Quantifying an individual's financial holdings, the subject matter often involves assessing assets, such as real estate, investments, and other holdings. This calculation, while not always precise, provides a snapshot of an individual's accumulated wealth. Understanding such figures can be relevant to various analyses, from personal finance planning to market trends.

While the specific monetary value of an individual's holdings fluctuates, this information can be useful in considering the potential reach or influence of an individual, particularly within their professional or public sphere. Insights into financial standing can contribute to a more nuanced understanding of their background and overall context, thereby enriching comprehension of their work and activities. This analysis can also serve as a key component in market research, helping to gauge the scope of consumer spending patterns and market saturation.

The following sections will explore specific individuals and the methodologies utilized for calculating financial worth. This examination will delve into the practical applications and impact of such data.

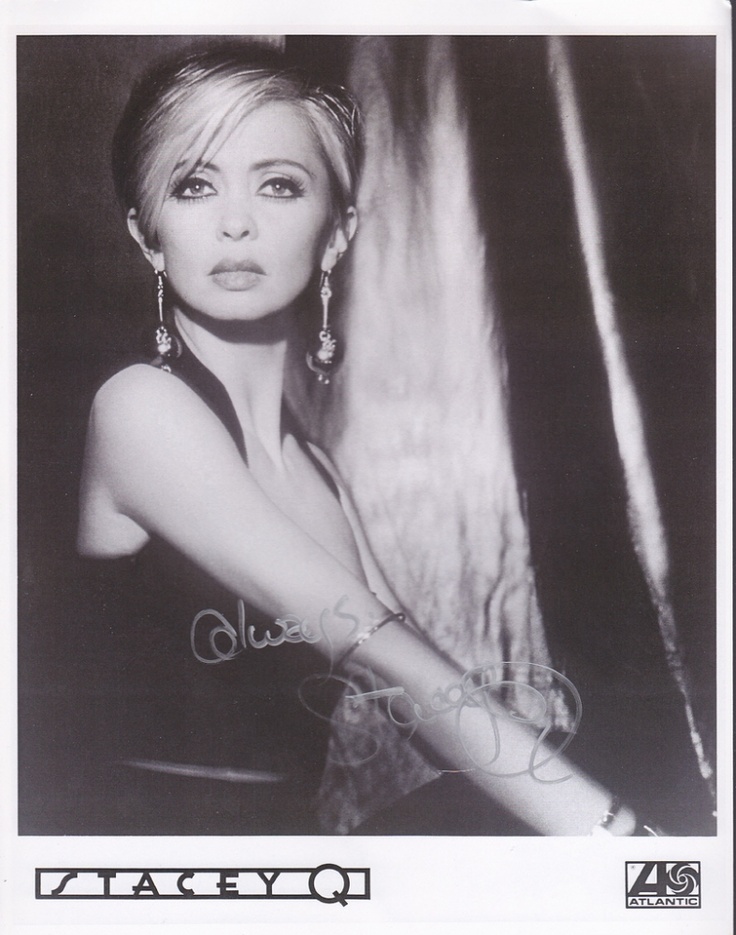

Stacey Q Net Worth

Assessing Stacey Q's net worth requires examining various financial factors. This involves understanding the components that contribute to overall wealth.

- Assets

- Investments

- Earnings

- Expenses

- Valuation

- Public Information

The elements of assets, investments, and earnings contribute directly to the overall calculation. Expenses, however, represent deductions. Accurate valuation methods are crucial in accurately reflecting financial standing. Publicly available information, while sometimes incomplete, offers a starting point for estimation. Ultimately, a precise figure for Stacey Q's net worth requires more detailed financial information than publicly available data, often remaining unclear or obscured by confidentiality concerns. This illustrates the challenge of determining net worth in such instances. For example, successful entrepreneurs might have significant hidden wealth, making public estimates potentially inaccurate.

1. Assets

Assets are fundamental components of an individual's net worth. The value of assets directly impacts the overall financial standing. Real estate holdings, for example, contribute significantly. A substantial property portfolio, valued according to market conditions, can represent a substantial portion of net worth. Similarly, investments in stocks, bonds, or other financial instruments influence the total value. Profitable businesses, if owned, also contribute to the calculation, reflecting their market valuation. The variety of asset types and their individual values are crucial considerations when evaluating an individual's overall financial position.

