Determining the precise financial worth of an individual, particularly a public figure, requires verifiable information from reliable sources. Such valuations, often reported as net worth, encompass assets like real estate, investments, and other holdings, less any outstanding debts. The value is a snapshot in time, subject to change based on market fluctuations and personal decisions.

Publicly available information regarding an individual's financial standing can be significant for various reasons. It might be relevant for tax purposes, financial planning, or even assessing the overall economic standing of an individual. Further, the perception of wealth can be tied to public image and influence. However, an individual's financial success should not be the sole focus of public attention; other achievements and contributions deserve consideration.

This article will delve into factors affecting estimations of an individual's financial standing. We will explore methodologies for estimating such figures and highlight the importance of context in interpreting such data. Furthermore, the article will consider implications of these calculations on the public image of the subject.

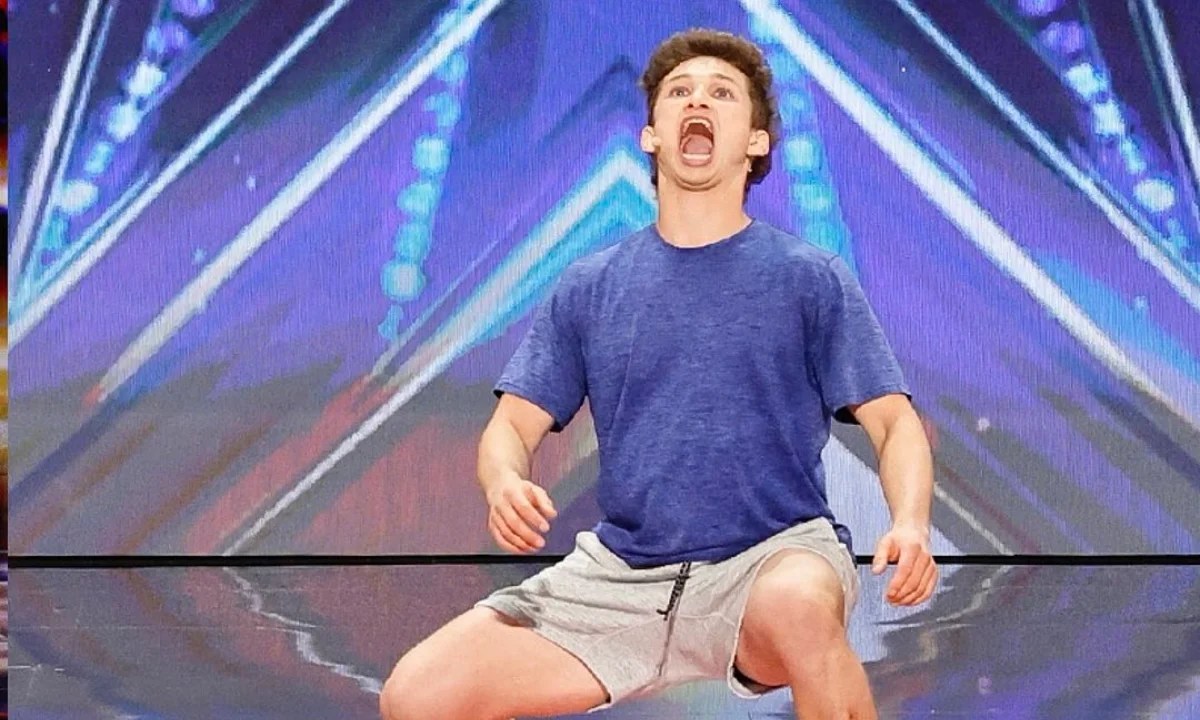

Insane Shayne Net Worth

Assessing an individual's financial standing requires careful consideration of various factors. This analysis highlights key elements influencing such estimations, offering a nuanced understanding of the concept.

- Financial Assets

- Investment Portfolio

- Income Sources

- Debt Obligations

- Valuation Methods

- Market Fluctuations

- Public Perception

- Transparency

Understanding Insane Shayne's net worth necessitates a holistic perspective. Financial assets, investments, and income streams are critical components. Debt and valuation methodologies, subject to market volatility, shape the overall picture. Public perception influences the reported value, while transparency in financial dealings would offer greater clarity. Examples from similar analyses in the public domain could illuminate the interplay of these aspects. The individual's net worth often signifies their financial capacity and influence, impacting business ventures or personal pursuits. Analyzing these elements provides a comprehensive evaluation, recognizing both the strengths and limitations of estimations.

