Determining an individual's net worth is a complex process, involving assessing various assets and liabilities. Publicly available financial information for Jon Tenney, if it exists, would reflect this total net worth. This encompasses various forms of wealth, such as investments, real estate, and income. Absence of publicly available financial data would mean an estimation of net worth is not possible.

Assessing an individual's financial standing is important for several reasons. It can offer insights into an individual's financial health and success. In certain contexts, such as industry or public figures, understanding their financial status may provide further context to their career trajectory or impact. Public figures often face scrutiny, and their financial information can be relevant in public discussions. However, respecting privacy and avoiding assumptions is critical.

The article that follows will explore the factors influencing estimations of net worth and the challenges in obtaining precise figures for individuals. It will provide insights into related topics, such as the importance of financial transparency in specific situations and the potential role of financial reporting in industry sectors.

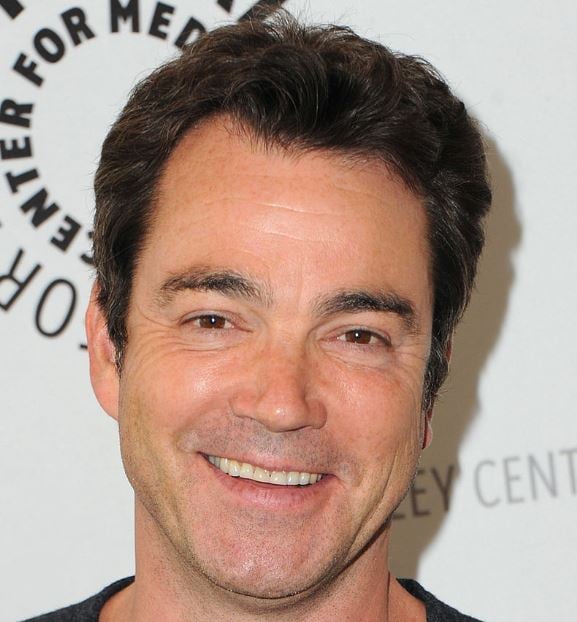

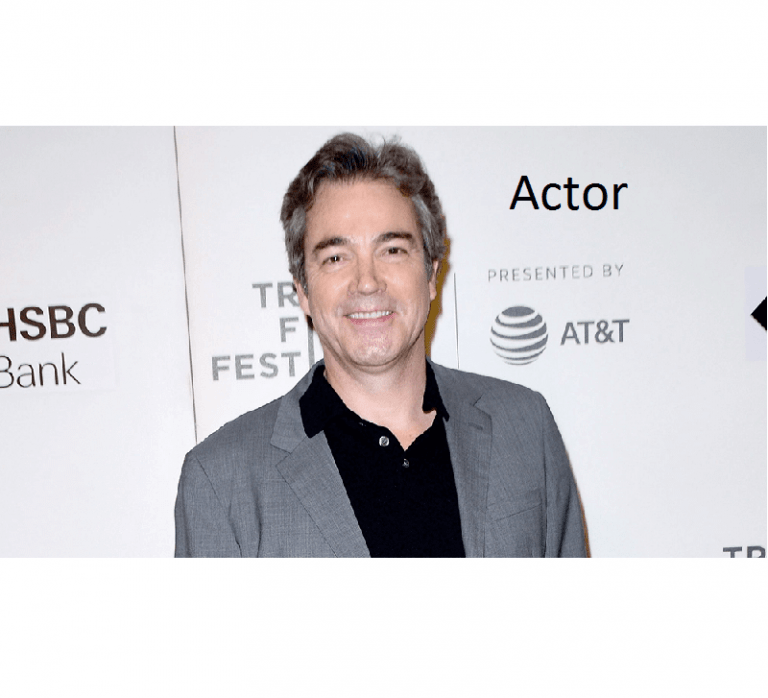

How Much Is Jon Tenney Worth?

Determining an individual's net worth requires a comprehensive approach. This includes evaluating various financial factors, recognizing that public information might be limited. The following aspects are crucial to understanding the complexities involved.

- Assets

- Liabilities

- Income sources

- Investment portfolio

- Real estate holdings

- Business valuations

- Public data availability

These factors, when combined, provide a more complete picture of financial standing. For instance, a substantial investment portfolio alongside significant real estate holdings will contribute considerably to a higher net worth. Similarly, substantial business valuations factor into the total. However, without access to detailed financial records, a precise figure becomes challenging to determine definitively. Publicly available information, if any exists, is often a starting point and will never provide the full picture, particularly without detailed tax filings and the like.

