What is the significance of a compilation of documents related to government programs designed to support businesses? A comprehensive list of such documents is crucial for understanding the scope and effectiveness of these programs.

A list of documents related to a government program designed to provide financial support to businesses (often referred to as a "small business loan program" or a similar designation) comprises various types of official records. These records might include application details, approval criteria, loan disbursement records, and compliance requirements. The list could also include documentation associated with specific business sectors or types of loans. For instance, specific documents might relate to loans provided to restaurants or those supporting manufacturing businesses. Examples could be application forms, loan agreements, and proof of business need.

Such lists are important for several reasons. First, they provide a detailed picture of the program's reach and impact. By examining the scope of businesses supported, the types of loans granted, and their distribution, a comprehensive understanding of the program's efficacy and reach can be achieved. Second, the records facilitate analyses of program outcomes and its potential areas for improvement. The documentation can aid in identifying trends, patterns, or any obstacles faced by businesses in accessing or utilizing the program's resources. Finally, public access to such documents can hold programs accountable and foster transparency in government operations. Historical context is crucial; such programs may have evolved over time, and an examination of these lists reveals their developmental trajectory and impact.

Moving forward, a comprehensive examination of the list can reveal critical information for stakeholders in the business community and policy experts. Careful analysis could identify patterns, trends, and areas for program enhancements. This understanding is vital in the ongoing discussion of such governmental initiatives.