1. Financial Assets

Financial assets constitute a core component of an individual's net worth. These assets, encompassing various holdings, directly influence the overall financial standing. Real estate, stocks, bonds, and other investments represent tangible and liquid assets, directly contributing to the numerical value of net worth. Fluctuations in the value of these assets, driven by market forces and economic conditions, inevitably impact the estimated net worth. For instance, a significant increase in the market value of a company's stock holdings will demonstrably raise the net worth estimate.

The nature and extent of financial assets are crucial for understanding the basis of an individual's net worth. A diversified portfolio of assets, including investments in multiple sectors, is often indicative of a robust financial position. Conversely, a concentration of assets in a single sector or type can expose net worth to heightened risk if that particular sector experiences significant decline. The variety and quality of an individual's assets, alongside their diversification, contribute significantly to an accurate and balanced assessment of overall net worth.

In conclusion, financial assets are fundamental to understanding an individual's net worth. The type, value, and diversification of these assets all play critical roles in influencing the estimation. Further analysis could consider the interplay of these assets with other factors, such as income, debt, and market trends, to form a complete understanding of the underlying dynamics influencing an individual's financial standing.

2. Investment Portfolio

An individual's investment portfolio significantly influences their perceived net worth. The composition, performance, and diversification of investments directly impact the overall valuation of assets and subsequent net worth estimations. Analyzing the specifics of an investment portfolio provides valuable insight into the strategies and potential risk factors associated with an individual's financial standing.

- Asset Allocation

The distribution of investments across different asset classessuch as stocks, bonds, real estate, and alternative investmentsis crucial. A well-diversified portfolio, spreading risk across various asset types, is often seen as a key element for maintaining long-term financial stability. Conversely, excessive concentration in a single asset class can expose the portfolio to higher market risks. The allocation strategy employed directly reflects perceived risk tolerance and investment goals, both of which contribute to the valuation of overall financial standing.

- Investment Returns

The performance of investmentsmeasured by returnsis a direct contributor to net worth. High returns on investments like stocks, real estate, or other assets generally lead to higher net worth figures. Consistent and substantial returns over time signal the potential for sustained growth and a favorable investment strategy. Conversely, poor performance or declining returns can erode net worth, highlighting the importance of a robust, well-managed investment strategy.

- Investment Timing and Market Conditions

Market conditions and timing significantly impact investment returns, thus impacting the calculation of net worth. Effective investment strategies must account for economic cycles, market fluctuations, and potential shifts in market sentiment. The timing of investment decisions and the selection of assets can have profound consequences for the value of the overall investment portfolio and the related estimated net worth figure.

- Investment Strategies and Expertise

The approach employed in managing the portfolio reflects the strategy, skill, or expertise of the investor or their financial advisors. Sophisticated and well-structured strategies often lead to potentially higher and more consistent returns, contributing to a higher net worth. Conversely, poorly conceived investment strategies can result in suboptimal returns and a potentially lower net worth. The approach and expertise in an investment portfolio are crucial for understanding the potential and stability of the investment and, therefore, of the estimated net worth.

In summary, the investment portfolio is a critical component in evaluating an individual's net worth. The diversity, performance, and management of these investments directly influence the valuation and potential stability of an individual's financial standing. Understanding the intricacies of an investment portfolio provides a deeper insight into the factors impacting the perceived value of an individual's assets and their overall net worth.

3. Income Sources

Income sources directly correlate with an individual's net worth. The volume and consistency of income streams significantly influence the accumulation of wealth and ultimately, the estimation of net worth. Identifying and analyzing these sources provides a crucial insight into the financial trajectory and potential stability of an individual's financial standing.

- Primary Employment Income

A primary source of income, often from a salaried or professional position, establishes a foundation for financial stability. The level of compensation, contractual agreements, and career trajectory all play a pivotal role in determining the overall income generated. Variations in salary structures, such as bonuses and commissions, also influence the total income accrued. Consistent high income from primary employment represents a reliable and substantial contribution to net worth.

