Estimating an individual's financial resources, often expressed in monetary value, provides insight into their economic standing. This figure, often reported publicly, is frequently used to understand an individual's financial capacity and potential influence within various spheres. A person's worth can be influenced by factors such as career earnings, investments, assets, and debts.

Public awareness of an individual's financial status can be significant. It may be relevant in understanding their potential influence in business dealings, political campaigns, philanthropic endeavors, or any other public sphere in which they are active. A person's net worth might also be considered within the context of societal trends in wealth distribution, or in relation to particular historical periods. For example, the reported financial status of prominent figures can be compared over time to track economic shifts and the evolution of personal wealth accumulation strategies.

This information is essential background for understanding the individuals' activities and potential influence. Further investigation into the factors contributing to this individual's worth, such as career, investments, and other endeavors, would form a crucial component of a comprehensive analysis. This will provide a context for understanding this person's overall standing, and their potential impact on various sectors.

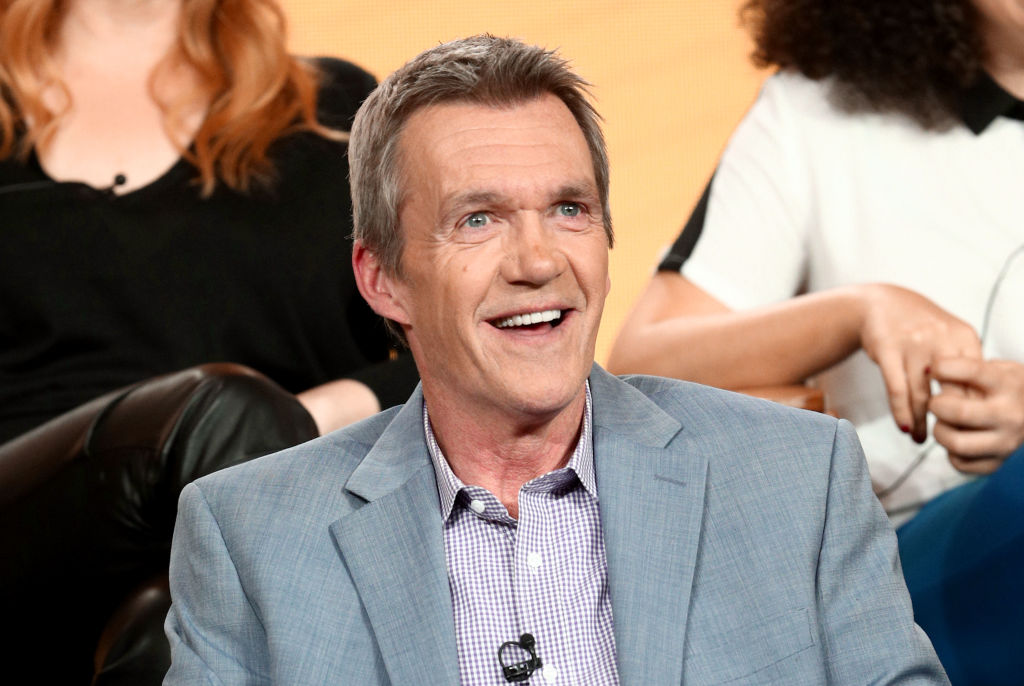

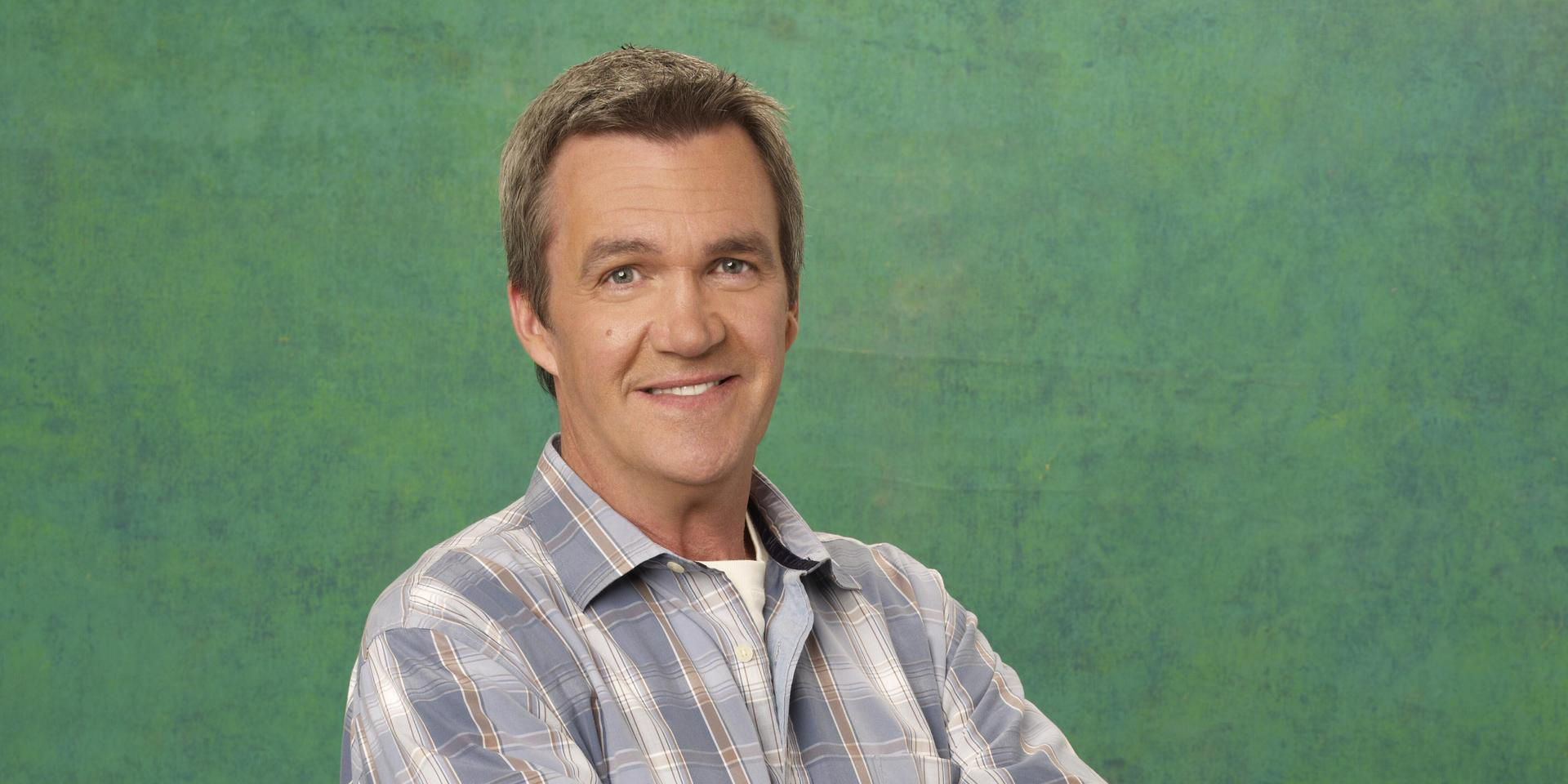

Neil Flynn Net Worth

Understanding an individual's financial standing, often represented by net worth, offers insight into their economic position and influence. This figure, derived from assets minus liabilities, can provide a glimpse into career trajectories and financial decisions.

- Earnings

- Investments

- Assets

- Debt

- Career

- Public Perception

