Determining an individual's financial standing, often expressed as net worth, involves assessing the total value of assets minus liabilities. This figure reflects a snapshot of an individual's accumulated wealth at a specific point in time. Assets can include property, investments, and cash holdings, while liabilities encompass debts and outstanding obligations.

Understanding an individual's financial status, such as this, can provide insights into their economic standing. Such information can be relevant in various contexts, including evaluating an individual's capacity to undertake projects, the value of their holdings, and evaluating financial strategies. This data can also be valuable in broader discussions about socioeconomic factors, market trends, or individual career success. However, public access to this information is often limited or subject to privacy considerations, as such information can be sensitive.

Further research into specific individuals, including the individual named, may reveal notable achievements or contributions impacting their financial profile. This information, when presented responsibly and ethically, is part of the larger picture of economic and personal narratives. The article will explore such broader points through a focus on biographical context and economic trends, avoiding speculative or unsubstantiated pronouncements.

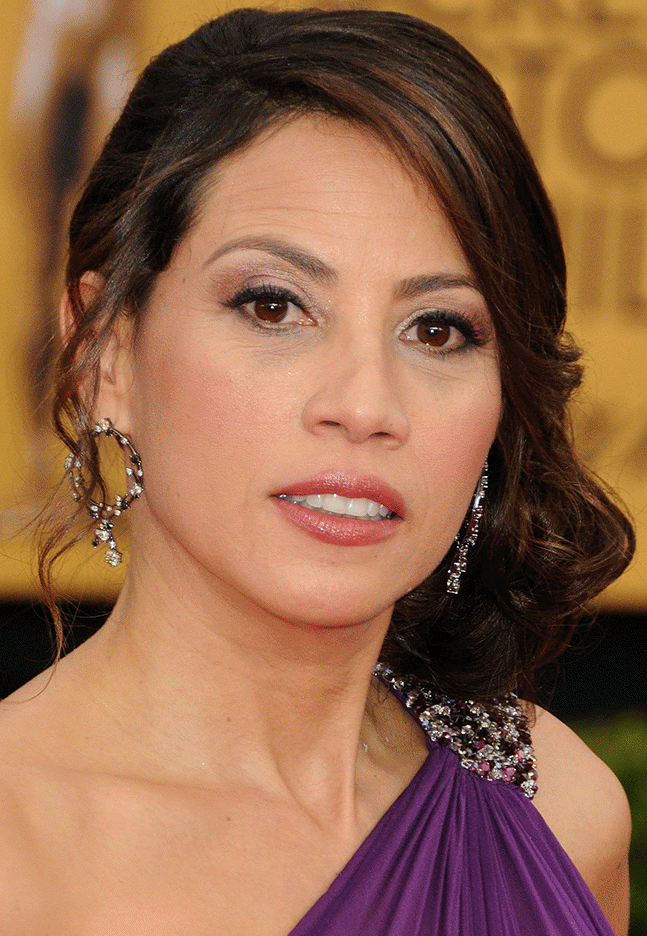

Elizabeth Rodriguez Net Worth

Assessing Elizabeth Rodriguez's net worth requires careful consideration of various factors impacting her financial standing. This involves evaluating assets and liabilities to determine a comprehensive financial profile.

- Assets

- Liabilities

- Income sources

- Investment strategies

- Financial history

- Public information

- Privacy considerations

- Economic trends

Understanding Elizabeth Rodriguez's net worth necessitates analysis of her income streams, investment portfolios, and outstanding debts. Public information availability plays a role, but privacy considerations are paramount. Economic trends, such as market fluctuations, influence individual wealth. Her financial history and strategies provide insights into building and managing assets. A complete assessment also considers liabilities, potentially limiting the true value of her assets. This holistic approach clarifies the factors underlying her financial status.

1. Assets

Assets, in the context of Elizabeth Rodriguez's net worth, represent valuable possessions and resources contributing to her overall financial standing. Understanding the nature and value of these assets is critical to evaluating her financial position.