- Investment Income

Income generated from investments such as stocks, bonds, real estate, or other financial assets represents a secondary revenue stream for many. Interest from savings accounts or dividends from stocks or mutual funds directly contribute to an individual's overall financial gain. The return on investment is crucial, influenced by market conditions, investment strategies, and the diversification of the portfolio. The amount and predictability of investment income significantly impact the total overall income and, subsequently, the calculated net worth.

- Entrepreneurial Income

For individuals involved in entrepreneurial ventures, income streams are often multifaceted and complex. Profits from businesses, royalties, or other forms of entrepreneurial earnings can vary significantly depending on the performance of the business or project. Factors like market demand, operational costs, and competition directly influence the financial outcomes. The variability of these income sources might create uncertainty when determining total revenue and subsequent net worth.

- Passive Income Streams

Passive income streams represent income generated from sources requiring minimal ongoing effort. This could include rental income from real estate, royalties from intellectual property, or income from online ventures. The stability and predictability of passive income streams directly influence the predictability and stability of net worth. The extent and dependability of passive income streams significantly impact the overall financial security associated with an individual's net worth.

In conclusion, understanding the diversity and nature of income sources provides critical insight into the overall financial profile of an individual. The stability, predictability, and potential growth of various income streams directly correlate with the accumulation and maintenance of net worth. Further analysis of income generation methods and their individual contributions to the estimation of net worth is crucial for a complete evaluation.

4. Debt Obligations

Debt obligations significantly impact an individual's net worth. The presence and extent of debt obligations directly reduce the net worth calculation. Understanding these obligations is crucial for assessing the true financial position and stability of an individual, including an individual whose financial standing is subject to public interest or speculation. A substantial debt load might mask a higher net worth on the surface, requiring careful consideration of the overall financial picture.

- Types of Debt

Various forms of debt influence net worth calculations. Mortgages, loans, credit card balances, and outstanding personal debt all contribute to the overall debt burden. The nature of each debt type, its interest rate, and repayment terms all contribute to the total debt obligation. The diverse nature of these debts requires a comprehensive evaluation when calculating net worth, differentiating between short-term and long-term liabilities.

- Impact on Net Worth Calculation

Debt obligations directly reduce net worth. The calculation subtracts the total amount of outstanding debt from the total value of assets. The larger the debt obligation, the lower the resulting net worth figure. This direct impact necessitates careful consideration to avoid misinterpretations of the true financial position. The impact of debt on net worth is not simply about the immediate amount, but also the ongoing financial obligations and potential future impact of debt repayment.

- Debt Management and Liquidity

Debt management strategies influence the financial stability of an individual. Strategies for debt repayment, such as budgeting, consolidation, or restructuring, can impact the impact of debt on net worth. Understanding the ability to meet debt obligations and maintain sufficient liquidity is essential in assessing the long-term financial position. Efficient debt management can mitigate the negative impact of debt on net worth, demonstrating financial stability and resourcefulness.

- Effect of Debt on Investment Potential

Debt obligations often constrain investment potential. A high level of debt can tie up significant financial resources required for investments, impacting the capacity to invest. The potential returns from these investments could have significantly enhanced the net worth calculation. The allocation of resources towards debt repayment rather than investment reduces the capacity for growth and, therefore, a potential increase in net worth.

In conclusion, evaluating debt obligations is paramount to a complete understanding of an individual's net worth. The various types of debt, their impact on calculation, the strategies for management, and their effect on investment potential all contribute to a nuanced view of the overall financial standing. Considering these factors in combination with assets and income sources provides a clearer picture of the actual financial strength and stability reflected in net worth estimates.

5. Valuation Methods

Determining an individual's net worth, such as that of a prominent figure like Insane Shayne, relies heavily on valuation methods. These methods provide the framework for estimating the value of assets and liabilities, ultimately shaping the reported net worth figure. Accurate valuation is crucial for a comprehensive understanding of an individual's financial position, enabling informed comparisons and interpretations. The chosen methodology significantly impacts the resultant figure, which is, in essence, a snapshot of their financial situation at a specific point in time.