1. Assets

Assets are crucial components in determining an individual's net worth. They represent valuable possessions or rights that can be converted into cash. For Jon Tenney, or any individual, the value of assets directly influences the overall net worth calculation. A diverse portfolio of assets, ranging from liquid investments to real estate, contributes significantly to the total. The greater the value and diversity of these assets, the higher the potential net worth.

Consider a scenario where an individual holds substantial shares in a publicly traded company. The market value of those shares directly impacts the individual's net worth. Similarly, real estate holdings, whether residential or commercial, are valued based on market conditions and comparable sales. The value of these assets fluctuates with the market; a rise in market value positively impacts the net worth, while a decrease has the opposite effect. Furthermore, assets can include personal property, such as vehicles or art collections, each with its own associated valuation methods. Detailed knowledge of the type and value of these assets is essential in estimating overall net worth accurately. For instance, if the value of an individual's portfolio of assets declines significantly, their net worth will likely reflect this decrease.

In summary, assets are fundamental to evaluating net worth. The types and values of an individual's assets directly determine a substantial portion of their overall financial standing. Understanding the role of various asset types and their potential impact on valuation is critical in accurately assessing and interpreting net worth figures. However, the precise calculation necessitates accurate valuations for each asset type, which can be subject to market fluctuations and complexities inherent in specific asset classes. This understanding is fundamental to a comprehensive financial analysis.

2. Liabilities

Liabilities represent an individual's financial obligations. Understanding these obligations is crucial for accurately determining net worth. Liabilities directly subtract from an individual's assets, reducing the overall net worth figure. For example, outstanding loans, mortgages, or credit card debts represent liabilities that diminish the overall financial standing. The amount of these obligations, alongside their associated interest rates and terms, significantly impacts the net worth calculation. A higher level of liabilities directly translates to a lower net worth, given their effect on total assets.

The importance of considering liabilities extends beyond simply subtracting them from assets. The types and amounts of liabilities can offer insights into an individual's financial health and stability. For instance, substantial debts in relation to income levels can indicate financial risk or potential strain. A diversified portfolio of assets, even substantial, might be overshadowed by an excessive burden of liabilities. The relationship between liabilities and net worth is fundamentally inverse. Understanding this connection provides a more comprehensive view of an individual's financial standing and potential risk.

In essence, liabilities counterbalance assets in the calculation of net worth. The more significant the liabilities, the more substantial the offset to the total asset value. Without acknowledging these obligations, a complete and accurate net worth calculation is impossible. This nuanced understanding of liabilities is essential for evaluating financial well-being, assessing potential risk, and understanding the broader picture of an individual's overall financial status.

3. Income Sources

Income sources are a critical component in determining net worth. The nature and volume of income directly influence the total accumulated wealth. Varied income streams, both current and historical, provide a comprehensive view of financial stability and potential for future accumulation.

- Salaries and Wages

Employment-based income is a fundamental source of wealth. The amount earned through salaries and wages directly contributes to an individual's overall income. Factors like job title, seniority, and industry influence earnings. High-paying professional positions or specialized skills contribute to a significantly higher income potential, impacting the accumulation of assets and, consequently, net worth.

- Investment Income

Returns from investments, such as dividends, interest, or capital gains, contribute significantly to an individual's financial position. Investment income is generated from assets held and managed, with the value and management of these assets playing a crucial role. A diversified and effective investment strategy can generate substantial income and contribute to a higher net worth. The historical performance of investments, including compounding effects, directly impacts the current net worth.

- Business Income

If applicable, income generated from business ownership or entrepreneurial ventures contributes substantially to net worth. Profit margins, revenue generation, and operational efficiencies all influence the financial output of these enterprises. The success of a business significantly correlates with the owner's income and overall financial status. The stability and scale of business operations influence the level of income and, ultimately, impact the net worth of the business owner.

- Other Income Sources

Various other sources, like royalties, trusts, or rental income, also contribute to an individual's total income. These additional streams can significantly influence the overall income picture and, consequently, the calculation of net worth. The predictability and stability of these income streams are crucial factors to consider in assessing the overall financial profile.

In conclusion, the variety and value of income sources are critical factors in determining an individual's net worth. The stability and consistency of income are just as important as the overall income amount. Understanding these sources and their contributions is crucial to comprehending an individual's financial standing and potential for future wealth accumulation. A thorough analysis considers the total contribution of all income sources to provide a more complete picture.

4. Investment Portfolio

An individual's investment portfolio is a significant determinant in calculating net worth. The value and performance of these investments directly impact the overall financial standing, reflecting the accumulated wealth and potential for future growth. Understanding the composition and performance of an investment portfolio is essential for assessing the total financial picture of an individual, like Jon Tenney.

