An individual's financial standing, often expressed as a numerical value, reflects accumulated assets minus liabilities. This figure, often referred to as net worth, is a snapshot of an individual's current financial position. For public figures, such as business leaders or entertainers, this data point can offer insights into their economic success and financial health.

Public access to an individual's financial position can be significant in several contexts. For investors, this information may help in assessing the potential investment value of a company or the overall financial stability of its leadership. In certain professional fields, such as business analysis or financial journalism, this data can be helpful in evaluating the economic conditions and trends present in a market or industry. For the public, understanding the financial status of prominent individuals can provide a broader picture of economic performance in specific sectors, although it should not be used as a measure of personal character or ability.

The following sections will explore specific factors that contribute to assessing net worth in the context of notable figures, along with the necessary caveats and limitations of using such information.

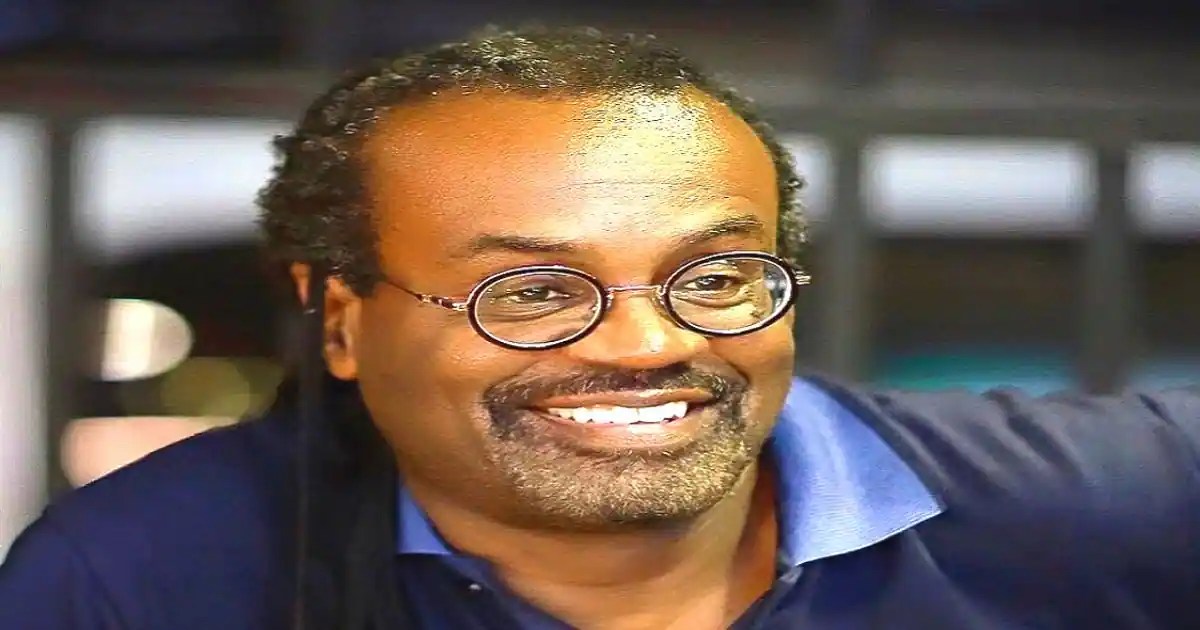

Hurby Azor Net Worth

Assessing Hurby Azor's net worth involves evaluating various financial factors to understand their overall economic standing. This numerical value, while not a complete picture of success, can offer valuable insights into their financial position.

- Assets

- Liabilities

- Income sources

- Investments

- Business ventures

- Real estate

- Salary

- Expenses

These elements, when considered together, paint a more complete financial portrait. For instance, high income, diverse investments, and minimal liabilities contribute to a substantial net worth. Conversely, large debts or expenses that outweigh income and asset values can result in a lower net worth figure. Understanding these aspects provides context for interpreting the significance of Hurby Azor's net worth, recognizing it as one piece of information within a larger picture of financial health.

