Estimating an individual's financial standing, often presented as a net worth figure, involves assessing assets (such as property, investments, and holdings) minus liabilities (debts and obligations). This calculation provides a snapshot of an individual's accumulated wealth.

A publicly available figure for someone's net worth can be useful for various purposes. For instance, it might be relevant in understanding a person's economic standing, potential financial impact on specific endeavors, or even for context in professional or personal relationships. In certain circumstances, understanding an individual's net worth can influence public perception or opinions.

This article will delve into factors influencing reported wealth for notable figures. The data presented here will provide a basis for understanding the factors shaping the economic standing of a public figure and the varying methods of gathering such information.

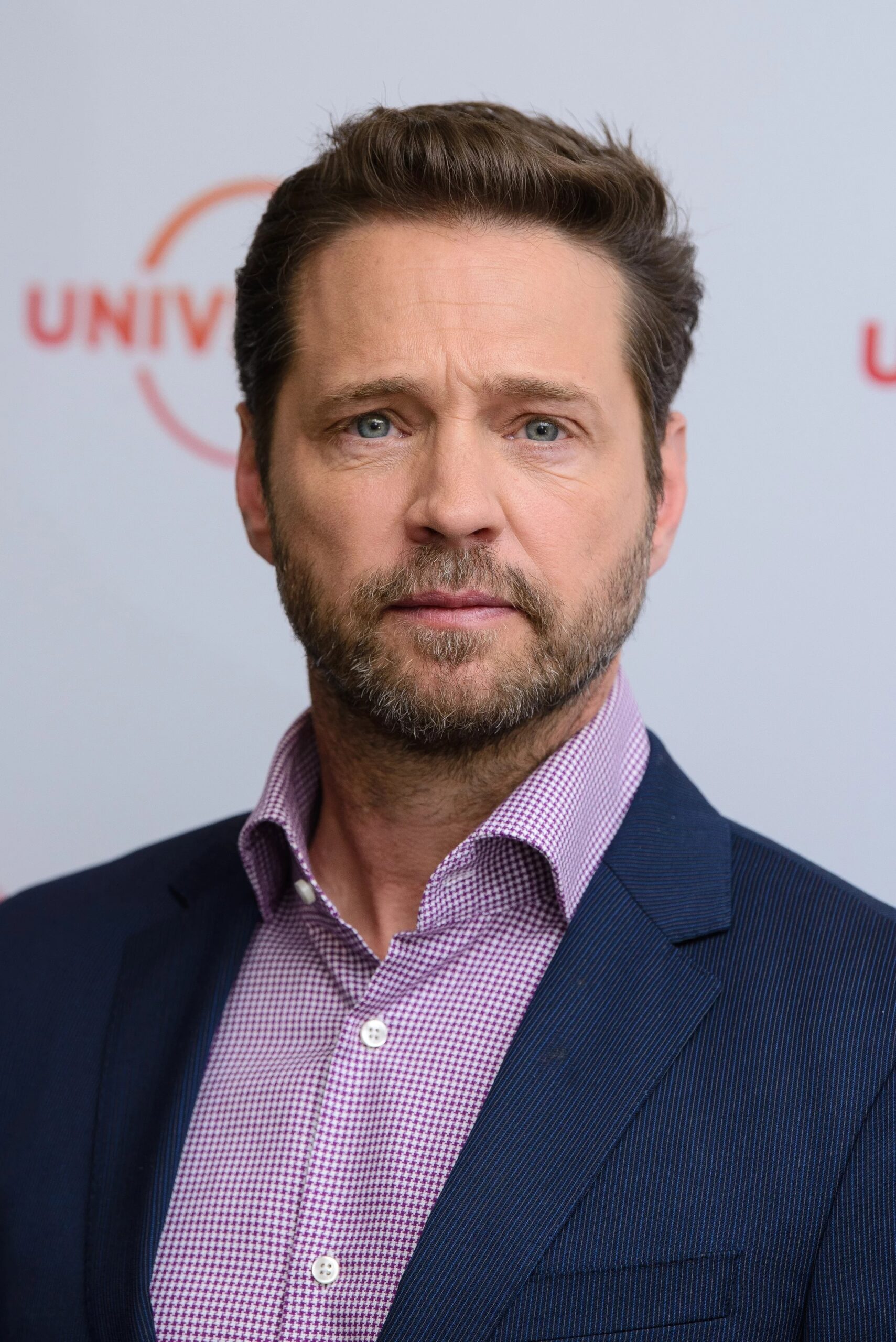

Jason Priestly Net Worth

Understanding Jason Priestly's financial standing involves examining various factors that contribute to his accumulated wealth. This includes income sources, investment strategies, and spending habits.

