The compensation owed to a terminated head football coach, Gus Malzahn, represents a significant financial obligation for the university. This payment, potentially substantial, is a component of the coach's contract and is triggered by specific circumstances, such as dismissal or resignation under certain conditions. Such financial settlements are a common element in contracts between collegiate athletic programs and head coaches.

The financial implications of such a settlement are substantial and require careful consideration by the institution. The agreements terms and conditions, influenced by factors like length of contract, performance metrics, and any extenuating circumstances surrounding the termination, determine the amount. Understanding the process helps to appreciate the financial commitments associated with high-profile coaching positions and the potential impact on university budgets. Historically, coaching buyouts have been a noteworthy aspect of university athletics finance, reflecting the significant investment made in these roles.

This analysis provides the necessary groundwork for a deeper understanding of the financial and personnel decisions surrounding collegiate athletics. Further research into the specific terms and conditions surrounding this particular instance will reveal critical information about the specifics of the situation. The discussion then moves to explore the broader implications of such compensation packages for athletics and university leadership.

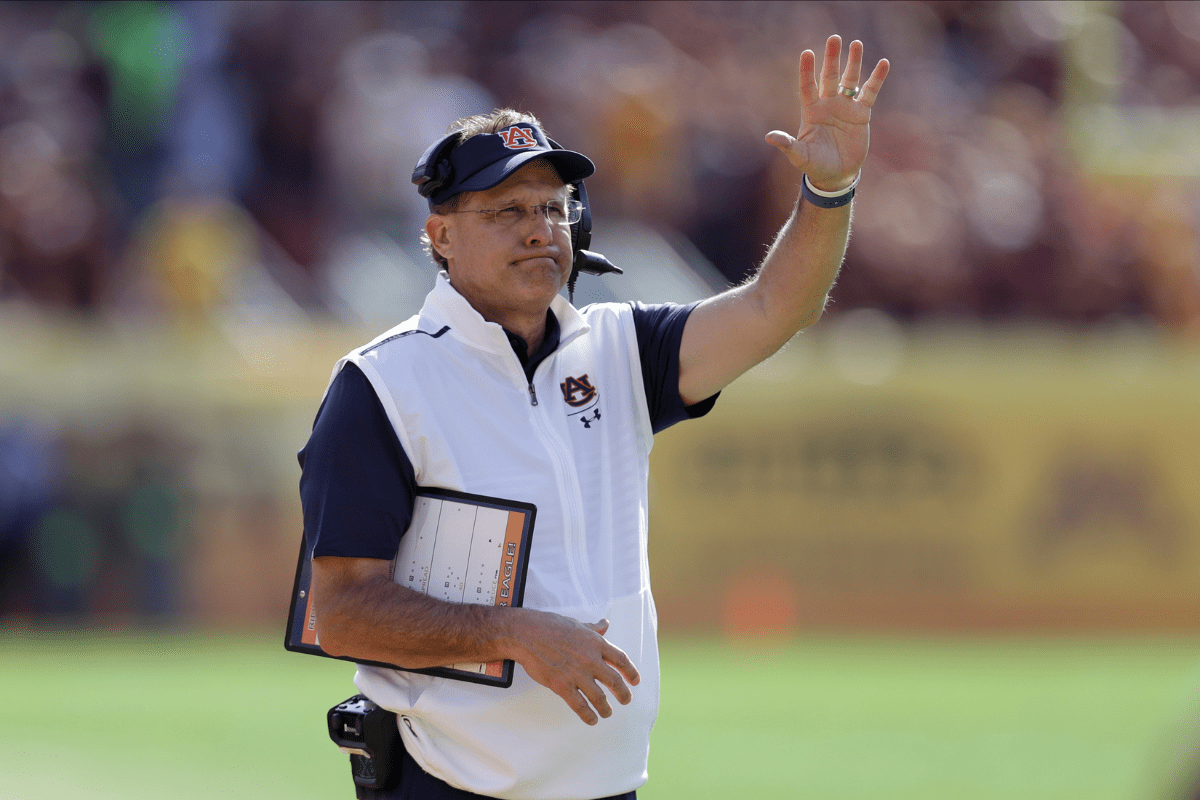

Gus Malzahn Buyout

Understanding the financial implications surrounding a terminated head coach's compensation is crucial for evaluating the management of collegiate athletics programs. The terms of Gus Malzahn's departure, including the associated payout, offer valuable insight into the dynamics of these arrangements.