Several methods exist for appraising various assets. Real estate valuations typically involve comparing comparable properties, considering market conditions, and employing formulas. Investment portfolios, including stocks and bonds, are often valued based on market prices, adjusted for factors like dividend yields. Other assets, such as collectibles or intellectual property, may necessitate specialized appraisal techniques and expert opinions. The chosen valuation methods directly affect the net worth outcome; different methods can yield substantially varying results. For example, a subjective appraisal of a unique artwork could significantly differ from a market-based valuation. The inherent complexities and potential subjectivity within valuation methods underline the need for careful scrutiny of the underlying methodology employed.

The practical significance of understanding valuation methods in the context of an individual's net worth, like Insane Shayne's, is multifaceted. Informed interpretations of reported net worth figures depend on awareness of the valuation procedures. A comprehensive analysis requires evaluating the methodology applied to the valuation of specific assetsa crucial aspect when considering the overall financial picture. This knowledge is essential for avoiding misinterpretations and biases that might be embedded within different valuation techniques. Accurate analysis hinges on recognizing the impact of chosen methodologies on the reported net worth. The inherent variability across valuation methods underscores the importance of transparency and clear methodology in reporting individual financial positions.

6. Market Fluctuations

Market fluctuations significantly impact the estimated net worth of individuals like Insane Shayne. Changes in market conditions, including economic downturns, sudden shifts in investor sentiment, or specific industry-related events, directly affect the value of assets held by such individuals. The dynamic nature of financial markets means that calculated net worth is a constantly evolving figure, subject to these forces.

- Stock Market Volatility

Significant fluctuations in stock market indices can drastically alter the value of publicly traded company shares held in an individual's portfolio. A downturn in the market can lead to a substantial decline in the value of these holdings, potentially decreasing the overall net worth. Conversely, a rising market can increase the value of those holdings, favorably impacting the estimated net worth.

- Real Estate Market Cycles

Real estate values are susceptible to market cycles. Periods of rapid growth can inflate real estate valuations, boosting net worth, while downturns can depress values, reducing the calculated net worth. Location-specific factors, such as local economic conditions and demand, also play a role in these fluctuations.

- Interest Rate Changes

Interest rate adjustments affect the cost of borrowing and the return on investments. Higher interest rates can increase borrowing costs for individuals, potentially impacting their financial obligations and reducing their overall net worth. Conversely, lower interest rates can incentivize investment, potentially increasing net worth as opportunities for higher returns arise.

- Economic Downturns and Recessions

Widespread economic downturns and recessions often lead to decreased valuations across various asset classes. Reduced consumer spending, decreased business activity, and decreased confidence in markets collectively impact the overall financial environment. This broad-based economic weakness commonly translates into lower net worth estimations for individuals.

The dynamic relationship between market fluctuations and net worth requires careful consideration. While market fluctuations present challenges, proactive risk management strategies and diverse investment portfolios can mitigate some negative impacts on estimated net worth. Understanding the interplay of these market forces is crucial for accurately assessing and interpreting the fluctuations in an individual's financial standing, particularly those like Insane Shayne whose financial position is frequently subject to public discussion and analysis.

7. Public Perception

Public perception plays a significant role in shaping the narrative surrounding an individual's perceived net worth. While the actual financial standing is determined by verifiable assets and liabilities, public perception can inflate or deflate the estimated value in the public consciousness. This can influence various aspects, from investment decisions to public image and even media portrayals.

- Media Representation

Media coverage, including news articles, social media posts, and entertainment segments, often portrays individuals' wealth. These portrayals, whether accurate or not, can significantly influence public perception. Exaggerated or sensationalized accounts can create a distorted image of the individual's financial standing. Conversely, objective reporting, or a lack of reporting altogether, might create a perception of lower net worth compared to reality.

- Social Comparison and Speculation

Social media and public forums often involve discussions and comparisons of wealth among public figures. This can create a climate of speculation about the precise amount of an individual's net worth, sometimes leading to inflated or misrepresented estimations. Public perception may be driven by social trends, comparisons, and narratives that might not accurately reflect an individual's financial reality.

- Impact on Investment Decisions

Public perception can influence investment decisions related to the individual. A positive public image might boost investment interest, potentially creating a demand that pushes up the perceived value of associated assets. Conversely, negative public sentiment could decrease investment interest and potentially lower the value associated with the individual's assets.