- Asset Allocation

The distribution of investments across different asset classes (stocks, bonds, real estate, etc.) significantly impacts potential returns and risk. A well-diversified portfolio spreads risk, protecting against losses in specific areas. A portfolio heavily weighted toward a single asset class, however, carries higher risk and could significantly influence the calculated net worth. For instance, significant exposure to a single volatile stock sector could result in substantial portfolio losses, reducing the overall net worth. Conversely, a balanced allocation across various asset classes can mitigate risk and contribute to more stable growth.

- Investment Performance

The historical and projected performance of investments plays a critical role in estimating net worth. Consistent gains in portfolio value contribute positively to the total net worth, while significant losses have the opposite effect. The timing and magnitude of these returns, along with the specific types of investments, greatly affect the net worth valuation. Performance figures, such as annual returns or the growth rate of specific investments, inform potential net worth figures.

- Investment Strategy and Management

The investment strategy employed and the competence of the investment management team, if applicable, are important factors in evaluating the potential and realized growth of the investment portfolio. A well-defined and consistently applied strategy, ideally tailored to the individual's risk tolerance and financial goals, generally leads to more favorable returns. Active management versus passive strategies, for example, can affect the growth pattern and influence the potential value of the portfolio and, consequently, the net worth calculation.

- Market Conditions

Market fluctuations significantly influence investment portfolio values. Economic downturns or periods of high volatility can cause substantial drops in investment values. Conversely, bull markets or periods of positive economic growth often lead to increased investment returns, positively impacting the estimated net worth. Therefore, the overall market environment and its impact on the portfolio are essential considerations in estimating the accurate net worth value.

In conclusion, an individual's investment portfolio is a key component in calculating net worth. The asset allocation, performance, management style, and overall market context combine to shape the investment's trajectory and, consequently, the financial standing. Precise valuation of investments requires careful consideration of these intertwined factors to arrive at an accurate and comprehensive assessment of an individual's net worth.

5. Real estate holdings

Real estate holdings significantly contribute to an individual's overall net worth. The value of properties owned, including land, buildings, and other real estate assets, directly impacts the total financial standing. Appraisals, market conditions, and current economic trends all play a role in determining the worth of these holdings in the context of overall wealth assessment.

- Property Valuation

Accurate appraisal of properties is paramount. Factors such as location, size, condition, and market demand influence the valuation. Comparable sales in the area, recent renovations, and zoning regulations all contribute to a property's assessed worth. The difference between the appraised value and the purchase price is a critical consideration when assessing net worth.

- Types of Real Estate

Different types of real estate assets have varying degrees of influence on net worth. Residential properties, commercial buildings, land holdings, and investment properties all contribute to the total. The value of each type varies based on location, market conditions, and specific characteristics. Rental income from properties also plays a significant role, adding to the overall financial picture. Vacant or underdeveloped land may have a lower impact than income-generating properties.

- Location and Market Conditions

Geographic location significantly impacts real estate value. Prime locations, proximity to amenities, and access to transportation networks increase the potential value of properties. Changes in the local and national economies, including interest rates, economic downturns, and population shifts, all affect real estate markets. These factors influence the estimated worth of properties held by individuals.

- Property Taxes and Expenses

Property taxes, maintenance costs, and other expenses associated with owning real estate must be considered in the assessment of overall financial value. These expenses reduce the net return and must be factored into the final worth of property holdings. Mortgage interest payments, insurance premiums, and upkeep expenses are also significant components to consider.

In conclusion, real estate holdings are a significant asset category when determining an individual's net worth. The complexity of valuation necessitates careful consideration of various factors, including property type, location, market conditions, and ongoing expenses. These factors collectively contribute to the overall financial picture and provide a more comprehensive understanding of the individual's economic position.

6. Business Valuations

Business valuations play a critical role in determining an individual's overall net worth, particularly when that individual has ownership or significant involvement in a business. If Jon Tenney, for example, owns or operates a business, its value is a significant component of his overall net worth. The valuation process assesses a company's financial health, market position, and future potential. Factors such as revenue, profitability, assets, liabilities, and industry trends all influence the valuation. A robust and profitable business enterprise typically contributes substantially to the overall net worth calculation.

Consider a scenario where an individual owns a majority stake in a thriving technology company. The company's strong financial performance, including high revenue growth and substantial profits, will likely result in a high valuation. This high valuation directly increases the individual's net worth. Conversely, if the same individual owns a struggling retail business, its low valuation might have a significantly smaller impact or even a negative impact on their overall net worth.