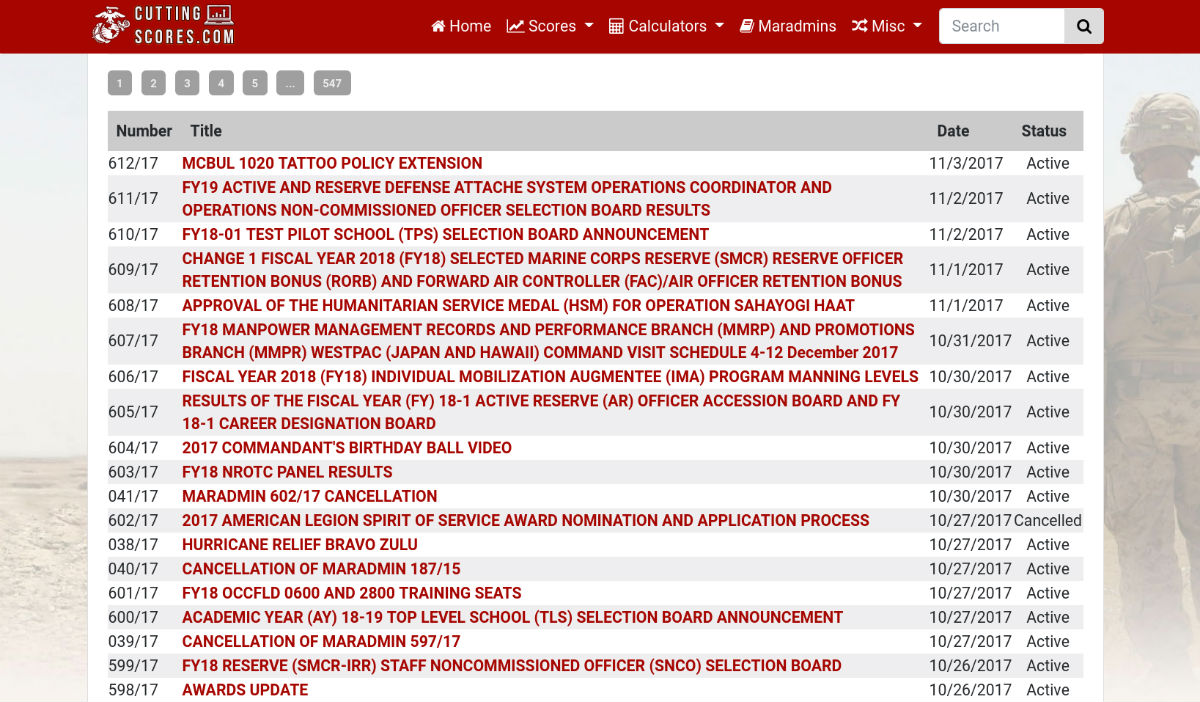

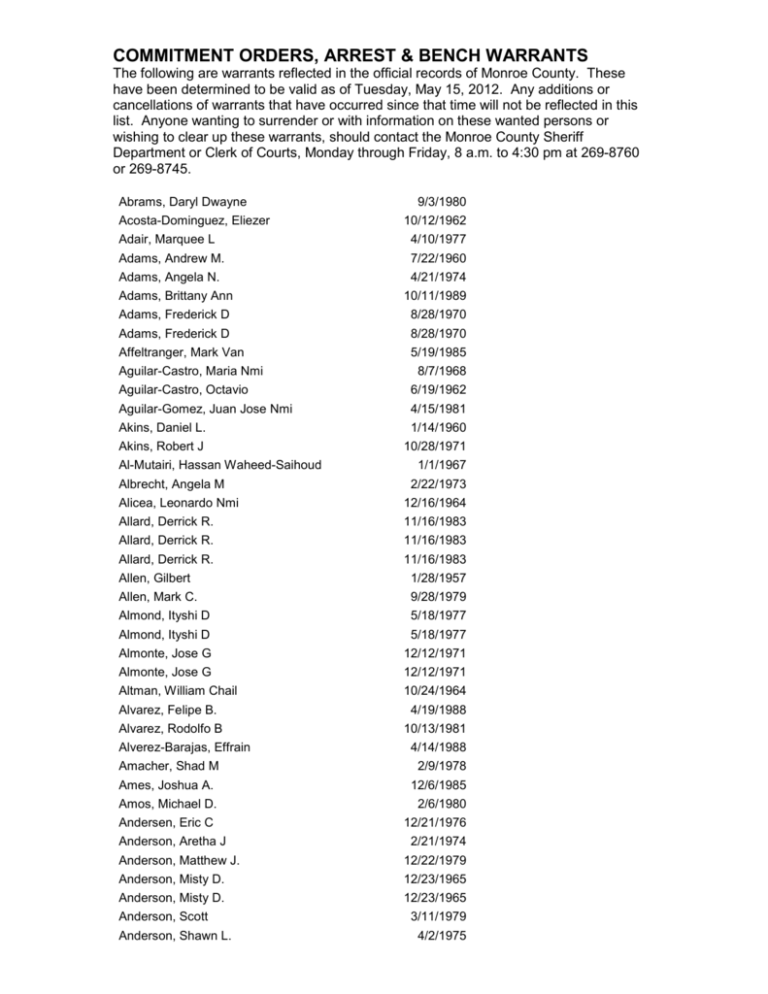

PPP Warrant List

Understanding a PPP warrant list requires careful consideration of its component parts. This list represents a crucial record, and its key aspects offer a window into government programs.

- Program details

- Applicant information

- Loan amounts

- Compliance status

- Disbursement dates

- Industry breakdown

- Geographic location

Analyzing a PPP warrant list reveals intricate details about a government program designed to aid businesses. Program details, such as eligibility criteria, show how the program operates. Applicant information, loan amounts, and disbursement dates allow for assessing the program's reach and impact. Compliance status data highlights the program's effectiveness in promoting adherence to regulations. Industry breakdowns and geographic locations indicate targeted support and reveal the program's distribution patterns. Combined, these elements provide a comprehensive picture of the program's performance and can guide future policy adjustments or improvements. For example, a correlation between loan amounts and loan defaults might indicate specific weaknesses in the program's design, while geographic patterns could reveal regional economic disparities.

1. Program Details

Program details are fundamental components of a PPP warrant list. These details provide context, define the parameters of the program, and underpin the rationale for each transaction. Essential elements within program details include eligibility criteria, loan amounts, disbursement methods, and compliance standards. Without these defining aspects, the warrant list itself becomes a largely uninterpretable collection of figures and names. A program requiring specific industry affiliations, for example, would be evident within the program details, allowing analysts to understand which industries benefited most from the program. The program's goals and objectives, outlined in the program details, establish a framework for assessing the list's impact.