- Income sources

- Investment returns

- Property holdings

- Business ventures

- Expenditures

- Asset valuation

- Debt obligations

- Public perception

Jason Priestly's net worth, while a crucial aspect of understanding his financial status, is often intertwined with career successes and public image. Income from acting, television appearances, and endorsements likely play a significant role. Investment strategies, including real estate acquisitions and other potentially lucrative investments, contribute to the wealth. Debts and expenditures further shape the picture. Accurate valuation of assets, including intellectual property or ownership of businesses, is essential. Public perception of his financial standing is also significant. Examples of how these aspects contribute are: Higher-profile roles can increase earnings and investment opportunities, impacting his overall wealth. A positive public image and consistent success tend to improve public perception and potentially inflate estimates of his worth. Conversely, significant debts or high-profile expenditures can affect his net worth.

1. Income Sources

Income sources are fundamental components in determining Jason Priestly's net worth. The sum total of his earnings directly influences the overall valuation of his assets. Higher income streams, through various professional activities or investments, typically lead to a higher net worth. Conversely, reduced or unstable income sources can potentially decrease or stabilize a person's overall net worth. This correlation is evident in numerous professions. For instance, successful actors frequently see significant income increases with leading roles in major productions. Investment gains also correlate strongly with net worth, as returns translate directly into increased assets.

Specific income sources for individuals like Jason Priestly can include salaries from acting or presenting roles, endorsements, and potential business ventures. Analysis of these income streams provides insights into the factors impacting the individual's financial status and projections. For example, a steady stream of income from consistent work in television and film directly contributes to a higher net worth. Similarly, successful investments in various asset classessuch as real estate or stockscontribute significantly to the growth of accumulated wealth. Understanding the stability and scale of these income sources, as well as potential future projections, is crucial when assessing the net worth. The variability of income (e.g., from acting) can also affect the overall financial stability and long-term growth of a person's wealth.

In conclusion, income sources form a critical foundation in evaluating net worth. Analyzing the variety, consistency, and potential growth of these income streams offers valuable insights into financial standing. While net worth is influenced by multiple factors, income sources remain a vital aspect in understanding the financial health and position of individuals like Jason Priestly.

2. Investment Returns

Investment returns play a crucial role in shaping an individual's net worth, particularly for figures like Jason Priestly. Returns on investments, whether from stocks, bonds, real estate, or other avenues, directly influence the overall value of assets. Positive returns translate to increased wealth, while negative returns can diminish it. The magnitude and consistency of these returns are significant factors in the growth or decline of net worth over time. For example, successful investments in a rising market can exponentially increase an individual's financial position, adding substantial value to their portfolio. Conversely, poor investment decisions can lead to substantial losses and negatively impact the overall net worth.

The impact of investment returns is multifaceted. Diversification across various asset classes can mitigate risk and potentially enhance returns, contributing to overall financial security. Understanding the risk tolerance of the investor and the potential return associated with different types of investments is key. Timing of market entry and exit also significantly influences returns, and is a crucial factor in the assessment of any investment strategy. For example, timing a real estate investment during a rising market could yield substantial returns, whereas entering a market at the wrong moment could lead to significant losses. The relationship between investment returns and net worth is not merely a simple addition; the compounding effect of consistent, positive returns over extended periods significantly amplifies the impact on total wealth.

In evaluating Jason Priestly's net worth, understanding the role of investment returns is essential. Analysis of investment portfolios, potential investment strategies, and past performance provides insights into the magnitude of their contribution to his financial position. Considering the factors involved in investment decisions and the resulting impacts on his net worth are vital. This analysis highlights the intricate connection between investment acumen and overall financial success, and allows for a more complete understanding of the factors contributing to an individual's financial standing.