Neil Flynn's net worth, as with any individual's, is a reflection of various factors, including income from acting, investments, and potentially real estate. Public perception of Flynn's success in his career and overall influence might also affect the perceived value of his assets and standing. The combination of factors determines a particular net worth figure, which provides a snapshot in time, but it can also be a dynamic number. Understanding and analyzing these elements is crucial for a comprehensive understanding of this topic.

1. Earnings

Earnings represent a fundamental component in calculating an individual's net worth. The total income generated through various sources plays a crucial role in shaping the overall financial standing. For Neil Flynn, as for any individual, assessing the sources and amounts of income is vital to understanding the factors contributing to their reported net worth.

- Income Sources

Identifying the diverse revenue streams is essential. These could include salary from employment (potentially acting roles), income from investments, and potentially other sources. The relative importance of each income stream can significantly influence the overall net worth.

- Salary and Compensation

In the context of an actor's career, earnings from acting roles, including salaries, residuals, and potentially other compensation packages, contribute directly to the overall income. Fluctuations in these earnings can reflect varying levels of demand or project success. Analysis of salary details and frequency of acting engagements could be helpful in assessing the reliability and magnitude of this income.

- Investment Income

Investment income, such as dividends, interest, or capital gains from assets like stocks or real estate, contributes to the overall financial picture. These returns, if present, augment earnings and can significantly impact the accumulation of wealth, thus influencing reported net worth.

- Influence on Net Worth

Higher earnings, consistent income sources, and shrewd financial management across all income streams, including potentially investments, will generally result in a higher net worth. The variability of earnings and income sources, and the potential for income fluctuation over time, are also critical aspects to consider when examining the relationship between earnings and net worth.