Determining the precise valuation of a business often requires expert analysis. Methods like discounted cash flow analysis, comparable company analysis, and asset-based valuation are used by professionals to estimate a company's worth. The chosen method depends on the specific circumstances of the business, its industry, and the availability of data. Understanding these valuation methods is vital for correctly interpreting a business's contribution to an individual's net worth. Moreover, fluctuations in the market value of the business, due to market trends, economic factors, or company-specific events, can cause changes in the net worth of the business owner.

In summary, the value of a business significantly influences an individual's overall net worth. The valuation process, utilizing various methods and considering numerous factors, provides a crucial element in determining the total financial standing of the owner or key stakeholder. This understanding of business valuation is fundamental for a comprehensive assessment of the individual's financial position and is critical for investors, stakeholders, and individuals assessing their own financial status.

7. Public data availability

Publicly available data plays a critical role in determining the potential scope of information about an individual's financial status. The extent of accessible information directly influences the accuracy and reliability of any estimate of net worth. Limited or absent public data significantly restricts the ability to make a definitive calculation.

- Financial Disclosures and Reporting

Specific industries or professions may have regulatory requirements for financial reporting. Publicly available documents, such as annual reports or tax filings (if available), offer valuable insights into an individual's financial position. These reports, if transparent, reveal aspects like income, assets, and liabilities, providing a foundation for estimations. However, the completeness and accuracy of such information vary significantly. For example, publicly traded companies have greater disclosure requirements compared to privately held businesses.

- Media Reports and Financial News Sources

Media outlets, financial news sources, and business publications frequently report on individuals in the public eye. These reports sometimes offer information about their income, investments, or business ventures. Such information can provide circumstantial evidence. However, news reports are often based on various reporting methods and may not contain comprehensive financial details, making estimations based solely on these sources unreliable. Examples include articles about significant investments or high-value transactions. Often, such reports represent a snapshot in time and are subject to interpretation rather than definitive financial statements.

- Availability of Public Records

Public records, including court filings or property records, may contain information related to assets like real estate or business ownership. These records, while offering crucial data, may not provide a complete financial picture. For example, property records may reflect ownership but not the full extent of assets or liabilities. These records, however, can offer vital elements of context and should be considered in the estimation process.

- Limitations and Privacy Concerns

Restrictions on access to information, privacy considerations, and the lack of comprehensive financial disclosures are significant limitations in obtaining precise figures. The absence of public financial statements for individuals, especially if not in a position of public trust or subject to financial disclosure requirements, poses a significant barrier to determining their net worth accurately. This limitation applies to individuals for whom public disclosure is not mandated or standard practice. The pursuit of financial information in these situations, therefore, encounters complexities and inherent privacy considerations.

Ultimately, the availability of public data significantly impacts the precision of any estimate for an individual's net worth. The reliability of assessments hinges on the accuracy, completeness, and transparency of the publicly accessible information. When data is limited or absent, estimations become less definitive and potentially more prone to speculation. This is crucial in understanding the context of any claim made regarding an individual's financial standing.

Frequently Asked Questions about Jon Tenney's Net Worth

This section addresses common inquiries regarding the financial standing of Jon Tenney. Accurate estimations of net worth are complex and require comprehensive data. Limited public information may impede definitive conclusions.

Question 1: How can I find out how much Jon Tenney is worth?

Determining precise net worth figures for individuals, including Jon Tenney, is complex. Publicly available financial information may be limited or incomplete. Direct access to detailed financial records is typically restricted, particularly for private individuals. Reliable estimations necessitate a thorough analysis of various assets, liabilities, and income sources, but such comprehensive data is often not publicly accessible.

Question 2: Why is knowing someone's net worth important?

Understanding an individual's financial standing can offer valuable insights in specific contexts. In the case of public figures, their net worth may provide additional context to their career trajectories or industry impact. However, focusing solely on net worth without considering other contributing factors can be misleading. Contextual understanding of the individual's career and financial history is essential.

Question 3: What factors influence estimations of net worth?

Estimating net worth involves assessing assets like investments, real estate, and business holdings. Liabilities, such as loans and debts, also significantly impact the calculation. Income sources, both current and historical, are crucial considerations. Estimating net worth requires a comprehensive approach and careful consideration of these factors.

Question 4: What are the limitations of publicly available information?

Publicly available information regarding an individual's finances is often limited, especially for private individuals. The lack of complete financial transparency significantly hinders the ability to calculate a precise net worth. Media reports may offer snippets of information, but often lack the comprehensive data needed for a precise calculation. Interpreting such data requires caution.