3. Property Holdings

Property holdings represent a significant component in evaluating net worth, particularly for individuals like Jason Priestly with diverse financial interests. The value of real estate holdings directly contributes to a person's overall financial standing. Appreciation in property value, resulting from factors like market conditions and location, translates into increased net worth. Conversely, declines in property value can diminish net worth.

Real estate investments often provide passive income streams through rental properties. This stream of income can act as a substantial component of overall wealth generation. The stability and consistency of rental income directly impact net worth. Moreover, property holdings can serve as a hedge against inflation, maintaining or increasing value over time. For example, a successful real estate portfolio can protect against economic downturns and offer diversification within an investment strategy.

Analyzing property holdings within the context of Jason Priestly's overall net worth requires considering factors like location, type of property (residential, commercial, or investment), and the historical trends of property values in those specific locations. The acquisition costs, improvements made, and maintenance expenses also contribute to the overall value and financial health of the properties. Ultimately, understanding the extent and nature of property holdings provides a substantial component in evaluating the overall financial position of Jason Priestly. Careful consideration of these factors offers a more complete understanding of the potential impact on his net worth.

4. Business Ventures

Business ventures significantly influence an individual's net worth. For someone like Jason Priestly, involvement in various business endeavors can substantially impact their overall financial standing. Profitable ventures increase assets and, consequently, net worth. Conversely, unsuccessful ventures can diminish wealth.

- Ownership and Equity:

Direct ownership in businesses or significant equity stakes contribute directly to a person's net worth. Profitable ventures generate income that raises the value of the business interest. This increase in equity value reflects in a higher net worth. For example, if a venture is successful and is worth a substantial amount, this directly contributes to the overall net worth of the individual owning it. Alternatively, if a business fails, the value of the associated equity will decrease, impacting the net worth.

- Investment Returns:

Success in business ventures often involves investment in equipment, facilities, and human capital. Positive returns on these investments directly translate into increased net worth. For example, a new equipment purchase for a growing business could yield substantial returns in productivity and efficiency, which in turn increases profitability and the business's value, thus elevating the owner's net worth. Conversely, poor investment decisions can result in losses, affecting the net worth negatively.

- Profitability and Revenue:

The profitability of a venture directly impacts net worth. Higher profits translate to higher net worth. A successful business model with consistent revenue streams creates increased assets and thus a higher net worth. For example, a growing and profitable business can generate substantial cash flow, enhancing overall wealth. Conversely, unsustainable or struggling ventures can decrease net worth.

- Management and Operational Efficiency:

Effective management and efficient operations within a business are crucial for profitability and increasing net worth. Operational efficiency minimizes costs, increasing profits and maximizing the return on investment, enhancing the valuation of the business venture, and thus elevating overall net worth. Conversely, poorly managed businesses often face increased costs and decreased profitability, diminishing an individual's net worth.

In summary, business ventures can be significant contributors to Jason Priestly's net worth. Success in ventures, measured through ownership value, investment returns, profitability, and efficiency, directly translates into increased wealth. Conversely, challenges and failures can diminish net worth. Thus, analyzing the financial impact of these ventures is a crucial aspect when assessing Jason Priestly's overall financial status.

5. Expenditures

Expenditures directly influence Jason Priestly's net worth, functioning as a counterpoint to income and investment returns. High expenditures, regardless of income level, can reduce net worth, as they represent resources drawn from assets. Conversely, prudent expenditure management can support and enhance wealth accumulation. The relationship between expenditures and net worth is not merely subtractive; it's an active component of financial health and strategic wealth building.

Careful consideration of expenditures is crucial. High-value purchases, such as luxury homes, vehicles, or significant investments, can reduce net worth if not appropriately planned and evaluated against projected income and investment returns. Conversely, responsible spending on essential items, and strategically planned investments, can support the growth of assets and ultimately elevate net worth. The effective management of expenditures is an active strategy, not merely an accounting function.

Analyzing expenditures in relation to income provides a comprehensive financial picture. High-expenditure lifestyles, even with substantial income, can lead to net worth stagnation or decline if not carefully managed. Conversely, individuals who diligently manage expenditures relative to income can consistently build assets and increase their net worth. The effective management of expenditures, therefore, represents a crucial aspect of financial planning. Understanding this correlation highlights the importance of balanced spending and long-term financial strategy. The practical implications extend beyond personal finance to include the wider context of investment strategies and the ongoing maintenance of financial stability.