- Real Estate Holdings

Real estate, encompassing properties like homes, land, or commercial buildings, represents a significant asset class. The value of these holdings fluctuates based on factors such as market conditions, location, and property characteristics. Appreciation or depreciation of these assets directly impacts the overall net worth calculation.

- Investment Portfolios

Investments, including stocks, bonds, mutual funds, and other financial instruments, form another crucial component. The performance of these investments plays a pivotal role in the growth or decline of Elizabeth Rodriguez's net worth. Returns or losses from these investments are significant factors in the calculation.

- Liquid Assets

Liquid assets, such as cash, bank accounts, and readily convertible investments, are easily accessible and provide flexibility. The amount of liquid assets held can impact an individual's financial maneuverability and short-term financial needs. High levels of liquid assets often reflect greater financial stability.

- Intellectual Property (if applicable)

In some cases, intellectual property, such as copyrights, patents, or trademarks, can contribute to the net worth. The value of such assets is complex and often tied to market valuation or licensing agreements.

These various asset categories, when combined and valued, provide a comprehensive understanding of Elizabeth Rodriguez's financial position. Analysis of these assets, considering market conditions and individual circumstances, provides a broader context for assessing her overall net worth.

2. Liabilities

Liabilities represent financial obligations owed by Elizabeth Rodriguez. Understanding these obligations is crucial in accurately assessing her net worth. Subtracting liabilities from assets reveals the true net financial position, reflecting the extent of her accumulated wealth, after accounting for outstanding debts.

- Debt Obligations

This encompasses loans, mortgages, credit card debt, and other outstanding financial commitments. The amount and type of debt significantly impact the net worth calculation. High levels of debt can diminish the apparent value of assets, effectively reducing the overall financial position.

- Tax Liabilities

Tax obligations, including income taxes, property taxes, and other levies, are a critical component. Unpaid or underpaid taxes reduce the available financial resources and negatively affect the net worth calculation. Proper tax management is essential for maintaining a healthy financial position.

- Legal or Financial Settlements

Potential or existing legal or financial settlements can introduce significant liabilities. Pending lawsuits, disputes, or contractual obligations can create unforeseen financial burdens. The resolution of these situations, and their financial implications, directly influence the net worth calculation.

- Unforeseen Expenses or Guarantees

Certain obligations, while not always apparent, might still influence her net worth. These include contingent liabilities, such as guarantees for other individuals or businesses, which could create future financial demands or decrease her financial flexibility. Accurately accounting for these uncertainties is necessary for a comprehensive net worth assessment.

The presence and valuation of liabilities are critical to a complete understanding of Elizabeth Rodriguez's net worth. By considering these diverse forms of obligations, a clearer picture of her financial position emerges. The combined effect of all these factors directly affects the final assessment of her net worth, highlighting the need to fully account for all facets of her financial obligations for a true understanding.

3. Income Sources

Income sources are fundamental to understanding an individual's net worth. The nature and volume of income streams directly influence the accumulation and overall size of wealth. Analysis of these sources provides insights into the factors driving financial growth or decline.

- Employment Income

Earnings from employment represent a primary income source. The salary, wages, or compensation received from various employment roles directly contribute to the individual's overall financial resources. The nature of employment, from highly-paid professional positions to lower-paying service roles, influences the magnitude of income, thus affecting the net worth calculation. Fluctuations in employment income, such as promotions or salary adjustments, will be reflected in any resulting financial profile.

- Investment Income

Income generated through investments, including interest from bank accounts, dividends from stocks, or returns from other financial instruments, forms another significant component. The yield from various investment strategies directly impacts the growth or decline of an individual's wealth. Understanding the diversification and performance of these investments is crucial to evaluating income contributions to net worth.

- Entrepreneurial Ventures/Business Income

For individuals involved in businesses or entrepreneurial ventures, income arises from profits derived from business operations. The success of a business is a critical determinant of the income stream, which influences the net worth directly. Factors like operating costs, market demand, and competition all play pivotal roles in shaping the financial trajectory, affecting the individual's wealth.