- Contractual Obligations

- Termination Clauses

- Financial Settlement

- Performance Metrics

- Length of Employment

- Extenuating Circumstances

- University Finances

- Public Perception

The specifics of the contract, including the stipulated buyout, define the financial implications for the university. Termination clauses, reflecting potential performance expectations and the buyout's triggering events, provide a framework for these decisions. Performance metrics, such as win-loss records, have direct impact on the buyout. The length of employment and extenuating circumstances surrounding a departure, if any, are also relevant factors. The impact on university financial resources is a crucial concern, alongside the potential influence on public image. Instances of similar payouts in other coaching departures offer valuable comparative context, demonstrating the multifaceted nature of these financial arrangements.

1. Contractual Obligations

Contractual obligations form the bedrock of employment agreements, including those involving high-profile coaches like Gus Malzahn. These commitments define the responsibilities and rights of both partiesthe university and the coach. Understanding these obligations is essential for comprehending the financial ramifications of a coach's departure, such as the buyout.

- Specific Termination Clauses:

Contracts frequently include detailed clauses outlining circumstances under which employment can be terminated. These clauses often specify payment terms, including buyouts, if certain conditions are met. For example, a contract may stipulate a buyout if the coach is dismissed for cause or if the coach resigns under a predetermined set of conditions. The specific language within these clauses directly determines the amount and conditions of a buyout, including any prerequisites or performance-based triggers.

- Length of Employment:

The length of the coaching contract influences the buyout amount. A longer contract typically results in a larger buyout, as it reflects a greater investment and commitment. The buyout is, in effect, compensation for the remaining contractual obligations. This financial compensation reflects the university's obligations, which are contingent on the stipulations outlined in the contract.

- Performance Metrics:

Many contracts incorporate performance metrics as benchmarks against which the effectiveness of a coach is judged. These metrics, which might include win-loss records or other key performance indicators, are sometimes directly linked to a buyout. A coach's performance record, thus, can shape a buyout figure, influencing the payment obligation for the university if they are released from their commitment.

- Extenuating Circumstances:

Contracts might include stipulations to account for extenuating circumstances. These clauses could address circumstances outside the coach's control that may affect their performance or the university's interest. Such provisions might adjust or waive certain obligations or aspects of the buyout.

The contractual obligations surrounding Gus Malzahn's departure, as with any similar cases, involve intricate details about termination clauses, employment duration, performance metrics, and any potential extenuating circumstances. These elements collectively define the financial implications of the coach's release. The precise terms within the contract directly influence the final payment, showcasing the importance of thorough contract review and analysis to understand the financial burden associated with coaching personnel changes.

2. Termination Clauses

Termination clauses in employment contracts, particularly those of high-profile coaches, are critical components in understanding financial settlements like the one potentially associated with Gus Malzahn's departure. These clauses define the conditions under which employment can be terminated, often specifying compensation arrangements, including buyouts, if certain stipulations are met. Analyzing these clauses provides crucial insight into the financial obligations incurred by the university in cases of coach dismissal.

- Specific Triggering Events:

Contracts frequently outline precise circumstances that justify termination. These may include poor performance, breaches of contract, or unforeseen circumstances. The specific language of the triggering event directly dictates the applicability of a buyout provision. For example, a clause might specify a buyout only if the coach is dismissed for cause, or if the university initiates termination based on performance evaluations falling below pre-agreed metrics.