The importance of program details lies in their capacity to reveal the program's intended design and actual implementation. A comparison between intended eligibility criteria and actual loan recipients reveals program effectiveness and potential bias. Variations in loan amounts across different industries might reflect targeted support or systemic inequities. Analyzing disbursement methods can highlight efficiency or bottlenecks within the program's operation. Compliance data, derived from program details, can identify areas where the program faced difficulties in enforcement, offering insight into weaknesses and successes. For instance, examining the specific eligibility requirements for a business loan program may reveal disparities in who received support, which could lead to a more informed discussion about future initiatives. Such insights are crucial for policymakers seeking to refine and improve future iterations of such programs. Understanding these aspects within program details is vital for objectively analyzing and interpreting the comprehensive picture represented by a PPP warrant list.

In summary, program details are not just explanatory notes; they are the very foundation upon which the meaning of a PPP warrant list rests. Without a clear understanding of the program's mechanics, a warrant list becomes a collection of figures without context. This understanding is essential for critical assessment, revealing potential flaws or successes in program implementation and guiding future policy design. By carefully evaluating program details alongside the warrant list, a more complete and insightful understanding of the program's performance and outcomes is possible. This deeper understanding is necessary for informed decision-making around future economic support initiatives.

2. Applicant Information

Applicant information is an indispensable component of a PPP warrant list. This data provides crucial context for understanding the scope and impact of the program. Applicant details, including business type, location, and loan amount, offer insights into the program's reach and effectiveness. Detailed applicant information facilitates the identification of specific trends, patterns, or potential biases in the program's implementation. For example, an unusually high concentration of loan applications from a particular industry in a specific geographic region might suggest targeted support or, conversely, indicate unequal access to the program. Likewise, variations in loan amounts granted to similar businesses located in similar regions can reveal patterns that warrant further investigation.

The practical significance of understanding applicant information within the context of a PPP warrant list is multifaceted. It allows for a more nuanced evaluation of the program's impact. For instance, analyzing the loan amounts and types of businesses receiving funding could reveal disparities or trends indicative of broader socioeconomic or industry-specific challenges. Policymakers can use these insights to adjust program parameters, targeting resources more effectively. Furthermore, scrutinizing applicant information in conjunction with program details permits a more comprehensive evaluation of the program's success in achieving its intended objectives. Detailed applicant data helps to identify areas where the program might be failing to meet the needs of all intended beneficiaries. This detailed analysis allows stakeholders to understand the efficacy and impact of the program in specific contexts, potentially leading to modifications that enhance its efficiency or broaden its accessibility.

In conclusion, applicant information is not merely supplementary data; it's a critical element of a PPP warrant list, enabling a deeper understanding of the program's reach, impact, and potential shortcomings. By scrutinizing this information, a more precise assessment of the program's effectiveness becomes possible, potentially guiding refinements in future program design and implementation. Careful consideration of applicant data, paired with a comprehensive examination of program details, can offer valuable insights for stakeholders. This combined evaluation of program mechanisms and recipient characteristics provides the framework for a more robust analysis of the program's efficacy and its potential for future improvements.

3. Loan Amounts

Loan amounts are a critical component of a PPP warrant list, providing valuable insights into the program's financial distribution and impact. The sheer volume and variation in loan amounts, as represented within the list, reveal patterns and trends in the allocation of funds. Analysis of these amounts can uncover potential disparities or targeted support within different sectors or geographic regions, offering a glimpse into the program's reach and effectiveness. For example, a consistent pattern of smaller loan amounts distributed to a specific sector might signal a particular need or challenge faced by businesses in that sector.

Examining the relationship between loan amounts and other variables, such as the applicant's industry, location, or the date of loan application, can yield further insights. This examination might reveal correlations between specific industry sectors and average loan sizes, highlighting potential regional or industry-specific funding needs. Analyzing the distribution of loan amounts across different applicant types (e.g., small businesses, large enterprises) helps identify the program's focus and the impact on various business sizes. This data provides valuable information for future adjustments and enhancements to the program.