1. Assets

Assets play a crucial role in determining Hurby Azor's net worth. They represent economic resources owned by the individual, with varying degrees of liquidity and value. Understanding the types and value of these assets provides insight into the individual's financial health and capacity.

- Tangible Assets

Tangible assets include physical possessions of value, such as real estate, vehicles, and collectibles. The value of these assets can fluctuate based on market conditions, location, and individual demand. Real estate holdings, for instance, might be significant contributors to a high net worth if located in areas with appreciating property values. The value of collections can also be substantial, contingent on rarity, condition, and demand from collectors.

- Financial Assets

Financial assets encompass accounts and investments like stocks, bonds, mutual funds, and bank accounts. These assets often represent a liquid source of capital and are crucial in generating income or appreciating in value. The market performance of stocks or bonds, or the yield of other financial instruments, directly impacts the overall value of these holdings and, by extension, Hurby Azor's net worth.

- Intellectual Property

Intellectual property, including patents, copyrights, and trademarks, can be significant assets. The value of intellectual property depends on its commercial viability and market recognition. This can be especially pertinent to individuals involved in creative industries, technology, or entrepreneurship.

- Intangible Assets

Intangible assets are often less tangible but still contribute to net worth. These can include goodwill from a business, valuable relationships with clients, or specialized expertise. For professionals with high levels of expertise, experience, and established networks, these intangible factors can hold substantial economic value.

The diverse range of assets, from tangible real estate to intangible goodwill, contributes to the overall calculation of net worth. The value and liquidity of these assets influence the individual's financial standing and potential for future gains or losses.

2. Liabilities

Liabilities represent financial obligations owed by Hurby Azor. These obligations, from outstanding loans to unpaid taxes, directly impact net worth. A significant level of debt reduces net worth, as liabilities are subtracted from assets to arrive at the figure. The relationship is a direct inverse correlation: increased liabilities translate to a decreased net worth.

The importance of considering liabilities in assessing net worth cannot be overstated. High levels of debt, regardless of the source, can significantly erode financial stability. For instance, substantial mortgage payments, high-interest credit card balances, or large outstanding loans represent financial burdens that reduce the net worth calculation. Conversely, low levels of debt can indicate financial prudence and contribute to a positive net worth. Understanding these relationships is crucial for assessing the financial health of any individual.

The analysis of liabilities is crucial in determining the overall financial health of an individual. A high level of debt, relative to assets, may indicate an inability to meet financial obligations, which can lead to financial distress. In contrast, a balanced proportion between assets and liabilities signifies sound financial management and a robust financial position. This understanding has practical applications in areas like investment analysis, business valuations, and personal finance management. The proper evaluation of liabilities, as well as assets, is fundamental to a comprehensive understanding of net worth and the factors that influence it.

3. Income Sources

Income sources directly influence Hurby Azor's net worth. The nature and magnitude of income streams are fundamental to building and maintaining financial wealth. Consistent, substantial income allows for the accumulation of assets, reduction of liabilities, and ultimately, an increase in net worth. Conversely, insufficient income hinders the ability to build substantial assets or effectively manage existing liabilities, thus impacting net worth negatively.

The type of income is also significant. Passive income, generated from investments or other sources that require minimal ongoing effort, can be a crucial component for long-term financial stability and growth. Active income, derived from employment or business ventures, requires significant investment and often immediate returns for similar accumulation. The interplay between diverse income sources and their respective return potentials has a substantial impact on overall net worth. For example, a successful entrepreneur with several revenue streams, including investments and business ventures, typically exhibits a higher net worth compared to an individual reliant solely on a single source of employment income. Understanding the correlation between income sources and net worth can empower individuals and organizations to make informed decisions about investment strategies and career choices.