- Performance Metrics and Their Role:

Many contracts tie termination clauses to performance metrics. These could involve win-loss records, specific on-field achievements, or other key performance indicators (KPIs). A coach's performance record influences the potential applicability of the buyout clause, affecting the university's financial obligation should the coach be released from the contract.

- Length of Employment and Its Impact:

The duration of the employment contract often correlates with the size of the buyout. Longer contracts typically entail larger buyouts, as they reflect a more substantial financial investment in the coach. The buyout, in essence, compensates for the remaining obligations under the contract in the event of termination. This demonstrates the financial commitment tied to high-profile coaching roles.

- Mutual Agreement and Potential Waivers:

Some contracts allow for mutual agreement on termination, with or without a buyout. Furthermore, certain clauses might permit the waiver of specific buyout provisions under particular circumstances. Understanding these potential waivers in contracts is important to ascertain the precise financial implications of a potential termination.

The interplay of these termination clauses, including triggering events, performance metrics, contract duration, and potential waivers, forms the foundation for evaluating the financial implications associated with a coach's departure. Understanding these elements is crucial for a complete perspective on the potential financial settlements, such as the potential Gus Malzahn buyout, and the broader financial management within collegiate athletics.

3. Financial Settlement

A financial settlement, in the context of a terminated head coach like Gus Malzahn, represents the financial compensation owed to the coach upon the termination of their employment contract. This payment is typically structured to account for the remaining period of the contract, and it often includes elements such as base salary, bonuses, and other benefits. The specifics of a financial settlement depend heavily on the terms of the employment contract, including provisions for termination, performance-based compensation, and length of employment. The importance of a financial settlement in these cases lies in its ability to provide a defined resolution for both parties involved, ensuring clarity and a practical conclusion to their contractual obligations.

The connection between financial settlement and a Gus Malzahn buyout is direct. The buyout, in this context, is a specific type of financial settlement negotiated as part of the termination agreement. It serves as a predetermined financial compensation, reflecting the value of the remaining contract period. Examples of these financial settlements abound in professional sports, including cases where contracts are terminated due to performance issues, mutual agreement, or unforeseen circumstances. Analysis of such settlements reveals the crucial role of contract provisions in shaping the financial outcome for both the coaching staff and the university. The settlement amount often factors in the length of the remaining contract, the coach's salary history, and any performance-related clauses within the agreement. Understanding these factors is essential for evaluating the financial implications of such decisions.

In conclusion, a financial settlement, particularly in the form of a buyout, is a critical component in managing the termination of a head coach's employment. The structured nature of such settlements provides clarity and closure to the contractual agreement, addressing the financial implications of the termination. Careful consideration of the elements influencing the settlement's details, such as contract terms, performance metrics, and extenuating circumstances, is essential for a thorough understanding of the financial management practices in collegiate athletics. Analysis of these financial settlements provides valuable insights into the practical implications of coaching contract management in a broad range of circumstances, ensuring equitable and transparent resolution of professional relationships.

4. Performance Metrics

Performance metrics play a significant role in evaluating the effectiveness of a head coach, and consequently, in potential buyout scenarios. These metrics provide quantifiable data on a coach's performance, which can be used to assess whether the coach has met expectations or not. Such assessment factors into any decisions regarding contract termination or compensation adjustments.

- Win-Loss Records and Conference Standing:

Consistent success, measured by a strong win-loss record and high conference standing, is often a key performance indicator. A significant drop in performance, especially when compared to prior seasons or projected outcomes, might trigger consideration of termination and potential buyout negotiations. For instance, a coach consistently leading their team to top-tier conference finishes, but whose subsequent team underperforms, could lead to a buyout discussion.

- Recruiting Class Rankings:

Attracting and developing talent is a critical function of a head coach. Subpar recruiting classes, failing to meet anticipated or prior recruiting class standards, can negatively impact performance metrics and potentially be a factor in determining a coach's future with the program. This factor's influence on a buyout calculation might be based on how the quality of recruiting classes has negatively affected the team's subsequent competitiveness.