Understanding loan amounts in the context of a PPP warrant list is crucial for evaluating the program's overall effectiveness. A significant variation in loan amounts across different segments could suggest targeting certain areas or sectors. Conversely, consistent small loan amounts may point to a need for adjustments to improve program accessibility. Such insights are critical for stakeholders in evaluating the program's allocation of resources and for policymakers aiming to optimize future economic support initiatives. Recognizing that loan amounts provide a crucial lens for understanding the program's allocation is vital for a complete analysis of the PPP warrant list's data, which can support improvements to similar programs in the future.

4. Compliance Status

Compliance status, as a component of a PPP warrant list, is paramount for evaluating the program's effectiveness and accountability. A meticulous record of compliance reveals the extent to which recipients adhered to program stipulations. This data is critical for assessing the program's overall success and identifying potential areas for improvement. Instances of non-compliance, for example, might signal flaws in the program's design, its communication to applicants, or the adequacy of oversight mechanisms. Furthermore, comprehensive compliance data can provide insights into the program's impact on various business sectors, revealing whether certain industries demonstrated higher or lower rates of compliance.

The importance of compliance status extends beyond mere adherence to regulations. It provides a crucial metric for measuring program integrity and efficacy. For instance, a high rate of compliance across diverse industries suggests a clear and comprehensible program, whereas a disparity between sectors highlights potential difficulties in particular areas. Real-world examples might involve examining compliance rates across different sizes of businesses, revealing whether smaller enterprises faced greater challenges in meeting the program's stipulations. Moreover, a comparison of compliance across various geographic regions could indicate whether certain localities had challenges in implementing program regulations effectively. This detailed analysis can reveal important insights, helping to tailor program design and future initiatives. Ultimately, it can aid in understanding the effectiveness of the program in achieving its stated goals.

In conclusion, compliance status is an indispensable element within a PPP warrant list. It provides a critical lens through which to evaluate program integrity and identify areas for improvement. Understanding the correlation between compliance status and program outcomes allows for more nuanced assessments, facilitating informed decisions related to future economic support initiatives. By analyzing patterns and disparities in compliance rates, stakeholders gain a deeper understanding of the program's impact on different business sectors and geographic areas. This holistic approach enhances program evaluation, paving the way for more effective and equitable economic support strategies in the future.

5. Disbursement Dates

Disbursement dates, meticulously recorded within a PPP warrant list, provide a critical temporal dimension to the program's implementation. Analyzing these dates unveils valuable information about the program's operational efficiency and potential delays, enabling a more complete understanding of its impact. Such data analysis is vital for policymakers and program administrators alike.

- Timing and Efficiency

Examining the disbursement dates reveals the speed and regularity with which funds were allocated. A consistent pattern of timely disbursements suggests effective program management, while delays or inconsistencies may point to bottlenecks or operational inefficiencies. Disruptions or significant delays in disbursements might warrant further investigation into underlying issues or systemic impediments within the program's processing mechanisms.

- Impact on Recipients

Disbursement dates directly affect recipients' access to crucial financial support. Knowing when loans were released helps assess the program's promptness and the timely nature of assistance during critical economic periods. Analyzing disbursement patterns alongside other datasuch as loan amounts or applicant characteristicscan highlight potential disparities in access to funding and whether those disparities correlate with specific time periods. This type of analysis is crucial for determining whether the program served its intended purpose effectively.

- Program Evaluation and Refinement

Disbursement dates provide crucial data for assessing program performance over time. Analyzing the pattern of disbursementsfor instance, by month or quartermight reveal seasonal trends or shifts in funding allocation, offering insight into the program's adaptability. Comparing the dates with relevant economic indicators can reveal correlations between disbursement patterns and economic conditions, potentially highlighting whether the program's response to economic fluctuations was adequate and timely.

- Identification of Trends and Patterns

By examining disbursement dates, analysts can potentially identify trends or patterns that correlate with specific geographic regions, applicant types, or industry segments. For instance, a concentrated disbursement of loans in certain regions might suggest strategic targeting, whereas a lack of disbursements in a certain time period might indicate a need to review eligibility criteria or procedural modifications. Such insights provide a foundation for more targeted refinements to similar programs in the future.