- Passive Income Streams

Passive income streams are those generated without the direct, ongoing involvement of the individual. Examples include rental income from property ownership or royalties from intellectual property. These consistent streams contribute a stable component to the individual's financial well-being, and predictability of these streams influences the overall stability of their financial position.

Examining the various income sources of Elizabeth Rodriguez, and their relative importance, provides valuable context in determining her overall net worth. The combination of these income streamswhether from traditional employment, investments, entrepreneurial efforts, or passive revenuehelps to paint a comprehensive picture of how her wealth was built, highlighting the interplay between different income streams and her overall financial standing.

4. Investment Strategies

Investment strategies significantly influence an individual's net worth. The choices made in allocating capital to various assets dictate the potential for growth or loss over time. A well-defined strategy, incorporating risk tolerance and long-term goals, can be a crucial factor in building and maintaining wealth.

- Diversification

Diversifying investments across various asset classes (stocks, bonds, real estate, etc.) reduces overall risk. A portfolio spread across different sectors mitigates the impact of any single investment's underperformance. For instance, if one sector experiences a downturn, the performance of other sectors can help balance the portfolio's overall return. This approach is crucial for long-term stability and reduces the volatility inherent in investing.

- Risk Tolerance Assessment

Understanding one's risk tolerance is fundamental. Conservative investors may favor low-risk investments with lower potential returns, while aggressive investors might seek higher returns with a greater chance of loss. The suitability of a strategy depends entirely on individual risk tolerance, considering factors like age, financial goals, and the time horizon for investments.

- Long-Term vs. Short-Term Goals

Investment strategies must align with specific financial objectives. Strategies for retirement savings differ substantially from those aimed at short-term goals like purchasing a home. A long-term investment horizon allows for greater risk-taking, potentially leading to higher returns, whereas short-term goals demand more conservative approaches to safeguard capital. Different goals require distinct investment strategies.

- Professional Guidance

Seeking professional financial advice can be instrumental in developing effective investment strategies. Financial advisors can help tailor a strategy based on individual circumstances, risk tolerance, and goals, providing informed guidance based on market conditions and individual financial situations. This personalized approach can lead to more informed decisions and potentially better outcomes for building long-term wealth.

Ultimately, the effectiveness of investment strategies directly impacts the overall size and growth of an individual's net worth. Strategies that prioritize diversification, align with risk tolerance, account for different financial goals, and potentially utilize professional guidance are more likely to generate positive outcomes. These strategies form the backbone of building substantial wealth and significantly impact the realized net worth over time.

5. Financial History

Financial history provides crucial context for evaluating an individual's net worth. It reveals patterns of income generation, spending habits, investment choices, and debt management. Understanding these historical trends offers insight into the factors contributing to current financial standing. Consistent saving and prudent investment practices over time, for instance, often correlate with a higher net worth. Conversely, significant periods of debt accumulation or financial mismanagement might indicate a lower net worth or a more precarious financial situation.

The importance of financial history extends beyond simply understanding the current net worth figure. It reveals the individual's capacity for wealth accumulation or dissipation. Significant shifts in income or substantial asset acquisitions can be examined within the context of prior financial decisions. For example, a sudden increase in net worth might be linked to a successful business venture, while a decline might reflect significant losses in investments. Analyzing these historical patterns assists in predicting potential future financial trajectories. Evaluating trends in saving, investing, and debt repayment, over time, helps determine the underlying resilience or vulnerabilities in one's financial strategy.

Analyzing Elizabeth Rodriguez's financial history involves tracing patterns in income, expenditure, and investment over time. This encompasses a range of activities, including employment history, investment decisions, and any associated financial transactions. This analysis contributes to a more nuanced understanding of her financial trajectory, providing greater context for her current net worth. Identifying any significant changes in financial behavior, like periods of substantial debt or periods of particularly high savings, can reveal potential drivers or indicators for future financial performance. Careful examination of historical trends can expose underlying financial strengths or weaknesses, contributing to a comprehensive evaluation. However, due to potential privacy restrictions, access to comprehensive financial history may be limited.