- Player Development and Improvement:

Performance metrics can also extend to evaluating player development and improvement. A consistent inability to develop players to meet predetermined standards or the team's performance metrics may be a factor in the evaluation process. This aspect might involve examining player statistics and participation rates, as well as the success and impact of player development initiatives.

- Team Culture and Discipline:

Maintaining a positive and productive team culture, along with ensuring discipline, often correlates with success on the field. Any noticeable decline in these areas, possibly leading to disruptive behavior or diminished team spirit, could be seen as performance-related factors and could potentially contribute to discussions regarding a buyout, particularly if it negatively impacts team morale or performance indicators.

The integration of these performance metrics is crucial in establishing a comprehensive evaluation of a coach's performance. A decline in any of these metrics could lead to a discussion about a possible buyout, weighing various factors such as the extent of the decline, its impact on the team, and the overall program goals. Further analysis would require detailed review of the specific metrics, their historical context, and the overall performance standards established for the coaching role.

5. Length of Employment

The duration of a head coach's employment significantly impacts the financial implications of a termination, including potential buyout arrangements. A longer tenure reflects a greater investment by the institution, potentially leading to a larger buyout amount. The buyout serves, in part, as compensation for the remaining obligations under the contract, reflecting the commitment made over a longer period. The financial outlay is substantial when a longer-term contract is terminated, especially if the coach has a significant salary or performance-based compensation tied to the length of their agreement.

Consideration of length of employment in a buyout calculation is crucial for understanding the financial commitment associated with high-profile coaching positions. Longer contracts often involve performance-based incentives and inducements, which are factored into the buyout. A coach with a shorter contract might have a less significant buyout, while a longer contract typically correlates with a larger amount, even if the reasons for termination are similar. Analysis of past coaching terminations reveals instances where the length of employment directly correlated with the size of the buyout settlement. This underscores the direct link between contractual duration and the financial implications of termination, specifically the amount of the buyout.

Understanding the relationship between length of employment and buyout amounts is vital for evaluating the financial health and management practices of collegiate athletic programs. The practice of buyout arrangements emphasizes the substantial financial investment in high-level coaching positions. Longer-term employment agreements, with the corresponding financial responsibilities, reflect a commitment to success, even when a termination occurs. This understanding is essential for analyzing the financial decisions surrounding personnel changes, shedding light on the underlying financial commitments and strategies within collegiate athletics.

6. Extenuating Circumstances

Extenuating circumstances, when present in a coaching termination, can significantly influence the terms and amount of a buyout. These circumstances, often outside the coach's direct control, might alter the typical interpretation of performance metrics or contractual obligations. Their consideration is crucial in determining the fairness and appropriateness of a financial settlement, such as a potential Gus Malzahn buyout.

- Unforeseen Injuries or Illness:

Significant injuries or illnesses, impacting the coach's ability to fulfill their duties or perform at expected levels, might qualify as extenuating circumstances. This could potentially impact the interpretation of performance metrics within a contract. For example, if a key player suffering a long-term injury negatively impacts team performance across a season, the coach's performance, while not explicitly affected by their health, could be indirectly impacted and warrant consideration. This could lead to a reassessment of the typical termination criteria if injuries or illnesses were a significant factor in the team's performance trajectory.

- Major Changes in Athletic Department Leadership or Policies:

Significant shifts in athletic department leadership or substantial changes in policies could create unanticipated challenges for a coach. If, for example, crucial resources were reallocated or crucial personnel were removed from the coaching staff amidst the tenure of the coach in question, this might introduce extenuating circumstances. Any unforeseen constraints on resources impacting the program's overall performance could influence the interpretation of a coach's performance and consequently influence the potential buyout considerations.

