuable insights into the individual's financial stability and long-term prospects.

Understanding debt obligations is essential to a complete picture of net worth. The types, amounts, and management strategies surrounding debt directly influence an individual's financial standing. By considering these factors, a more comprehensive understanding of an individual's financial health and overall position can be developed. The size and nature of debt obligations provide valuable context for understanding the factors influencing net worth.

6. Public Perception

Public perception of David Giuntoli's net worth, whether accurate or not, significantly impacts various aspects of his public image and professional life. The perceived financial standing can influence professional opportunities, public trust, and even philanthropic endeavors. This perception, irrespective of its factual basis, has tangible effects on how individuals and organizations interact with him.

- Influence on Professional Opportunities

A perceived high net worth can open doors to exclusive partnerships, collaborations with prestigious organizations, and potentially higher-paying contracts. Conversely, a negative perception, even if unfounded, might hinder or limit professional advancement. This is especially true in fields where financial standing correlates with trust or legitimacy.

- Impact on Public Trust and Reputation

Public perception of financial status can affect the public's trust and overall view of the individual. A positive perception of wealth can foster confidence and credibility, while a perceived lack of financial success might generate suspicion or skepticism. This can significantly affect the perceived value of one's contributions or leadership.

- Effect on Philanthropic Endeavors

Public perception of wealth plays a role in an individual's credibility as a philanthropist. A positive perception can garner increased support and funding for charitable initiatives, while a negative one may hinder fundraising efforts and donor interest. The perceived commitment to philanthropy is strongly influenced by the public's view of the individual's financial capabilities and commitment.

- Media Representation and Public Discourse

Media portrayals often reflect and shape public perception. Negative or inaccurate reports can damage the reputation of the individual, whereas positive or accurate portrayals can create a favorable view. The way media represents Giuntoli's financial standing, whether in news articles or social media, shapes the wider discourse surrounding him.

Ultimately, public perception of David Giuntoli's net worth, whether accurately reflected or not, has a considerable bearing on his public image. The influence of these perceptions can range from affecting professional connections to impacting charitable initiatives, all highlighting the significant role of societal views in individuals' lives.

7. Industry Trends

Industry trends significantly influence an individual's financial standing, including David Giuntoli's. The success or downturn of a particular sector impacts the profitability of businesses and careers within that sector, directly affecting the wealth generated by individuals. Understanding these industry trends is crucial for comprehending the factors that shape net worth.

For example, a thriving technology sector may generate high incomes for software developers, entrepreneurs, and executives. Conversely, economic downturns in industries like manufacturing can lead to reduced earnings or job losses, potentially affecting an individual's wealth. An individual whose career is strongly tied to a sector experiencing decline might see a reduction in their net worth. Analyzing historical trends in the industry can reveal cyclical patterns that offer insights into potential future fluctuations.

Specific industry trends, like increasing automation or shifting consumer preferences, may necessitate adaptation in career paths. Understanding these trends can guide individuals to adjust their skills, seek further education, or explore new opportunities. This adaptability is crucial in navigating an evolving economic landscape. The successful adaptation to industry trends directly impacts career longevity and, consequently, the trajectory of one's net worth. Changes in regulations or technological advancements within an industry can alter the value of certain assets or skills held by an individual. Therefore, staying informed about industry trends is not just academically interesting; it is a practical component of managing wealth effectively.

In conclusion, industry trends are integral to understanding an individual's financial position. These trends exert a substantial influence on career prospects, income levels, and ultimately, net worth. A thorough understanding of these trends empowers individuals to make informed decisions regarding career choices, investments, and financial planning, thereby facilitating greater financial security and well-being.

8. Market Fluctuations

Market fluctuations, encompassing variations in asset values and economic conditions, directly influence an individual's net worth. Changes in stock prices, interest rates, and overall economic health impact investment portfolios and income streams. Understanding these fluctuations is essential for evaluating the dynamic nature of accumulated wealth.

- Stock Market Volatility

Fluctuations in stock market values significantly affect net worth, particularly for individuals with substantial investments in equities. Decreases in stock prices lead to a reduction in the value of shares, potentially lowering overall net worth. Conversely, rising stock market values increase the value of holdings, boosting net worth. This volatility underscores the risk inherent in stock market investments and the need for diversification.

- Interest Rate Changes

Interest rate adjustments impact borrowing costs and investment returns. Higher interest rates increase borrowing costs for individuals with outstanding loans, potentially affecting their ability to manage debt effectively. They can also attract investors seeking higher returns, possibly increasing the value of bonds and fixed-income securities. Conversely, lower interest rates can make borrowing cheaper but may reduce returns on fixed-income investments. These changes directly affect the value and growth of assets and liabilities, thus impacting net worth.

- Economic Downturns and Recessions

Economic downturns or recessions often coincide with declines in asset values across various sectors. Reduced consumer spending, decreased business investment, and decreased employment rates can collectively trigger a decline in overall market performance, leading to a drop in the value of stocks, real estate, and other investments. The impact of these declines on an individual's net worth can be substantial, especially for those heavily invested in market-sensitive assets.

- Inflationary Pressures

Inflationary pressures erode the purchasing power of money over time. Rising prices for goods and services reduce the real value of assets and income, potentially affecting net worth. For example, while an individual's net worth may show a nominal increase, the real value (adjusted for inflation) may be declining. Understanding the inflationary context is crucial when assessing net worth in a long-term perspective.

Market fluctuations present a dynamic interplay influencing an individual's net worth. The volatility of stock prices, interest rates, economic conditions, and inflation all affect the valuation of assets, potentially leading to significant variations in net worth. This necessitates a comprehensive understanding of these market forces when evaluating and projecting an individual's financial well-being. Individuals and analysts must consider these fluctuations when making financial decisions, developing investment strategies, and predicting future financial standing.