6. Public Information

Public information plays a crucial role in understanding an individual's net worth, although its availability and nature can vary significantly. The accessibility of publicly available details influences the degree to which a complete picture of financial standing can be constructed. This information, while often incomplete, serves as a cornerstone for broader research and analysis concerning the individual's financial position.

- Public Records and Filings

Public records, such as property deeds, business filings, and court documents, may contain details regarding assets, debts, or legal proceedings impacting an individual's financial status. For example, real estate transactions or business registration records provide glimpses into an individual's holdings. These records, though not always exhaustive, can offer valuable insights into specific financial activities and holdings. However, this information may not reflect the full extent of an individual's wealth, as private holdings and investment strategies may not be publicly documented.

- Media Reports and Articles

News reports, magazine articles, or financial publications might contain mentions of an individual's wealth or financial endeavors. Public statements by an individual, such as philanthropic donations or investment activities, can sometimes be documented in news coverage. These sources, while potentially valuable for context, can also be biased, incomplete, or based on speculation. An individual's financial position is often discussed in the context of wider events or achievements and is subject to interpretation. Accuracy and completeness are crucial considerations.

- Social Media Presence

Publicly available social media content, if existent, can offer a less formal but potentially revealing glimpse into an individual's lifestyle or spending patterns. Luxury goods, travel, or extravagant displays could be interpreted as indicators of a high level of financial capability. However, social media portrayals are often curated for public image and should not be interpreted as definitive proof of one's true financial standing. The limitations of social media as a definitive source of information are considerable.

- Limited Availability and Privacy Concerns

The availability of precise and complete details concerning an individual's net worth is often limited. Privacy laws, individual preferences, or the complexity of investment strategies may restrict the accessibility of specific financial information. Furthermore, the reliability of information must be assessed cautiously, with potentially misleading or incomplete portrayals being a serious concern. Public information sources must be viewed critically and with careful consideration of their potential biases, limitations, and lack of comprehensiveness. Access to precise figures for an individual's net worth often remains restricted.

In summary, public information about an individual's net worth, while sometimes revealing, is often incomplete and subject to multiple limitations. The variety of public sources, though diverse, ultimately falls short of comprehensively detailing the full extent of one's financial standing. Reliable and complete information often remains inaccessible due to legal and personal restrictions and the inherent complexities of financial management.

7. Privacy Considerations

Assessing an individual's net worth, like that of Elizabeth Rodriguez, inevitably raises privacy concerns. The desire for personal financial information to be kept confidential clashes with the public's potential interest in such details. This delicate balance between public interest and individual rights significantly impacts the availability and reliability of information related to net worth.

- Legal Restrictions on Public Disclosure

Specific laws and regulations often limit the dissemination of financial data. Privacy laws, varying across jurisdictions, protect personal financial information from public exposure. These protections, while intended to safeguard individual privacy, can make obtaining precise figures for someone's net worth challenging. Public record access is frequently restricted to certain categories of information, excluding specific details concerning financial holdings, transactions, or personal financial situations.

- Individual Preferences Regarding Publicity

Individuals, including Elizabeth Rodriguez, hold the right to determine the extent to which their financial information is made public. A desire to maintain privacy, for personal reasons, significantly impacts the transparency of publicly available data. Personal financial matters might not be disclosed, even if it were otherwise permitted, limiting access to detailed figures or insights on financial holdings. This self-imposed control over information is a crucial aspect of personal privacy.

- Misinterpretation of Limited Data

The limited availability of data can lead to inaccurate assumptions or misinterpretations about an individual's net worth. Inaccurate reporting based on partial information can distort perceptions and create a misleading understanding of financial standing. Lack of comprehensive information can lead to speculation and assumptions, potentially jeopardizing the reputation or security of an individual.