- Unforeseen Major Issues Impacting the Team:

Unexpected major issues impacting the team, such as major off-field disruptions or external factors, could be deemed extenuating circumstances. For instance, community controversies, major legal issues affecting players, or extensive off-the-field disruptions could negatively impact team morale and on-field performance. Such circumstances may necessitate a reevaluation of the expected outcomes and the coach's potential performance, impacting the terms of a buyout. Evaluating the extent of this impact on the program and the coach is crucial in the buyout discussion.

- Changes in Athletic Conference or Schedule:

Significant changes in conference affiliations or major schedule alterations might create extenuating circumstances. The changes may negatively affect the coachs ability to maintain prior performance levels, or they might introduce new challenges that require a different approach or strategy. This could potentially shift the standards against which the coach is measured, deserving consideration in a buyout discussion.

Ultimately, the presence and nature of extenuating circumstances, in a coach's termination, demand careful consideration during the buyout negotiation process. These factors, when significant enough, might modify the application of standard performance metrics or contractual obligations. They highlight the need for a nuanced evaluation of the specific situation to ensure a fair and equitable settlement. Analyzing real-life examples of similar circumstances and their implications for financial settlements can provide additional context and insight into how extenuating circumstances influence buyout negotiations.

7. University Finances

University financial resources are intrinsically linked to decisions regarding coaching compensation, including potential buyouts. The financial implications of a head coach's departure, such as in the case of Gus Malzahn, are substantial and must be considered within the broader context of the university's budget and long-term financial health. This examination explores key facets of university finances relevant to such a significant personnel decision.

- Budgetary Constraints and Allocations:

University budgets are finite, allocating resources across various departments and programs. A significant payout like a buyout represents a substantial drain on the athletics budget, potentially impacting other areas. The allocation of funds, including determining priorities, is central to understanding the feasibility and potential ramifications of a buyout. A university facing financial constraints may be more hesitant to approve a large buyout compared to a financially stable university.

- Revenue Streams and Dependence on Athletics:

Many universities rely on athletic revenue, particularly from ticket sales, sponsorships, and media rights, to supplement general operating funds. Large buyouts, such as a potential Malzahn settlement, can impact these revenue streams. For instance, a poor season might affect ticket sales, reducing potential income to offset the expenditure. This dependency on athletics revenue makes the financial implications of coach terminations crucial in long-term financial planning.

- Long-Term Financial Planning and Projections:

Universities must project future financial needs, including staffing costs, facility maintenance, and program development. A large buyout, such as a potential Malzahn settlement, becomes a significant item in financial projections, potentially impacting the institution's overall budgetary planning and resource allocation strategies for years to come. This consideration underlines the importance of prudent financial management, particularly in decisions affecting coaching personnel.

- Public Perception and Fundraising:

Significant payouts like a possible Malzahn buyout can influence public perception of the university's financial management. Decisions on how to handle such expenses can affect fundraising efforts and the institution's reputation. A large buyout, handled inefficiently, could negatively impact fundraising efforts, diminishing the university's financial capacity. Conversely, a transparent and responsible approach to such expenditures can maintain public trust and support.

In conclusion, the financial implications of a potential Gus Malzahn buyout are multifaceted, directly impacting the university's overall budget, revenue streams, long-term financial planning, and even its public image. Understanding the specific interplay between university finances and such decisions is vital for sound decision-making and the long-term sustainability of the athletic program and the university as a whole. These interconnected factors are critical to evaluating the financial and strategic implications of a coaching buyout in the context of a university's broader mission.

8. Public Perception

Public perception of a university's handling of a significant financial settlement, like a potential Gus Malzahn buyout, holds considerable weight. The manner in which the university addresses such a financial commitment directly influences public opinion and potentially impacts future fundraising efforts, recruitment, and overall institutional image. This analysis examines the crucial link between public perception and the financial decisions surrounding a coaching termination.