6. Asset Valuation

Accurate asset valuation is fundamental in determining net worth. The process of assessing the monetary worth of an individual's assetsincluding property, investments, and other holdingsdirectly impacts the calculated net worth. In the case of a public figure like Jason Priestly, reliable valuation methods are crucial for an accurate representation of their financial standing. Inaccurate or poorly conducted estimations can lead to misleading interpretations of their overall financial situation.

- Market-Based Valuation:

This approach uses current market prices to determine the value of assets. For publicly traded stocks, this is straightforward. For real estate, appraisal reports based on comparable sales in the area are common. The fluctuations in market values can significantly impact the valuation of holdings like stocks, property, or other investments. Changes in market conditions necessitate revisiting valuations to reflect current worth, ensuring an accurate snapshot of the overall net worth at a given point in time. This is essential for accurate assessment and financial planning.

- Intrinsic Value Assessment:

This method focuses on the inherent value of an asset, considering factors beyond its market price. For example, a business's intrinsic value might be based on projected future earnings potential, or a unique artwork might be valued based on its historical significance and market demand. This method is particularly applicable when valuing non-liquid or non-standard assets. Evaluating the potential future performance of these assets and projecting the value growth becomes crucial for an accurate calculation of Jason Priestly's net worth. In complex scenarios, professional valuations are often employed.

- Professional Appraisal:

Employing professional appraisers, particularly for complex assets, ensures objectivity and accuracy. These experts, with their specialized knowledge, use established valuation techniques to arrive at reliable estimations. Their knowledge and experience in appraising various asset types are vital for detailed analysis, including properties, artwork, or business ventures. This method is crucial in ensuring accurate representation and understanding of the potential value within the individual's overall financial portfolio.

- Impact of Asset Type:

Different types of assets require diverse valuation methodologies. Liquid assets like cash or stocks are easily valued based on current market prices. Illiquid assets, such as real estate or privately held businesses, often demand more intricate approaches. Understanding the different methodologies needed for varying asset types is critical in determining a comprehensive and accurate assessment of net worth. This is particularly crucial for public figures with multifaceted financial interests, ensuring a fair and comprehensive evaluation of the value of their portfolio.

Accurate asset valuation is paramount for a fair representation of Jason Priestly's net worth. The various methods discussed highlight the multifaceted nature of valuation, emphasizing the importance of reliable methods for tangible and intangible assets alike. By applying these approaches, a comprehensive understanding of his financial standing emerges, free of inaccuracies that can influence public perceptions and hinder professional judgments.

7. Debt Obligations

Debt obligations significantly impact an individual's net worth. The presence and extent of debt subtract from total assets, directly affecting the calculated net worth figure. Accurate assessment of debt obligations is essential for a complete understanding of a person's financial standing, particularly in cases like Jason Priestly where public perception and financial scrutiny are considerations. Evaluating the nature and extent of these obligations provides crucial context when evaluating overall financial health.

- Types of Debt:

Understanding the types of debt is critical. This includes various forms like mortgages, loans, credit card debt, and other outstanding financial obligations. The nature and terms of each debt typeinterest rates, repayment schedules, and collateralinfluence the overall financial picture. For example, high-interest credit card debt has a greater impact on net worth than a low-interest mortgage. Accurate categorization and detailed analysis of the different debt categories offer a comprehensive view of the individual's debt load.

- Debt-to-Asset Ratio:

The ratio of debt to assets provides insights into an individual's financial leverage. A high debt-to-asset ratio indicates a greater financial risk. Careful analysis of this ratio provides insight into potential financial pressures and the potential impact on future earnings or investments. A lower debt-to-asset ratio suggests more financial stability and potentially increased capacity to pursue other financial opportunities. Evaluating this ratio allows a deeper understanding of financial risk tolerance and the health of their overall financial strategy.

- Impact on Cash Flow:

Debt obligations directly impact cash flow. Regular debt payments reduce the amount of disposable income available for other purposes, including investment or future financial endeavors. The impact on cash flow needs consideration in evaluating how debt obligations affect overall financial well-being and potential future opportunities. Detailed analysis of payment schedules and potential future obligations offers insight into the potential strain on future cash flow and helps anticipate potential financial constraints.