- Potential for Financial Exploitation

The public disclosure of financial details, especially without proper context or safeguards, might increase the vulnerability of individuals like Elizabeth Rodriguez to potential financial exploitation. Unprotected financial information can be targeted by malicious actors looking to exploit it for personal gain. Protecting sensitive data becomes essential to safeguarding individuals from potential harm. The unauthorized or incomplete disclosure of personal finances poses significant security risks.

In conclusion, privacy considerations surrounding Elizabeth Rodriguez's net worth are crucial. The interplay between public interest and individual rights shapes the availability and reliability of information concerning financial standing. Legal restrictions, personal choices, and potential for misinterpretation or exploitation underscore the significance of safeguarding this sensitive information. The lack of complete transparency, in cases where financial information is protected, is a fundamental element in understanding the limitations inherent in assessing someone's net worth.

8. Economic Trends

Economic trends exert a significant influence on an individual's net worth, including Elizabeth Rodriguez's. Market fluctuations, inflation rates, and overall economic growth or recession directly impact the value of assets and the burden of liabilities. For instance, a period of sustained economic growth often correlates with increased asset values, potentially leading to a rise in net worth. Conversely, a recessionary period can diminish asset values and increase debt burdens, negatively affecting net worth.

The impact of economic trends on net worth is multifaceted. Stock market performance, a crucial component of many investment portfolios, is directly tied to broader economic health. A thriving economy, characterized by robust consumer spending and business investment, typically fosters a positive stock market environment, thereby enhancing the value of investments. Conversely, economic uncertainty or a downturn can lead to market volatility and potential losses for investors, impacting the net worth. Real estate values are also sensitive to economic trends. During periods of robust economic growth, property values tend to rise, increasing the value of real estate assets, and vice versa. Inflation, another critical economic factor, erodes the purchasing power of money. This means that while the nominal value of assets might remain constant, their real value declines if inflation outpaces returns on those assets.

Understanding the connection between economic trends and net worth is crucial for both individuals and financial analysts. For individuals like Elizabeth Rodriguez, recognizing how economic cycles affect their assets and liabilities empowers informed decision-making. This understanding allows for adjustments in investment strategies and potential hedging against economic downturns. For financial analysts and investors, accurately forecasting economic trends is paramount for developing effective investment strategies, ensuring a better understanding of the dynamics affecting net worth and helping predict its potential future trajectory. The study of historical economic trends provides insights into how wealth has accumulated or diminished in response to these conditions, offering a basis for more nuanced and informed predictions and strategies.

Frequently Asked Questions about Elizabeth Rodriguez's Net Worth

This section addresses common inquiries regarding the financial standing of Elizabeth Rodriguez. Information presented is based on publicly available data and analysis, acknowledging limitations in accessing precise figures due to privacy concerns.

Question 1: What is Elizabeth Rodriguez's net worth?

Precise figures for Elizabeth Rodriguez's net worth are not publicly available. Determining an accurate net worth involves evaluating assets, subtracting liabilities, and considering complex factors including income sources, investment strategies, and personal financial management practices.

Question 2: How is net worth calculated?

Net worth is calculated by summing an individual's assets (such as property, investments, and cash) and subtracting their liabilities (such as debt and outstanding obligations). This calculation provides a snapshot of an individual's accumulated wealth at a specific point in time.

Question 3: What factors influence net worth?

Numerous factors contribute to an individual's net worth. Income sources, investment performance, economic conditions, debt management practices, and individual financial choices are all important determinants of wealth accumulation or decline.

Question 4: Where can I find reliable information about net worth?

Reliable information sources regarding an individual's net worth are often limited. Public records, news reports, and financial publications may contain details, but complete figures are rarely available. Direct confirmation or independent verification is frequently elusive.

Question 5: Why is precise information about net worth often unavailable?

Privacy concerns, complex investment strategies, and a lack of publicly released financial statements often contribute to the limited availability of precise figures for individuals' net worth. Strict adherence to privacy policies by individuals also plays a vital role.