Question 5: How can I assess the reliability of reported figures regarding net worth?

The reliability of reported net worth figures hinges on the source and methodology used. Figures based on incomplete data or unreliable sources may not reflect the true financial standing. Scrutinizing the methodology and the context of the information source is essential for a reasoned assessment. Understanding the methodologies used to arrive at the estimates is key to evaluating their reliability.

Question 6: What are the ethical considerations in discussing someone's net worth?

Respecting privacy and avoiding assumptions about an individual's financial standing is paramount. Excessive speculation or assumptions based on incomplete information should be avoided. Concentrating on factual and verifiable information is crucial when discussing financial matters and an individual's financial circumstances. Respect for privacy is vital.

In summary, accurate and complete information on an individual's net worth is often not available publicly. When discussing financial standings, relying on verified and verifiable information while respecting privacy is critical.

The next section explores the complexities of financial reporting for individuals and the challenges in estimating net worth accurately, given the lack of comprehensive public data.

Tips for Assessing Net Worth

Determining net worth, particularly for individuals not publicly reporting financial data, requires careful consideration of available information. Reliable estimations rely on a thorough approach, encompassing diverse factors and acknowledging limitations. The following tips provide a framework for navigating this process.

Tip 1: Focus on Publicly Accessible Information. Begin by compiling all publicly accessible data, such as financial disclosures (if available), media reports, and official records. Examining these sources can offer insights into income, investments, or property ownership. This provides a foundation upon which to build a broader analysis.

Tip 2: Scrutinize Reporting Methods. Assess the methodologies employed by reporting sources. If the data comes from news articles, evaluate the credibility of the news outlet and the methods used to obtain the information. If the reporting comes from financial disclosures, recognize the limitations inherent in any summary. Context and rigor of reporting methods are essential for informed analysis.

Tip 3: Identify and Evaluate Assets. Carefully document and value all identifiable assets, such as investments, real estate, and business interests. Valuation methods vary depending on asset type. For example, publicly traded stocks have readily available market values. However, privately held assets or businesses may require professional valuation to obtain a reliable figure. Diligence is needed in researching appropriate valuation methods for different asset categories.

Tip 4: Accurately Account for Liabilities. Thoroughly investigate and document all known liabilities, including outstanding debts, loans, and other financial obligations. Precise calculations require accurate figures for these obligations. Failure to account for liabilities will misrepresent the individual's net worth.

Tip 5: Analyze Income Sources. Evaluate all verifiable income sources to understand the individual's financial support. This includes wages, investment returns, business profits, and other income streams. The consistency and predictability of income are vital considerations for evaluating financial stability.

Tip 6: Recognize Limitations of Information. Acknowledge potential gaps in accessible information. Limited public data may hinder a completely accurate calculation. Be prepared to acknowledge uncertainty in estimations based on incomplete data. Transparency about limitations is key to responsible analysis.

Tip 7: Consult Professional Expertise. Consider engaging financial professionals for in-depth analysis, particularly if complex assets or business interests are involved. Professionals possess specialized knowledge and expertise in valuation methods, offering valuable insights when comprehensive data is unavailable.

Following these tips provides a structured approach to assessing net worth, especially in situations with limited public data. A thorough understanding of these procedures leads to a more responsible and accurate interpretation of financial information.

The following section will delve into the complexities of financial reporting for individuals, highlighting the inherent challenges in accurately estimating net worth in the absence of comprehensive public data.

Conclusion

Determining a precise figure for Jon Tenney's net worth presents significant challenges due to the absence of readily available, comprehensive financial data. This article has explored the multifaceted nature of net worth assessment, highlighting the interplay of assets, liabilities, income sources, and business valuations. The analysis underscored the complexities inherent in calculating an individual's financial standing, particularly when detailed financial disclosures are not publicly accessible. Key elements explored include the diverse nature of assets, ranging from investment portfolios to real estate holdings and business interests, and the significance of liabilities in balancing the overall financial picture. Furthermore, the article emphasized the critical role of income sources in shaping an individual's wealth accumulation and the limitations imposed by the scarcity of public financial information.

In conclusion, while estimations of net worth can be attempted using available public information, a definitive, precise figure remains elusive without complete access to private financial records. This emphasizes the importance of accurate financial reporting and transparency in specific circumstances where public interest or scrutiny exists. The ongoing quest for a complete understanding underscores the importance of responsible analysis and the need to acknowledge the limitations inherent in evaluating private financial matters.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJ6Rory2v4yfoKCtoprAbr%2FHmqmippdktbDDjKasnKBdnsButs6nZK2dnqOyunnWqKmtoF6dwa64