A comprehensive analysis of Hurby Azor's net worth requires a detailed examination of income sources. This includes evaluating the stability, sustainability, and growth potential of each source, as well as the associated costs and risks. Identifying income streams with the highest potential for increasing net worth can help prioritize investment decisions and guide future financial planning. The relative importance of income sources can shift over time, reflecting changes in market conditions or personal circumstances. Consequently, ongoing monitoring and adaptation of income-generating strategies are vital for maintaining a healthy net worth and overall financial stability.

4. Investments

Investments are a critical component in shaping net worth. The successful management and growth of investments directly correlate with the accumulation or erosion of overall wealth. Strategic investment decisions, when aligned with financial goals and risk tolerance, can significantly increase net worth. Conversely, poor investment choices or a lack of investment strategy can diminish accumulated wealth. Real-world examples demonstrate this dynamic. Entrepreneurs who diversify their investment portfolios often experience higher net worth increases compared to those relying on a single source of income. Similarly, individuals who consistently reinvest dividends or capital gains frequently exhibit substantial increases in their net worth over time. This correlation highlights the pivotal role investments play in building and maintaining wealth.

The type of investments chosen, their risk profile, and the market conditions during investment periods all influence the impact on net worth. High-risk investments, such as venture capital or certain cryptocurrency ventures, may offer the potential for substantial returns but also carry a high risk of loss. Conversely, investments with lower risk profiles, like government bonds or high-yield savings accounts, provide more stable returns, which may contribute to modest but sustained growth in net worth. The optimal investment strategy depends on individual financial objectives, risk tolerance, and the broader economic context. Understanding the interplay of these factors is crucial for making informed investment decisions that align with personal financial goals.

In conclusion, investments represent a critical element in the overall equation of net worth. Strategic, well-researched investment choices can yield significant returns and contribute substantially to a healthy net worth. However, the potential for loss exists with any investment, underscoring the importance of understanding risk and employing appropriate strategies to manage financial exposures. The success of investment strategies directly impacts net worth, emphasizing the need for careful consideration and informed decision-making in the realm of personal finance.

5. Business Ventures

Business ventures significantly influence an individual's net worth. The success or failure of these endeavors directly impacts the overall financial position. Profitable ventures generate revenue, increasing assets and, consequently, net worth. Conversely, unsuccessful ventures can lead to losses, reducing assets and impacting net worth negatively. The connection is direct: successful business ventures contribute positively to a high net worth, while struggles diminish it.

The impact of business ventures on net worth extends beyond simple profit or loss. Successful ventures often attract further investment opportunities, leading to amplified returns and a higher net worth. Furthermore, established businesses can generate passive income streams, such as dividends or royalties, which contribute consistently to an individual's financial health and net worth over time. This is demonstrably evident in numerous entrepreneurial success stories. Individuals who have founded and scaled successful companies often exhibit substantial net worth, reflecting the cumulative effect of profitable ventures. Conversely, individuals whose business ventures face challenges or fail may experience a decline in net worth.

Understanding the connection between business ventures and net worth is crucial for strategic decision-making. Individuals considering launching a business or expanding existing ventures can assess the potential impact on their overall financial standing. This understanding helps in risk assessment, resource allocation, and long-term financial planning. It also highlights the importance of careful planning, market research, and sound financial management in business ventures, all contributing to a positive effect on net worth. This link underlines the essential role of shrewd business practices in shaping financial prosperity, as success in this domain is a major driver of overall net worth.

6. Real Estate

Real estate holdings are a significant component in evaluating an individual's net worth. Properties, whether residential or commercial, represent tangible assets with inherent value. Appreciation in property values contributes directly to overall wealth accumulation. Conversely, declines in property values can decrease net worth. The presence and value of real estate holdings are a critical factor in determining the overall financial health and standing of any individual, including Hurby Azor.