- Impact on Fundraising:

A perceived mishandling of a buyout can negatively affect public confidence and willingness to contribute to the university. Public perception of financial prudence directly correlates with trust and support. If the public feels the university is not managing its resources effectively, or that the buyout was excessive, fundraising efforts could be hindered. Conversely, a transparent and justifiable handling of the situation, with a clear rationale for the payment, can foster trust and potentially enhance donations.

- Effect on Recruitment and Retention:

Negative public perception regarding financial management practices can affect the university's attractiveness to potential students and faculty. The perception of value and judicious allocation of resources influences recruitment. A perceived misuse of funds associated with a buyout could potentially deter prospective students and faculty. Conversely, a transparent approach to the situation could project competence and stability, ultimately enhancing the institution's overall appeal.

- Influence on Brand Reputation:

The way a university handles a high-profile termination, particularly one involving a substantial financial settlement, reflects upon its brand reputation. A well-managed approach, characterized by transparency and justification, can reinforce a positive image of fiscal responsibility and prudent decision-making. Conversely, a poorly handled situation might cast doubt on the university's competence and financial management acumen. This perception can have lasting effects on the institution's standing in the broader academic community.

- Influence of Media Coverage:

Media coverage significantly shapes public perception. Thorough and balanced reporting, alongside transparent explanations from the university, can influence how the public interprets the buyout. A lack of clarity or perceived lack of justification can fuel negative commentary, potentially exacerbating negative public sentiment. A proactive approach to communicating the reasoning behind the financial settlement, coupled with responsible media relations, can mitigate negative perceptions.

Ultimately, the public perception surrounding a Gus Malzahn buyout, or any similar financial settlement, is a crucial consideration for universities. A thoughtful and transparent approach, coupled with effective communication, can mitigate potential negative impacts, maintain public trust, and foster a positive image. Conversely, a lack of transparency or perceived mismanagement can have lasting repercussions on the university's reputation and financial standing.

Frequently Asked Questions

This section addresses common inquiries surrounding the financial settlement associated with Gus Malzahn's departure. These questions aim to clarify the complexities of such arrangements within collegiate athletics.

Question 1: What constitutes a "buyout" in this context?

A buyout, in this case, represents the financial compensation owed to a terminated head coach as part of a contract termination. This payment often covers the remaining period of the contract and may include salary, bonuses, and other benefits. The specific terms and conditions, including the trigger for payment, are defined within the contract.

Question 2: What factors influence the amount of a buyout?

Several factors impact the buyout amount. Length of contract, performance metrics, specific termination clauses, and any extenuating circumstances all play a role in determining the final figure. The complexity of the coach's agreement and the university's rationale for termination are essential components in the calculation.

Question 3: How do performance metrics factor into a buyout calculation?

Performance metrics, such as win-loss records, recruiting class rankings, and player development, often influence a buyout. A substantial deviation from projected performance or pre-agreed standards might justify a renegotiation or adjustment of the buyout amount. The specific role of metrics is clearly outlined within the contract.

Question 4: What role do university financial resources play in this decision?

University finances are central to the buyout decision. Budget constraints, revenue streams, and long-term financial planning are key considerations. A thorough analysis of the university's financial position influences the feasibility and terms of the buyout agreement.

Question 5: How does public perception affect these arrangements?

Public perception of the buyout process significantly impacts the university's reputation and potential fundraising efforts. Transparency and justification are vital in managing public opinion. A clear and reasoned approach to the settlement can maintain trust and support.

Question 6: Are there examples of similar financial settlements in other coaching departures?

Analyzing previous coaching terminations, including financial settlements, provides a comparative context for understanding this situation. Such comparisons offer insight into the financial dynamics within collegiate athletics. The specific details of comparable situations should be carefully considered in a holistic assessment of the particular instance.

These frequently asked questions provide a framework for understanding the complexities surrounding a coaching buyout. The specific circumstances and details of Gus Malzahn's case remain the subject of ongoing discussion and evaluation.