- Impact on Investment Strategies:

Debt obligations often constrain investment strategies. Significant debt obligations might limit an individual's ability to invest in new opportunities due to cash flow constraints or to avoid incurring additional debt. For example, if debt servicing requires a large portion of monthly income, there is reduced capacity to invest in other avenues. The constraints posed by debt obligations influence available resources and shape investment choices. Analyzing the correlation between existing debt and available capital is critical.

Considering debt obligations within the broader context of Jason Priestly's net worth highlights the interconnectedness of financial factors. By carefully analyzing various facets of debt, including types, ratios, cash flow impact, and influence on investment strategies, a more comprehensive understanding of his financial situation emerges. This analysis underscores the importance of debt management in maintaining financial health and achieving long-term financial goals. It also illustrates the crucial role of debt obligations in shaping public perception of financial standing, particularly for individuals in the public eye.

8. Public Perception

Public perception of Jason Priestly's financial standing, while not a direct component of his net worth, significantly influences how the figure is viewed and potentially impacts perceptions of his success and value. Public perception, whether positive or negative, can subtly or dramatically impact various aspects of his career. Positive public image often correlates with increased desirability for roles, partnerships, or endorsements, indirectly boosting potential revenue streams. Conversely, a negative public image, particularly one related to financial mismanagement, could deter collaborations and opportunities, potentially affecting income and overall perceived value.

Consider, for example, how media coverage influences public opinion. Favorable media portrayals, often linking success to financial stability, can reinforce a positive public perception of a person's financial standing. This enhanced image can create a self-fulfilling prophecy, driving opportunities and attracting further favorable attention. Conversely, unfavorable media attention, sometimes tied to speculation about financial difficulties, might diminish the public perception of the person's financial success, potentially impacting future opportunities.

Understanding the interplay between public perception and perceived net worth is crucial for figures in the public eye. This interplay is not simply about reputation; it's directly tied to the marketplace of opportunities. Positive public perception, often linked to a perceived high net worth, can be a catalyst for lucrative collaborations. Conversely, perceptions of financial vulnerability or mismanagement can lead to reduced desirability and impact potential earnings. The importance of carefully managing public perception, particularly in the context of financial matters, is paramount for long-term career success and maintaining a favorable reputation. This understanding of the dynamic between public perception and perceived net worth enables proactive strategies to manage image and reputation, effectively influencing financial opportunities and overall perceived success. For public figures, accurate financial reporting and transparent communication are vital in maintaining a positive image that aligns with their actual financial standing.

Frequently Asked Questions About Jason Priestly's Net Worth

This section addresses common inquiries regarding Jason Priestly's financial standing. Accurate and reliable information is presented based on available data and publicly accessible sources. Questions concerning private financial matters are beyond the scope of this document.

Question 1: What factors influence Jason Priestly's reported net worth?

Numerous factors contribute to an individual's net worth, and Jason Priestly's is no exception. Key influences include income sources (salaries, endorsements, investments), investment returns (profitability of various investments), property holdings (value of real estate), business ventures (success and profitability of any business interests), and expenditures (personal and business spending). Accurate valuation of assets and liabilities is critical in determining a precise net worth.

Question 2: How is net worth typically calculated?

Net worth is determined by subtracting total liabilities from total assets. Assets encompass various holdings, including cash, investments, property, and other valuable items. Liabilities represent debts and outstanding obligations. This calculation provides a snapshot of an individual's accumulated wealth at a given point in time.

Question 3: Where can I find reliable information about net worth figures for public figures?

Reliable information on net worth for public figures is often found in financial news publications, reputable financial reporting agencies, and expert analysis pieces. Information from unofficial or speculative sources should be approached with caution.

Question 4: Is Jason Priestly's net worth a static figure?

No, net worth is a dynamic figure that changes over time. Changes in income, investment returns, asset values, and expenditures all impact the net worth calculation. It's a reflection of an individual's financial position at a particular moment.

Question 5: Can public perception influence perceptions of Jason Priestly's net worth?

Yes, public perception can significantly influence the perception of net worth for public figures. Favorable media portrayals, successful endeavors, or any other favorable narrative might elevate the perceived net worth. Conversely, negative perceptions might diminish the perceived value.

Question 6: Is there a publicly available definitive figure for Jason Priestly's net worth?