- Property Types and Values

The variety of real estate holdings, encompassing residential homes, investment properties, land, and commercial spaces, all contribute to the total value. The type and location of property significantly influence its market value. Prime locations or properties with unique characteristics often command higher valuations. The interplay between property type, location, and market trends determines the influence on net worth.

- Investment Strategies and Returns

Real estate investments can yield diverse returns. Rental income from residential or commercial properties provides a regular cash flow, impacting net worth through recurring revenue. Appreciation in property value over time adds to the overall capital gain, contributing further to a positive net worth. Strategies employed in managing and maintaining real estate holdings influence the rate of return and consequently affect overall financial standing.

- Financing and Liabilities

Financing plays a crucial role in real estate investments. Mortgages, loans, and other financing methods are liabilities that reduce net worth. The balance between the value of real estate assets and outstanding financial obligations significantly impacts the final calculation of net worth. Proper management of these liabilities is crucial in maximizing the positive contribution of real estate to an individual's overall financial position.

- Market Fluctuations and Risk Factors

Market fluctuations in real estate values are a significant factor influencing net worth. Changes in local or national economic conditions can lead to price volatility. Factors like interest rates, inflation, and supply and demand dynamics within specific markets play a vital role. Understanding and mitigating these market risks is essential to maintaining a stable and positive net worth, particularly regarding real estate holdings.

In summary, real estate investments, encompassing diverse property types, investment strategies, financing considerations, and market fluctuations, are integral factors in determining Hurby Azor's net worth. The value and management of real estate assets, combined with liabilities and market forces, ultimately influence the individual's overall financial standing. A careful evaluation of these factors is essential for a comprehensive understanding of the role real estate plays in contributing to or detracting from Hurby Azor's net worth.

7. Salary

Salary constitutes a significant component in the calculation of Hurby Azor's net worth. Consistent, substantial income from employment directly impacts the accumulation of assets, reduction of liabilities, and ultimately, the overall financial standing. The value of salary, both in terms of amount and regularity, is crucial to understanding the trajectory and potential of their financial health.

- Impact on Asset Accumulation

A high salary allows for greater savings and investment opportunities. Consistent income provides the capital base necessary for building assets such as real estate, stocks, or other investments. The ability to allocate a portion of the salary toward these assets directly contributes to increasing net worth over time. Conversely, a low salary may limit the resources available for such investments, impacting the rate at which assets accumulate and the overall net worth.

- Influence on Debt Management

Salary directly affects an individual's capacity to manage debt. Higher salaries allow for greater repayment capacity on existing loans or the ability to avoid incurring significant debt in the first place. Individuals with lower salaries may face challenges in paying off debts or securing financial stability, which can hinder the growth and development of net worth. A significant portion of salary dedicated to debt repayment will impact the remaining capital available for investments and asset accumulation.

- Correlation with Lifestyle Expenses

Salary levels determine the lifestyle an individual can maintain. Higher salaries often support more substantial living expenses, leading to an impact on personal finances. The gap between salary and expenses is key: a high salary with proportionally low expenses will allow for more substantial investment in assets, directly influencing the growth of net worth. Conversely, when lifestyle expenses significantly exceed salary, savings and investments become curtailed, thus reducing potential increases in net worth.

- Role in Investment Decisions

A significant portion of salary can be channeled into strategic investments. Investment decisions directly affect the future growth of an individual's net worth. A higher salary provides greater flexibility for experimenting with different investment options. Conversely, a lower salary may limit investment choices, potentially leading to more conservative and potentially less profitable returns, impacting overall net worth growth.

Ultimately, salary acts as a foundation for financial health. The relationship between salary, lifestyle expenses, debt management, and investment strategies determines the pace and magnitude of changes in net worth. Understanding these factors provides insights into the correlation between salary and Hurby Azor's overall financial standing. For individuals in the public eye, this understanding can also give insights into the potential financial impact of various factors, both internal and external, influencing their financial well-being.