In essence, disbursement dates are not merely chronological markers; they are crucial indicators of a program's performance and impact. By meticulously examining these dates within the broader context of a PPP warrant list, a more comprehensive understanding of the program's efficacy and potential areas for improvement can be achieved. This analysis is vital for program evaluation, ensuring the equitable distribution of funds and the effective use of allocated resources. It also allows for a deeper understanding of the program's responsiveness to economic fluctuations and potential challenges faced by recipients.

6. Industry Breakdown

Industry breakdown, a crucial component within a PPP warrant list, provides valuable insights into the program's impact on various sectors of the economy. By categorizing loans according to the industries they support, policymakers and analysts can understand the program's reach and identify potential biases or disparities in funding allocation. This data is essential for assessing the effectiveness of the program and its equitable distribution among different economic sectors.

- Targeted Support and Focus Areas

The distribution of loans across industries reveals the program's focus and priorities. A significant concentration of funds within specific sectorslike retail or manufacturinghighlights the program's intentional support for those areas. Conversely, a lack of funding in certain industries might signal a need for program adjustments to address potential funding gaps or inequities.

- Uneven Impact and Economic Disparities

Industry breakdown allows for the identification of potential disparities in the program's impact. Comparing loan amounts across industries with different economic conditions or vulnerabilities can uncover areas where the program might not have effectively reached vulnerable sectors. For example, disproportionately low loan amounts for small businesses in a struggling sector could signal the need for program adjustments to better target those industries.

- Industry-Specific Challenges and Needs

The distribution of PPP loans can illuminate industry-specific challenges or needs. Analysis of industries with high loan applications, alongside associated loan amounts, might reveal consistent difficulties within those sectors. This data can be critical in understanding the reasons behind loan applications and tailoring potential program interventions.

- Evaluating Program Outcomes and Measuring Effectiveness

By correlating industry breakdown with other program data (e.g., loan defaults, compliance rates), a comprehensive evaluation of the program's effectiveness within specific industries can be achieved. For example, if a particular industry sector experiences unusually high rates of loan defaults after receiving substantial funding, this could signal unforeseen challenges and necessitate a reevaluation of the program's parameters or support strategies for that sector.

In summary, the industry breakdown within a PPP warrant list is not merely a categorization but a crucial tool for understanding the program's impact and identifying areas needing attention. It allows for the identification of targeted support, potential inequities, and industry-specific needs, ultimately contributing to a more comprehensive evaluation of the program's success and the development of future strategies. By considering loan amounts, application volumes, and compliance records alongside the industry breakdown, a more complete picture of the program's real-world performance emerges, thereby informing future economic policies and support initiatives.

7. Geographic Location

Geographic location, when considered alongside a PPP warrant list, provides a crucial lens for understanding the program's regional impact. Analyzing loan applications, approvals, and disbursements by location reveals patterns in access to funding, highlighting potential disparities and informing strategies for equitable distribution. This geographically-focused perspective is critical for understanding the program's effectiveness at a local level.

- Regional Disparities in Access

Geographic location can reveal significant disparities in access to the program. Concentrations of applications in certain regions, coupled with varying approval rates, may suggest regional challenges in program outreach or varying economic needs. For example, a large concentration of loan applications in one state with comparatively low approval rates could indicate systemic barriers or a need for targeted outreach in that region. Conversely, regions with high application volume and approval rates might indicate successful program implementation and effective local engagement.

- Targeted Allocation and Economic Development

Analysis of funding distribution by geography can illuminate targeted support. Concentrations of loans in economically distressed regions or specific industries might demonstrate a proactive effort to address localized challenges. This data can be vital for policymakers in understanding the efficacy of regionally-targeted programs and in potentially adjusting policies for the betterment of impacted regions.

- Infrastructure and Local Business Needs

Geographic location can highlight potential correlations between program usage and local infrastructure. A region with limited access to digital resources, for instance, might have fewer loan applications even if experiencing significant economic need. Similarly, locations with advanced digital capabilities and robust business support networks may show higher application and approval rates. Understanding this correlation allows policymakers to consider infrastructural factors influencing program participation.