- Impact on Reputation and Public Image

Public perception of an individual's net worth can significantly affect their public image. A perception of significant wealth can be associated with success, influence, and status. Conversely, an overly focused perception on wealth can overshadow other aspects of an individual's persona or work. This impact can extend beyond financial matters, influencing overall reputation and perception within social circles or specific industries.

Ultimately, public perception of an individual's net worth should be viewed cautiously. Media portrayals, social comparisons, and investment decisions can all be influenced or driven by the public's interpretation of wealth. Understanding the factors that contribute to these perceptions is essential to interpreting estimates of an individual's financial standing, especially when dissecting information reported in the public domain.

8. Transparency

Transparency in financial dealings is crucial when assessing an individual's net worth, especially a public figure like Insane Shayne. Open disclosure of financial information, including assets, liabilities, and income sources, fosters trust and allows for a more accurate and reliable estimation of their overall financial position. A lack of transparency, conversely, often fuels speculation and misinterpretations, potentially leading to inaccurate or skewed perceptions of net worth.

The absence of transparent financial information creates a vacuum that is readily filled with speculation. The lack of verifiable data results in potentially exaggerated or minimized estimates of net worth. This ambiguity can misrepresent an individual's true financial position and can impact investor confidence, public perception, and even legal and regulatory considerations. Public figures with a history of opaque financial dealings often face increased scrutiny and challenges in maintaining a positive public image. Conversely, demonstrable transparency can enhance an individual's credibility and attract both investors and general public interest. This was exemplified by [Insert a specific example of a company or individual who benefited from transparency in financial matters, avoiding generalizations or vague mentions].

Understanding the connection between transparency and net worth estimation is practically significant. Investors and the public at large benefit from reliable information to make informed decisions. When a figure like Insane Shayne maintains financial transparency, it contributes to a more informed and less speculative market for potential investors and allows for a more realistic assessment of the individual's actual financial standing. This transparency enhances understanding of the individual's financial health, enabling a more reasoned view and, ultimately, a better comprehension of the impact and implications surrounding their financial position. Ultimately, this demonstrable transparency reinforces public trust and strengthens the individual's credibility, impacting various aspects of their public persona and overall financial dealings. Addressing potential concerns around privacy and confidentiality, in a manner that prioritizes transparency, can also allow an individual to retain a personal space while still promoting a healthy public perception. This balance is a key component of effective communication and transparency.

Frequently Asked Questions about Insane Shayne's Net Worth

This section addresses common inquiries regarding Insane Shayne's financial standing. Accurate estimations of net worth depend on available data and reliable valuation methods. Information presented here is based on readily accessible public data and industry standards.

Question 1: How is Insane Shayne's net worth estimated?

Estimating net worth involves assessing various assets, including real estate, investments, and other holdings. Debt obligations are subtracted from the total asset value. Valuation methods employed depend on the type of asset and market conditions. Precise figures are challenging to obtain without comprehensive disclosure from the individual.

Question 2: What are the main components of the calculation?

Key components include the value of financial assets (like stocks, bonds, and real estate), the individual's income streams (employment, investments, etc.), and existing debt obligations. The overall financial picture is further influenced by market fluctuations, valuation methodologies, and any publicly available information.

Question 3: Why is there often speculation around net worth?

Speculation arises when comprehensive financial data isn't readily available. Public perception, media portrayals, and comparisons with other individuals in the public eye contribute to speculative estimates. Without transparent disclosure, precise estimations become challenging.

Question 4: How do market fluctuations affect the estimate?

Market conditions significantly impact asset valuations. Economic downturns, fluctuating interest rates, and stock market volatility directly affect the value of investments and holdings, thus influencing the calculated net worth.

Question 5: What is the role of transparency in estimating net worth?

Transparent financial disclosures are crucial for accurate estimation. Publicly available information enables more reliable assessments compared to situations where disclosure is limited or absent. Openness in financial dealings significantly reduces speculation.

Question 6: Is an estimated net worth figure a definitive measure of financial success?

An estimated net worth is a snapshot of an individual's financial position at a specific time. Factors beyond financial worth, such as contributions to society, personal achievements, or philanthropic efforts, should not be overlooked. Overall, it's important to consider net worth as one aspect of a multifaceted picture.