8. Expenses

Expenses directly influence an individual's net worth. Expenditures, whether personal or business-related, represent outflows of capital. A careful examination of expenses reveals the extent to which resources are consumed and how effectively financial resources are utilized to achieve specific goals. The relationship between expenditures and net worth is a crucial element in evaluating financial health.

- Impact on Asset Accumulation

High expenses, particularly if not aligned with income, can impede the accumulation of assets. A significant portion of income dedicated to expenses leaves less capital available for investments, savings, or debt reduction, slowing the growth of net worth. Conversely, a well-managed expense structure, with expenses aligned with income, allows more financial resources for accumulating assets and improving the net worth. Individuals who prioritize savings and investments over extravagant expenditures generally exhibit higher net worth over time.

- Influence on Debt Management

Expenses can impact debt management. High expenses, exceeding income, can lead to increased reliance on debt to meet financial obligations. This can result in mounting debt, reducing net worth. Conversely, a controlled expense structure allows for greater capacity to repay debts, contributing to a stronger financial position and a positive net worth. Responsible expense management is crucial in maintaining a healthy debt-to-asset ratio, ensuring financial stability.

- Correlation with Lifestyle Choices

Expenses often reflect lifestyle choices. Different lifestyle choices lead to different expenditure patterns. Luxurious lifestyles, characterized by high expenses, can negatively affect net worth growth. A more frugal lifestyle, with controlled expenses, permits greater accumulation of assets, potentially leading to a higher net worth. Lifestyle choices significantly impact the proportion of income allocated to expenses, directly influencing net worth.

- Role in Evaluating Financial Health

Analysis of expense patterns reveals insights into an individual's financial health. A detailed breakdown of expenses, categorizing them into necessities and discretionary spending, provides a clear picture of resource allocation. Individuals who prioritize essential expenses while keeping discretionary spending in check often exhibit better financial stability and a positive net worth. The evaluation of expense patterns provides a critical benchmark for assessing an individual's financial health and future financial prospects.

Ultimately, the relationship between expenses and net worth is undeniable. Understanding and managing expenses effectively is vital for financial health and wealth accumulation. Controlling expenses while optimizing income generation is crucial for achieving and maintaining a healthy net worth, signifying a balanced approach to financial management.

Frequently Asked Questions about Hurby Azor's Net Worth

This section addresses common inquiries regarding Hurby Azor's financial standing. Accurate financial information is complex and requires careful consideration of various factors. The data presented here is intended to offer a general overview, acknowledging that precise figures are not publicly available.

Question 1: How is net worth determined?

Net worth represents the difference between an individual's total assets and total liabilities. Assets encompass all valuable possessions, including cash, investments, real estate, and other holdings. Liabilities include debts, loans, and outstanding obligations. Calculating net worth involves a comprehensive evaluation of these factors.

Question 2: Why is net worth important?

Understanding net worth provides insight into an individual's financial position and stability. It offers a snapshot of their accumulated wealth and financial obligations. For public figures, this data can be relevant in assessing investment opportunities or industry trends, but it should not be the sole determinant of an individual's worth or character.

Question 3: Where can I find reliable information on net worth?

Direct, publicly available financial statements for private individuals are not commonplace. Reported net worth figures often originate from financial publications, news sources, or reputable financial analysts. It is advisable to verify data from multiple sources to gain a more accurate perspective. Care should be taken when evaluating such information from less reliable sources.

Question 4: How does income influence net worth?

Income plays a significant role. Regular, substantial income allows for increased savings and investment opportunities, which contribute to the accumulation of assets and thereby a higher net worth. Conversely, insufficient income or significant expenses can impede the growth or even erosion of net worth.

Question 5: What role do investments play in net worth?

Investment choices and their performance significantly impact net worth. Strategic investments, carefully selected according to risk tolerance and financial goals, can lead to greater wealth accumulation. Conversely, poor investment decisions or lack of a well-defined strategy can reduce net worth.