In summary, earnings serve as a critical component of an individual's financial standing, reflecting their income sources and the impact these sources have on their overall wealth. Assessing the totality of earnings and the potential fluctuations in those sources is necessary to contextualize the individual's net worth and financial position.

2. Investments

Investment activities play a significant role in shaping an individual's net worth. The returns generated from these activities, coupled with other income sources, contribute to the overall financial standing. For Neil Flynn, as for any individual, evaluating the impact of investments on their total financial picture is crucial.

- Types of Investments

Investments can encompass a wide range of financial instruments. These might include stocks, bonds, real estate, or other assets. The choice of investments and the associated risk profiles can influence the potential for growth and the level of volatility. Analyzing the diversification of these investments can provide insights into potential risk mitigation strategies and portfolio balance.

- Investment Returns and Growth

Investment returns, including capital gains, dividends, or interest, directly affect the growth of an individual's net worth. The consistent generation of positive returns from well-chosen investments is often associated with increasing wealth. Examining the historical performance of any investments is essential to assessing their overall impact on a total financial picture.

- Potential for Loss

It is important to acknowledge the potential for loss inherent in many investment strategies. Understanding the risk tolerance of investments and the potential for market fluctuations is critical to creating a diversified portfolio. Evaluating past returns, alongside periods of decline, offers valuable context to overall investment strategy.

- Impact on Net Worth

The successful management of investments, including selection, diversification, and consistent monitoring, plays a substantial role in increasing net worth. Conversely, poorly managed investments or those affected by market volatility can significantly reduce the value of assets and ultimately influence the overall net worth. The combination of different investment types and their related return profiles within a portfolio offers a better overall picture of the individual's investment strategy.

In summary, investments significantly impact an individual's net worth, acting as a critical component in wealth accumulation. Understanding the various types of investments, their potential returns and associated risks, and how these investments are managed are crucial aspects of assessing the long-term impact on financial standing.

3. Assets

Assets are crucial components in determining an individual's net worth. Assets represent ownership of valuable items or resources, including financial instruments and tangible property. The value of these assets contributes directly to the calculation of net worth. For Neil Flynn, as for any individual, the types and values of assets held significantly influence the overall financial picture.

Tangible assets such as real estate (residences, properties) and vehicles represent direct ownership with inherent value. Financial assets, including stocks, bonds, and bank accounts, represent holdings with fluctuating values. The sum total of these assets, considered against liabilities, creates a net worth figure. The value of assets is not static. Market fluctuations, changes in ownership, and other factors influence the asset's value and thus, its contribution to the overall net worth. A diverse portfolio of assets, with appropriate diversification, can offer protection against market volatility and generally enhance long-term financial stability.

Understanding the connection between assets and net worth is vital for assessing an individual's overall financial health and potential for future financial security. Appreciating the impact of asset values, both individually and as a collective portfolio, is fundamental in evaluating a person's financial standing. The composition of assets, whether real estate, vehicles, or various financial instruments, plays a key role in the assessment of net worth and provides insight into investment strategies and financial decision-making processes. This understanding is essential in a broader financial context, whether considering personal wealth or assessing the overall financial standing of individuals in public life.

4. Debt

Debt represents a crucial counterpoint to assets when assessing net worth. The presence and magnitude of debt directly impact an individual's financial standing and overall wealth. Understanding how debt is managed is integral to comprehending the full picture of an individual's financial health.

- Types of Debt

Debt encompasses various forms, including mortgages on properties, loans for vehicles, and outstanding personal loans. Each type of debt has different terms and associated interest rates. The nature and extent of these obligations significantly influence the final net worth calculation.

- Impact on Net Worth Calculation

Debt acts as a deduction from an individual's total assets. The calculation of net worth considers the difference between the value of assets and the total amount of outstanding debt. Higher levels of debt relative to assets will result in a lower net worth figure. This impact on net worth is a direct reflection of the financial obligations an individual carries.

- Management of Debt Obligations

Effective debt management is a critical factor in maintaining financial stability. Strategies such as consistent repayments, seeking to reduce interest rates, and prioritizing high-interest debt repayment are essential. Financial planning and careful budgeting are vital to manage debt effectively and influence the level of debt reflected in net worth calculations.

- Influence on Financial Decisions

The existence of debt significantly influences financial decisions. Borrowing decisions, spending habits, and overall financial planning are often impacted by the need to meet debt obligations. High levels of debt might restrict investment opportunities or limit the potential for future wealth accumulation. The extent of indebtedness influences an individual's ability to make long-term financial plans and can affect their overall financial flexibility.