Frequently Asked Questions about David Giuntoli's Net Worth

This section addresses common inquiries regarding David Giuntoli's financial standing. The information presented is based on publicly available data and analysis. Precise figures for net worth are often difficult to ascertain definitively.

Question 1: How is net worth determined?

Net worth is calculated by subtracting total liabilities from total assets. Assets include any holdings of value, such as real estate, investments, and personal property. Liabilities represent financial obligations, like outstanding debts or loans. Precise valuations of assets can vary based on market conditions and appraisal methods.

Question 2: Where can I find reliable data on net worth?

Accurate, publicly available data on net worth is often limited. Reliable data sources may include publicly filed financial documents, news articles, and industry analyses. It is crucial to scrutinize the source and methodology used in any reported net worth figure.

Question 3: Why is net worth important to understand?

Understanding net worth provides context regarding an individual's financial position. This information can be relevant for investment analysis, business dealings, and potential collaborations. Moreover, the evolution of net worth over time can reveal patterns and trends.

Question 4: How do market fluctuations affect net worth?

Market fluctuations significantly influence net worth. Changes in stock prices, interest rates, and economic conditions can impact the value of assets held. Individuals with substantial investment portfolios may experience greater fluctuations in net worth than those with limited investments.

Question 5: What role do career earnings play in net worth?

Career earnings form a substantial part of net worth. Consistent high income, coupled with prudent investment, contributes significantly to wealth accumulation. Factors like career trajectory, industry trends, and compensation packages influence an individual's earning potential and, consequently, their net worth.

Question 6: How do debt obligations affect net worth?

Debt obligations reduce net worth. Outstanding loans, mortgages, and other debts are subtracted from total assets when calculating net worth. Effective debt management strategies can positively impact an individual's financial position.

In summary, determining and understanding an individual's net worth requires a careful examination of various factors, including assets, liabilities, market conditions, and career earnings. Reliable data sources and critical analysis are essential for a comprehensive understanding.

The subsequent section will delve into specific details of David Giuntoli's career and background, exploring how these elements may have contributed to their financial status.

Tips for Understanding Net Worth

Assessing net worth, often a key factor in evaluating an individual's financial position, demands a structured approach. This section provides actionable tips for comprehending and analyzing net worth, focusing on practical applications and informed decisions.

Tip 1: Define Clear Financial Goals. Establishing specific financial aspirations, whether short-term or long-term, is fundamental. These goals provide a framework for evaluating financial progress. For example, saving for a down payment on a house, funding education, or building retirement savings each necessitate unique strategies for wealth accumulation and management. Knowing the objectives helps in aligning financial decisions with those goals.

Tip 2: Categorize Assets and Liabilities. Detailed categorization of assets and liabilities is crucial. Assets encompass valuable possessions like real estate, investments, and personal property. Liabilities include outstanding debts, loans, and other financial obligations. Accurate categorization facilitates a clearer picture of the financial standing. For example, separating investment accounts (assets) from outstanding credit card debt (liabilities) provides a precise understanding of the net worth.

Tip 3: Track Income and Expenses. Thorough record-keeping of income and expenses is vital. This detailed documentation offers insights into spending habits and potential areas for saving. For instance, tracking monthly expenditures can reveal opportunities to reduce unnecessary expenses, freeing up capital for investments. This systematic approach allows for better financial planning and decision-making.

Tip 4: Regularly Review and Update Financial Plans. Regular evaluation and adjustment of financial strategies are essential. Market conditions, personal circumstances, and financial goals evolve. Periodic reviews allow for modifications to investment portfolios, expense management, and overall financial plans. Examples include rebalancing investment portfolios based on market performance or adjusting spending habits based on career changes or life events.

Tip 5: Consult with Financial Professionals. Seeking guidance from financial advisors or experts is highly recommended, particularly for complex financial situations. Consultants can provide personalized advice on investment strategies, debt management, and estate planning. Professionals can offer expert insights and support in making informed financial decisions.

Tip 6: Understand Investment Risks and Rewards. Investment decisions involve inherent risks and potential rewards. Understanding the nature of each investment is crucial. Different investment options, such as stocks or bonds, carry unique levels of risk and potential return. A thorough grasp of these considerations supports well-informed investment choices.

Following these tips offers a structured approach to understanding net worth, empowering informed financial decisions, and contributing to overall financial well-being. By implementing these practices, individuals can develop a comprehensive understanding of their financial position and effectively manage their resources.

The subsequent sections will delve deeper into David Giuntoli's career, industry, and relevant financial details, offering a more contextualized understanding of the factors influencing net worth.

Conclusion

This analysis of David Giuntoli's net worth has explored various facets contributing to an individual's financial standing. Key components examined include financial history, career earnings, asset valuations, investment strategies, debt obligations, public perception, industry trends, and market fluctuations. The evaluation highlights the complex interplay of these factors in shaping an individual's accumulated wealth. The study underscores the dynamic nature of net worth, influenced not only by individual decisions but also by external economic forces. A detailed understanding of these components provides valuable context for assessing financial success and its various contributing elements.

While this analysis offers insights into the factors influencing David Giuntoli's financial position, it is crucial to acknowledge limitations in accessing precise data. Publicly available information often falls short of fully revealing the intricacies of an individual's financial profile. Further research, utilizing additional data sources if accessible, might provide a more comprehensive view of the subject's net worth. Ultimately, this exploration underscores the importance of comprehending the intricate variables that shape personal financial standing and emphasizes the need for continued analysis to fully interpret these complex financial narratives.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJuVobKjvsitsGadnpm8s7%2FEnWSmnZSewaLAyKilaJyRq7alecairKesn6G2brrErWSwp6KptW%2B006aj