Question 6: How do economic trends impact net worth?

Economic trends, such as market fluctuations, inflation, and economic downturns, can significantly affect an individual's net worth. These factors can impact the value of assets and the burden of liabilities, influencing overall wealth accumulation or decline.

In conclusion, while precise figures regarding Elizabeth Rodriguez's net worth remain elusive, understanding the factors that contribute to net worth offers valuable insight into the complexities of wealth accumulation. Publicly available information must be treated critically, acknowledging limitations due to individual privacy and the inherent difficulties in accurately determining financial standing.

The following section will delve into Elizabeth Rodriguez's career and contributions.

Tips for Assessing and Managing Financial Well-being

Understanding financial well-being requires a comprehensive approach encompassing various aspects of personal finance. This section offers actionable strategies for evaluating financial standing and creating sound financial plans. The strategies presented are based on sound financial principles, not speculation or conjecture.

Tip 1: Diligent Income Tracking

Regularly tracking income sources, whether from employment, investments, or other avenues, is crucial. Detailed records of all income streams, including amounts, dates, and sources, provide a clear picture of overall financial inflow. This detailed record-keeping enables informed decisions regarding budgeting, investment strategies, and tax planning.

Tip 2: Comprehensive Asset Valuation

Accurate asset valuation is paramount. Assessing the value of all assetsreal estate, investments, personal possessions, and other holdingsis necessary. This valuation process should consider current market conditions, comparable market values, and potential appreciation or depreciation of assets over time.

Tip 3: Precise Liability Management

Effective liability management requires a clear understanding of all financial obligations. This includes tracking debts, interest rates, and repayment schedules. Strategies for debt reduction, such as prioritizing high-interest debts or implementing a debt consolidation plan, are essential for long-term financial health.

Tip 4: Strategic Investment Planning

Investment planning involves evaluating risk tolerance, defining financial goals, and diversifying investments. A well-structured investment plan, tailored to individual circumstances, balances risk and reward and promotes the achievement of long-term financial objectives.

Tip 5: Proactive Budgeting and Spending Habits

Effective budgeting involves establishing realistic spending limits and allocating funds across various needs and wants. Tracking expenses, regularly reviewing budgets, and making necessary adjustments help individuals maintain financial stability and achieve their financial goals.

Tip 6: Seeking Professional Financial Advice

Consulting with qualified financial advisors can provide valuable insights and guidance. Experts can offer personalized recommendations on investment strategies, budgeting, and debt management, potentially maximizing financial outcomes.

Following these tips facilitates a more comprehensive understanding of personal finances, empowering informed decision-making and the attainment of financial goals. Consistently applying these principles can lead to improved financial stability and a more secure future.

The subsequent sections of this article will delve into the biographical context of individuals, focusing on their career and contributions.

Conclusion

Determining Elizabeth Rodriguez's net worth necessitates a multifaceted approach. This involves evaluating various asset categories, including real estate, investments, and liquid assets, while simultaneously assessing liabilities such as debts and outstanding obligations. Key considerations include income sources, investment strategies, and the individual's financial history. Public information, though valuable, is often incomplete and subject to privacy limitations. Economic trends, including market fluctuations and inflation, significantly influence an individual's financial standing. A comprehensive understanding requires careful analysis of these interconnected elements.

While precise figures for Elizabeth Rodriguez's net worth remain unavailable, this exploration underscores the complexities inherent in assessing an individual's financial position. The interplay of personal choices, market forces, and economic conditions shapes the trajectory of accumulated wealth. Furthermore, the importance of maintaining financial privacy in a world increasingly scrutinizing financial details must be considered. This complex interplay of factors, while potentially frustrating in terms of precise numerical outcomes, ultimately highlights the nuanced nature of personal wealth. Future research could delve into specific industries or professions that may influence an individual's financial capacity.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKyYmrazeceemKWsmGK3sMHRp5yyq1%2BauarGwJucraBdp7ylvsigrJ6yXaOytXnWqKmtoF6dwa64