This concludes the FAQ section. Further research into the financial details, contractual obligations, and performance metrics can yield a more comprehensive understanding of the specific case.

Tips Regarding Gus Malzahn Buyout

Analyzing a coaching buyout, such as the one potentially associated with Gus Malzahn, requires a multifaceted approach. Understanding the factors influencing such decisions is crucial for assessing the financial health and strategic direction of collegiate athletic programs. The following tips offer guidance on approaching this type of complex evaluation.

Tip 1: Scrutinize Contractual Provisions. A comprehensive review of the contract is paramount. Examine termination clauses, performance metrics, and the specific language regarding compensation. Identify the specific conditions that could trigger a buyout payment, such as poor performance or mutual agreement. For example, a clause stating a buyout is triggered with a 3-year losing streak is crucial in the assessment.

Tip 2: Analyze Performance Metrics. Evaluate the coach's performance against established metrics. Consider win-loss records, recruiting class rankings, and other relevant indicators. A significant deviation from expected performance over time can contribute to a termination decision. For instance, a consistent decline in win-loss records over a multi-year period provides context to the possible financial settlement.

Tip 3: Assess University Financial Resources. Consider the university's financial health. Evaluate budgetary constraints, reliance on athletic revenue, and overall financial sustainability. A buyout represents a substantial financial commitment. For example, a university facing a budget deficit might be less likely to approve a large buyout.

Tip 4: Examine Extenuating Circumstances. Identify any extenuating factors that might have influenced the coach's performance or the termination decision. Issues such as significant injuries, unforeseen schedule changes, or unexpected administrative alterations should be considered. For instance, a key player's injury could significantly affect team performance, potentially influencing the assessment of the coach's performance.

Tip 5: Evaluate Public Perception. Consider the potential impact of a buyout on public image. Public opinion can directly impact fundraising, recruitment, and the overall reputation of the university. A large or seemingly unwarranted settlement might generate negative publicity.

Tip 6: Compare to Similar Cases. Analyzing similar coaching terminations can provide context and potentially illuminate relevant precedents. Examining comparable situations reveals common patterns in handling these complex financial arrangements. This comparison would include reviewing the length of contracts, performance expectations, and the resulting buyout amounts in past situations.

Implementing these tips provides a framework for evaluating a coaching buyout like the potential Gus Malzahn situation. This approach ensures a comprehensive understanding, incorporating various crucial factors for a thorough assessment.

These tips provide a structured approach to analyze the financial and strategic elements of such decisions within collegiate athletics. A diligent review of these factors is essential for a well-rounded evaluation of the specifics of any coaching buyout situation.

Conclusion

The potential Gus Malzahn buyout represents a complex financial and personnel decision with significant implications for the university. Key factors, including contractual obligations, performance metrics, extenuating circumstances, and the university's financial position, all played a role in shaping the potential settlement. The length of employment, specific termination clauses, and the broader context of similar coaching departures provided essential comparative insight. Public perception, a crucial element, further underscored the delicate balance between financial obligations and institutional reputation. The analysis reveals a nuanced interplay of factors, demanding careful consideration of each element in a complex decision-making process.

The case of Gus Malzahn's potential buyout highlights the intricate nature of financial settlements in collegiate athletics. Careful and transparent communication, coupled with a thorough understanding of financial responsibilities, is critical to navigate such situations effectively and preserve the positive image and reputation of the institution. This case serves as a reminder that these decisions demand a comprehensive evaluation considering all relevant factors, ensuring fair and equitable outcomes for all stakeholders. Further examination of similar scenarios and their outcomes can contribute to best practices for managing high-profile personnel decisions in athletic programs within the collegiate landscape.

Article Recommendations

/cdn.vox-cdn.com/uploads/chorus_image/image/61819117/usa_today_11393543.0.jpg)

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaK%2BforKvecCrq2agmajBsL7YaJ6uq12irq3GwKGlZpqlrry2wI2hq6ak