Question 6: What are the limitations of net worth information?

Net worth represents a single point in time, not a comprehensive measure of an individual's overall well-being or success. Private individuals often do not release detailed financial information. Reported data may not reflect the full complexity of an individual's financial situation, and therefore should not be relied on for a complete evaluation of an individual or their overall standing in a particular field.

In conclusion, understanding the factors influencing net worth, along with recognizing the limitations of publicly available data, provides a more balanced perspective. This information serves as a starting point for further exploration, not a definitive conclusion. The following sections will delve into specific aspects of Hurby Azor's career and background.

Tips for Understanding Net Worth

This section offers practical guidance on interpreting and understanding the concept of net worth, focusing on critical factors. Understanding net worth is fundamental for informed financial decision-making.

Tip 1: Define Net Worth Clearly. Net worth is a quantitative measure of financial standing, calculated as total assets minus total liabilities. Assets encompass all possessions of value, including cash, investments, and property. Liabilities represent debts and obligations owed. A clear understanding of these components is crucial for accurate interpretation.

Tip 2: Evaluate Asset Diversity. A diversified portfolio of assetsstocks, bonds, real estate, and other investmentsis often associated with a more robust financial position. Over-reliance on a single asset type exposes an individual to potential risks. Diversification mitigates these risks and enhances financial stability.

Tip 3: Assess Liability Levels. A significant proportion of debt compared to assets indicates a higher financial risk. A careful assessment of liabilities, including mortgages, loans, and outstanding credit, provides insights into potential financial strain. Managing liabilities effectively is crucial for maintaining financial well-being.

Tip 4: Analyze Income Sources. Examining income streams, including salary, investments, and business ventures, reveals the sustainability and stability of financial resources. Diverse and reliable income sources generally correlate with higher net worth potential. Understanding the stability of each income stream is essential for predicting future financial health.

Tip 5: Monitor Investment Performance. Regular monitoring of investments' performance, including stocks, bonds, and real estate, is vital. Investment gains contribute positively to net worth, whereas losses reduce it. Understanding market trends and adapting investment strategies accordingly is important.

Tip 6: Track Expenses Carefully. A comprehensive overview of expenses, both fixed and variable, is necessary to evaluate financial prudence. By tracking expenses, individuals can identify areas where spending can be reduced, freeing up capital for savings, investments, or debt reduction, all factors influencing net worth.

Tip 7: Seek Professional Advice When Necessary. Seeking guidance from financial advisors can offer valuable insights and strategic recommendations for managing finances. Experts can help develop personalized plans that align with financial goals and risk tolerance. Professional guidance can be invaluable in optimizing financial outcomes, impacting net worth favorably.

By applying these tips, individuals can better understand the concept of net worth and make informed decisions regarding financial health.

The subsequent sections will delve deeper into the specifics of Hurby Azor's background and career, relating these concepts to their individual case.

Conclusion

Assessing Hurby Azor's net worth requires a comprehensive analysis of various financial factors. This includes evaluating assets, liabilities, income sources, investments, business ventures, real estate holdings, salary, and expenses. The interplay between these elements forms a complex picture of financial standing. A high net worth often signifies successful management of financial resources, whereas a lower net worth may indicate challenges or areas needing attention. Understanding the nuances of these factors provides a more complete picture of Hurby Azor's economic position.

The exploration of Hurby Azor's net worth underscores the multifaceted nature of financial success. It highlights the dynamic interplay between various financial aspects and their influence on overall economic standing. Further investigation into individual components, such as specific investment portfolios or business performance, might offer a more in-depth understanding of Hurby Azor's financial situation. Ultimately, the information presented here serves as a starting point for analysis, prompting further inquiry into the intricate relationship between individual choices and financial outcomes.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKSVlrGqusZmq6GdXZi1orrGnmahraKXxm6t2aipZqaVqXq4u9Gtn2egpKK5