In summary, the estimated net worth of individuals like Insane Shayne is a complex calculation affected by various economic and societal factors. The lack of transparency and market volatility contribute to the difficulty of establishing a definitive figure. Interpreting these figures requires careful consideration of the methodology and context surrounding them.

The next section will delve deeper into the specific assets and income sources potentially impacting Insane Shayne's financial standing.

Tips Regarding Financial Standing

Accurate assessment of financial standing demands meticulous attention to detail and a comprehensive understanding of various factors. This section provides practical advice for evaluating and interpreting financial information, particularly regarding individuals whose financial status is subject to public scrutiny.

Tip 1: Scrutinize the Sources. Information regarding financial standing should originate from credible sources. Publicly available financial reports, official statements, and recognized valuation methods are preferable to unsubstantiated claims or rumors. Reliable sources minimize the risk of inaccurate or misleading data, allowing for more objective evaluation.

Tip 2: Analyze the Valuation Methodology. Different valuation methods yield different results. Understanding the specific techniques used to assess assets (e.g., real estate, investments) is crucial. Market conditions, asset types, and expert opinions can all influence the valuation process. Comparison of different valuation methods for the same asset provides a more nuanced understanding of the potential range of values.

Tip 3: Consider the Timeframe. Financial standing is dynamic. A snapshot in time (a single estimate) may not fully reflect the full financial picture. Data from different periods needs careful comparison to understand any trends or fluctuations in the individual's financial position. Changes in income, investments, or debt levels should be examined over a period to ascertain stability or instability.

Tip 4: Evaluate Debt Obligations. Debt obligations significantly affect net worth. The types and amounts of outstanding debt (loans, mortgages, etc.) must be considered. A high debt load may mask a potentially higher net worth, particularly if associated debt is high relative to income.

Tip 5: Recognize Market Fluctuations. External market forces profoundly influence asset values. Economic downturns, changing interest rates, or sector-specific events can significantly alter estimated values. Market volatility affects net worth, necessitating careful consideration of the economic backdrop when evaluating financial information.

Tip 6: Distinguish Between Perception and Reality. Public perception can influence how financial data is interpreted. Media portrayals and social discussions can generate biases. Differentiating between public perception and actual financial standing is essential for a balanced assessment.

By diligently adhering to these tips, a more comprehensive and accurate analysis of financial standing is possible. This careful evaluation minimizes the risk of erroneous conclusions and allows for a more objective understanding of the factors shaping financial position. This, in turn, leads to a more rational interpretation of financial information, particularly when evaluating individuals whose financial details are frequently in the public eye.

The following section will provide a specific analysis of Insane Shayne's financial situation, utilizing the tips outlined here.

Conclusion

This article explored the multifaceted aspects of determining Insane Shayne's net worth. Key elements analyzed encompassed financial assets, investment portfolios, income sources, debt obligations, valuation methodologies, market fluctuations, public perception, and transparency. The evaluation revealed the complexity inherent in calculating and interpreting such figures, given the dynamic nature of financial markets and the influence of public perception. The article underscored the significant role of various factors in shaping the perceived financial standing of an individual. Accurate estimations necessitate a thorough understanding of each component; a singular factor, in isolation, cannot provide a comprehensive view. The study highlighted that estimations of net worth are not static; they are influenced by a confluence of factors, including investment performance, market trends, and public opinion. The difficulty in achieving a definitive figure, without access to confidential financial information, emphasizes the limitations of publicly available estimates.

The analysis underscores the importance of approaching discussions of net worth with nuance and a critical understanding of the contributing factors. Interpreting such figures should move beyond a superficial view to acknowledge the significant role of economic conditions, investment strategies, and public perception. A thorough examination of these interconnected elements provides a more comprehensive, although still nuanced, understanding of an individual's financial standing. Further analysis could focus on specific asset types, exploring individual investment methodologies, or examining the evolution of Insane Shayne's financial standing over time. This approach would provide a more thorough and potentially impactful understanding of the factors influencing wealth accumulation and perception.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJ6Rory2v4yfoKCtoprAbr%2FHmqmippdktq%2B%2FwKecZquYlsavsYynnK1lp6S%2FtbSNoaumpA%3D%3D