Considering the interplay between debt and assets is essential for a comprehensive understanding of an individual's financial position. The amount and type of debt, combined with asset values, provide a more holistic view of their financial well-being, and the management of debt is a critical aspect in the overall determination of net worth. The specific debts of an individual, and their associated terms and conditions, need to be taken into account when analyzing their financial status.

5. Career

A person's career significantly influences their net worth. Income generated through employment, coupled with investment opportunities arising from a career path, contributes directly to an individual's financial standing. The nature of a career, including the industry, level of responsibility, and potential for advancement, plays a crucial role in wealth accumulation.

- Income Generation

A career directly impacts income levels. Higher-paying jobs, promotions, and lucrative industry sectors often correlate with greater financial resources. An individual's career trajectory, including the progression from entry-level positions to senior roles, will affect their earnings over time. For example, a career in high-demand fields like finance or technology can lead to substantially higher salaries compared to less lucrative professions. This income directly translates to the growth of net worth.

- Investment Opportunities

Certain career paths can provide opportunities for investment or other lucrative ventures. For example, professionals in finance or business often gain access to investment opportunities and strategies that can increase their net worth through returns on capital. Network building through professional connections can create avenues for investment and future wealth accumulation.

- Industry and Compensation Structures

The industry in which an individual works greatly influences their compensation structure and potential for advancement. High-growth industries and well-compensated professions tend to offer more opportunities for substantial wealth accumulation. Industries like tech, entertainment, or finance often have different compensation models that contribute to variations in overall net worth.

- Career Longevity and Stability

The stability and longevity of a career contribute significantly to net worth accumulation. Consistent employment and professional growth over time provide a foundation for consistent income generation and the potential to invest further. A career with prolonged tenure can allow for compounding returns and long-term wealth building, impacting the net worth significantly.

In conclusion, career choices and professional success are fundamental in shaping an individual's net worth. Income, investment opportunities, industry-specific compensation, and career stability are all interwoven factors affecting the accumulation of wealth. This dynamic interplay between career choices and financial success contributes significantly to the overall picture of an individual's net worth.

6. Public Perception

Public perception of an individual, particularly a public figure like Neil Flynn, can significantly influence the perceived value of their assets and overall financial standing, although this connection is not directly causal. Public perception, while not a direct component of net worth calculation, can nonetheless impact the perception of net worth and, indirectly, opportunities for further financial accumulation. Favorable public image, often associated with positive career evaluations, can enhance the value attributed to assets or even open doors to lucrative opportunities. Conversely, negative perceptions can diminish perceived asset value and potentially limit investment or other financial opportunities.

Consider the effect of media portrayals. Positive portrayals in media or high public regard for an individual's work, like in acting or other professions, often correlate with increased perceived value. Conversely, a negative reputation may influence public opinion in a way that devalues an individual's assets in the market's perception. This could be reflected in reduced interest in investments related to that person or lower valuations for their property. A successful career, often accompanied by favorable media coverage, frequently correlates with a perception of higher net worth.

The influence of public perception on the perceived net worth isn't necessarily straightforward. While a highly regarded individual might attract greater interest or value associated with their name, the connection between reputation and an individual's actual net worth remains somewhat tenuous. Public perception operates more on an estimation of wealth and success rather than a precise calculation. Understanding this distinction is critical for analyzing the intricate interplay between public opinion, perceived value, and actual financial standing.

Frequently Asked Questions about Neil Flynn's Net Worth

This section addresses common inquiries regarding Neil Flynn's financial standing. Information presented here is based on publicly available data and various financial reporting methods. Precise figures for net worth are often estimates and may vary.

Question 1: What is the primary source of income for Neil Flynn?

The primary source of income for Neil Flynn is typically derived from acting engagements, including salaries, residuals, and potentially other forms of compensation.

Question 2: How does investment income influence Neil Flynn's net worth?

Investment income, if applicable, contributes to the overall financial picture. Returns from investments, such as stocks, bonds, or real estate, augment income generated from acting roles and affect the total net worth calculation.

Question 3: What is the role of assets in determining Neil Flynn's net worth?

Assets, like real estate holdings, vehicles, or other valuable possessions, play a significant role in determining Neil Flynn's net worth. The value of these assets contributes directly to the calculation of total net worth.

Question 4: How does debt impact Neil Flynn's net worth calculation?

Outstanding debt, including mortgages, loans, and other financial obligations, is subtracted from the total value of assets to arrive at Neil Flynn's net worth figure. The level of debt relative to assets is a crucial factor in assessing financial health.

Question 5: Does Neil Flynn's public image affect the perception of his net worth?