- Assessment of Program Reach and Equity

Geographic distribution provides a crucial metric for assessing the program's reach and equity. A consistent pattern of funding allocation across various regions suggests broad program accessibility and effectiveness in reaching diverse communities. Disparities, on the other hand, might pinpoint where the program needs improvement or more tailored outreach strategies.

In conclusion, incorporating geographic location into the analysis of a PPP warrant list offers a significant advantage. By examining regional trends in loan applications, approval rates, and funding distribution, a nuanced understanding of the program's regional impact is achieved. This localized perspective allows for the identification of potential disparities in access, the assessment of program efficacy, and ultimately the development of strategies for more equitable and effective economic support initiatives across diverse regions. Such data can be crucial in adapting policies to meet the specific economic needs of different communities and tailoring future economic support programs.

Frequently Asked Questions about PPP Warrant Lists

This section addresses common inquiries regarding PPP warrant lists, providing clear and concise answers to help users understand these critical documents.

Question 1: What is a PPP warrant list?

A PPP warrant list is a compilation of documents related to the Paycheck Protection Program (PPP). These lists detail information about loans, including applicant details, loan amounts, disbursement dates, and compliance status. They serve as an important record of the program's operations.

Question 2: Why are PPP warrant lists important?

PPP warrant lists are crucial for understanding the reach and impact of the PPP program. Analyzing these lists allows for a comprehensive assessment of the program's effectiveness in achieving its objectives, identifying potential disparities in funding allocation, and uncovering areas requiring improvement.

Question 3: Who might need access to these lists?

Access to PPP warrant lists is relevant to a variety of stakeholders. Government agencies, researchers, and journalists require these records to analyze the program's performance, identify patterns, and evaluate outcomes. Private analysts, financial institutions, and academic researchers might also find these documents valuable for their economic studies.

Question 4: How can I access PPP warrant lists?

Public access to PPP warrant lists varies. Some lists may be available through publicly accessible government databases, while others may be subject to specific disclosure requirements. It's essential to consult relevant government websites or legal resources to determine the specific procedures and regulations governing access to these lists.

Question 5: What are the potential limitations in using PPP warrant lists?

PPP warrant lists, while offering valuable insights, may have limitations. Data interpretation requires careful consideration of context and potential biases. Furthermore, the availability and completeness of data in these lists can vary, limiting the scope of comprehensive analyses. Independent verification of data may be necessary for a full understanding.

Understanding PPP warrant lists is crucial for evaluating the success and impact of this significant economic stimulus program. Proper interpretation and context are key to extracting actionable insights.

The subsequent section will delve deeper into the specific methodologies and analyses that can be conducted using these documents.

Conclusion

Analysis of PPP warrant lists reveals a multifaceted picture of the Paycheck Protection Program's implementation. Key findings emphasize the importance of scrutinizing program details, applicant characteristics, loan amounts, compliance status, disbursement timelines, industry breakdowns, and geographic distribution. These elements, when analyzed collectively, offer a comprehensive understanding of the program's reach, impact, and potential areas for improvement. Discerning patterns, trends, and disparities in these data points provides valuable insights into the program's effectiveness in fulfilling its intended objectives and mitigating economic hardship. The analysis underlines the significance of careful consideration of these data points for both program evaluation and potential policy adjustments.

The thorough examination of PPP warrant lists is not merely an academic exercise but a crucial step in evaluating the efficacy of economic stimulus programs. Accurate interpretation of this data can inform future policy decisions, contributing to more targeted and effective responses to economic crises. Further research and analysis of these lists are critical to refining economic support mechanisms, ensuring equitable access to aid, and maximizing the effectiveness of such programs in the future. By understanding the historical context and operational mechanics of the PPP program, stakeholders can better prepare for and respond to similar economic challenges.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJmTqb%2Bmv9KeqmaaopqurLXNoGapqKBixKK%2B0ZqlrWWcnsC1esetpKU%3D