No, a definitive and publicly available figure for Jason Priestly's net worth is not commonly released. Such financial information is often proprietary. Public estimates come from various sources, and the accuracy and completeness of these estimations may vary.

Understanding these factors helps provide a more well-rounded comprehension of Jason Priestly's financial situation as it's presented in public sources. Information found in public resources should be carefully scrutinized. The next section will further explore Jason Priestly's career and public image.

Tips for Understanding Net Worth

This section provides practical advice for comprehending net worth, focusing on the key factors that influence financial standing. Understanding these elements allows for a more informed perspective on personal finance and the financial standing of public figures. Careful consideration of multiple factors is crucial for accurate interpretation of financial data.

Tip 1: Analyze Income Streams. Identify and categorize all sources of income. This includes salary, investments, business ventures, and any other revenue streams. Detailed records of income sources provide a clear picture of financial inflows. For example, a public figure's income might include salaries from acting roles, endorsement deals, or other professional endeavors. Detailed income records are crucial for a complete financial assessment.

Tip 2: Evaluate Investment Returns. Scrutinize the performance of investments. This includes assessing gains and losses from various investments, such as stocks, bonds, real estate, and other assets. Understanding investment strategies and their associated risk factors is essential. For instance, consistent gains from a well-diversified portfolio generally indicate prudent investment practices.

Tip 3: Assess Property Holdings. Evaluate the value and type of property holdings. This encompasses residential property, commercial properties, and any other real estate holdings. Consider factors like location, market conditions, and property condition in the assessment. For example, a valuable property in a high-growth area will typically hold or increase in value over time.

Tip 4: Consider Business Ventures. Analyze the financial health and profitability of any business ventures. Assess the potential return on investment, revenue generation, and operational efficiency. For example, a successful business venture with a demonstrably profitable model will increase overall net worth. Conversely, a declining or unprofitable venture will have a negative impact.

Tip 5: Factor in Expenditures. Scrutinize the pattern of spending habits. Assess the balance between expenses and income. A thoughtful approach to expenses, balanced with income, is a critical component of sustainable financial health. For example, high spending habits exceeding income can quickly erode net worth. Careful budgeting and spending within one's means are key to long-term financial security.

Tip 6: Understand Asset Valuation. Recognize the importance of accurate asset valuation. Assess various asset types and use reliable methods for evaluating their current market value. Different assetsfrom stocks to real estate to intellectual propertydemand specific valuation methods. For example, real estate valuation may use comparative market analysis or appraisal reports, whereas publicly traded stocks have readily available market prices.

Tip 7: Account for Debt Obligations. Evaluate the extent and impact of debt obligations on net worth. Factor in various debt types and their impact on cash flow. For example, high-interest debt will significantly reduce net worth compared to low-interest debt.

Applying these tips provides a more comprehensive understanding of financial standing, whether for personal finance or evaluating public figures. These principles offer a structured and analytical approach for assessing financial situations and making informed judgments.

The subsequent sections will explore the career and public image of Jason Priestly, offering deeper insight into the factors impacting his public image and perceived financial standing.

Conclusion

This exploration of Jason Priestly's net worth reveals a complex interplay of factors shaping financial standing. Income sources, investment returns, property holdings, and business ventures all contribute significantly. Expenditures, debt obligations, and the crucial element of asset valuation are integral components in the calculation. Furthermore, public perception plays a significant role, albeit indirectly, influencing the perceived value of the individual's economic standing. The analysis underscores that a precise figure for net worth often remains elusive, particularly for individuals whose financial affairs are not publicly disclosed. Evaluating the available evidence carefully yields a comprehensive understanding of the key contributing factors.

While a definitive figure for Jason Priestly's net worth remains elusive, a deeper understanding of the components affecting financial standing is crucial. Careful consideration of income, investments, assets, and liabilities provides a more robust and informed perspective on personal finance and the economic realities of public figures. This article highlights the multifaceted and nuanced nature of financial valuation, illustrating the complexity of such calculations and the significance of various contributing elements. Further analysis of specific data points, particularly in the realms of income and investment, could enhance the understanding of this individual's overall financial standing.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKyYmrazeceemKWsmGK3sMHRp5yyq1%2BfrrS7zWanq6GVqMGtxYynnK1lp6S%2FtbSNoaumpA%3D%3D