While not a direct factor in the calculation, public perception of Neil Flynn's success and career can impact the perceived value of assets. A positive public image, often linked to a successful career, can enhance the estimation of net worth.

Question 6: Where can I find accurate information on net worth?

Precise figures for net worth are often considered estimations. Reliable information sources include financial news outlets and publications that specialize in wealth reporting. However, these figures are often approximations, and the accuracy varies considerably. Direct confirmation of these figures from the individual is generally unavailable.

In summary, Neil Flynn's net worth is a reflection of a complex interplay between career earnings, investments, assets, and debts. Public perception can further influence the perceived value. Directly verifying precise figures from a private individual is not usually possible. This overview aims to address common questions related to this subject.

This concludes the FAQ section. The following section will delve deeper into the factors influencing Neil Flynn's career and its possible impacts on financial standing.

Tips for Understanding Net Worth

Assessing net worth involves a multifaceted approach, considering income sources, investments, assets, and liabilities. This section provides practical guidance for a comprehensive understanding of financial standing, with a focus on clarity and objectivity.

Tip 1: Identify Income Sources. Detailed tracking of income streams is crucial. Categorize sources such as salary, investment returns, royalties, or other earnings to understand the variety and magnitude of revenue. Accurate categorization aids in determining the overall financial picture.

Tip 2: Evaluate Investment Performance. Analyze returns on various investment strategies. Consider the types of investments (stocks, bonds, real estate), their potential for growth or loss, and the diversification within a portfolio. Historical performance data provides context to assess potential risk and reward.

Tip 3: Categorize Assets and Liabilities. Thoroughly document all assets, encompassing tangible items (real estate, vehicles) and financial holdings (stocks, bonds, bank accounts). Equally important is a precise listing of liabilities (loans, mortgages, outstanding debts). Accurate data is paramount for accurate net worth calculation.

Tip 4: Assess Debt Management Strategies. Evaluate debt levels in relation to assets. A robust approach involves understanding interest rates, loan terms, and repayment schedules for existing debts. Effective debt management is critical to achieving financial stability and potentially influencing net worth positively.

Tip 5: Consider Long-Term Financial Goals. A clear understanding of future goals (retirement, education, significant purchases) helps frame financial decisions. A well-defined long-term plan enhances financial strategy, aligning investment decisions with future aspirations.

Tip 6: Seek Professional Advice. Consulting with financial advisors offers invaluable guidance on investment strategies and debt management. Professionals provide expertise in navigating complex financial matters and assist in developing personalized plans.

Tip 7: Monitor and Update Records Regularly. Financial circumstances evolve. Regular reviews of income, investments, assets, and liabilities maintain accuracy and provide insights into adjustments needed for financial planning.

Tip 8: Apply Consistent Methodology. Maintain a consistent framework for tracking and analyzing financial data to ensure a clear, comprehensive picture. Consistency in methodology provides a reliable reference for evaluating financial standing over time.

Applying these tips provides a structured approach to understanding net worth, offering a more nuanced and informed perspective. The combination of detailed data collection, analysis, and strategic planning ultimately results in a more comprehensive view of financial health and facilitates sound financial decision-making.

This section highlights essential considerations for understanding financial standing. The following segment will delve deeper into the implications of net worth in various contexts.

Conclusion

This analysis of Neil Flynn's net worth explores the multifaceted factors contributing to an individual's financial standing. Key elements examined include income sources, particularly from acting engagements, investment performance, asset valuation, debt management, and the influence of public perception. The interplay of these factors paints a complex picture of financial accumulation and the dynamic nature of an individual's financial position. Understanding these elements provides a comprehensive view of how career trajectory, investment strategies, and financial management practices combine to influence overall wealth accumulation. The analysis underscores the importance of considering the various facets of financial well-being when evaluating an individual's economic position. Estimating precise figures is challenging due to the inherent complexities and often private nature of such data.

In conclusion, the exploration of Neil Flynn's net worth highlights the intricate interplay between financial decisions, professional success, and market forces. The insights gained from this assessment extend beyond a specific individual to provide a framework for understanding broader economic principles, such as wealth accumulation strategies and the interaction between personal finances and broader societal trends. Further research into the nuances of financial analysis and reporting would provide a more comprehensive and detailed understanding of these principles in various contexts. Continued study of these factors, applied across different professions and individuals, can illuminate the diverse strategies and challenges associated with building and managing wealth.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKyYmrazeceemKWsmGK3sMHRp5yyq1%2Bjsqq4jJ%2BjsqaeYrumwIywpqusmGO1tbnL