Understanding the composition of assets is vital for comprehending the potential reach and influence an individual might possess. A diversified portfolio, including various asset classes, can demonstrate financial acumen and stability. Conversely, a concentration in a limited number of assets presents different risks and potential volatility. The value of these assets, subject to market fluctuations, influences the estimated net worth. For instance, a substantial increase in the value of a particular investment could significantly impact the overall net worth calculation. Conversely, a decline in the value of an asset class would decrease the estimated worth, highlighting the dynamic nature of this calculation.

In summary, assets are a cornerstone of an individual's net worth. The diverse nature of assets, from real estate and investments to businesses, contributes to a complex calculation. Evaluating the value and composition of these assets provides insights into the individual's financial standing and its potential volatility. This understanding is crucial for evaluating the implications and significance of an individual's financial position. The accuracy of the net worth calculation hinges on the accurate valuation of these assets.

2. Investments

Investments play a critical role in determining an individual's net worth. The return on investments, coupled with the initial investment amount, directly influences the overall financial standing. The types and performance of investments held significantly impact the calculation of net worth. Understanding the dynamics of these investments provides a deeper insight into the factors that shape financial portfolios.

- Types of Investments and Their Impact

Diverse investment strategies, such as stocks, bonds, real estate, and various alternative investments, contribute to the overall portfolio. The performance of each investment type fluctuates over time, impacting the value of the overall portfolio. A portfolio concentrated in a single investment type carries greater risk than a portfolio diversified across multiple types. Understanding the specific investment types and their historical performance trends provides insight into potential future performance and risk associated with these decisions.

- Investment Return and Growth

The return on investment is a key factor in net worth calculation. High-performing investments lead to increased portfolio value, which in turn positively impacts net worth. Conversely, poor-performing investments can diminish the overall net worth. Analyzing the historical return trends of specific investments provides insights into their potential future performance. Factors such as market conditions, economic trends, and industry-specific factors all influence investment returns.

- Investment Diversification and Risk Management

A well-diversified investment portfolio is crucial in managing risk. Diversification across various asset classes helps mitigate the impact of poor performance in any single investment. The strategic allocation of funds across different investment types minimizes the negative effect of any single investment's potential downturn. The level of risk tolerance influences the appropriate diversification strategy for an individual's specific circumstances.

- Investment Timing and Market Conditions

Market conditions and economic trends influence investment performance. Investments made during periods of economic growth may yield higher returns, while investments made during economic downturns may experience lower returns. Assessing market conditions and economic forecasts can aid in understanding the potential return of an investment. Understanding market cycles allows investors to make informed decisions about investment timing.

In conclusion, investments are integral to the calculation of net worth. The types, performance, and diversification of investments directly affect an individual's overall financial position. Understanding these factors allows for a more comprehensive evaluation of the complexities involved in determining net worth.

3. Earnings

Earnings represent a crucial component in determining net worth. They directly influence an individual's financial position and accumulated wealth. The level and consistency of earnings play a significant role in building and sustaining overall financial stability.

- Sources of Earnings

Various sources contribute to an individual's total earnings. Salary from employment is a primary source. Income from investments, including dividends, interest, and capital gains, also contributes. Entrepreneurial ventures, royalties, and other business-related activities can generate substantial income. Understanding the different income streams and their relative importance is essential for a complete picture of financial contributions. The specific sources of income can vary greatly based on career, industry, or personal choices. For instance, someone in a highly compensated professional field will have a different income profile compared to someone with a small business.

- Earnings Consistency and Stability

The stability and predictability of earnings significantly affect long-term financial health. Consistent income streams provide the foundation for saving, investment, and debt management. Fluctuating or inconsistent earnings can pose challenges in planning and achieving financial goals. A steady stream of income allows for more reliable budgeting and long-term financial planning. For instance, a salaried employee with consistent income can better manage expenses and plan for retirement compared to someone with freelance or commission-based income.

- Earnings Growth and Advancement

Growth in earnings over time is often a key factor in accumulating wealth. Career advancement, skill development, or increased responsibilities often lead to higher earnings. Recognizing opportunities for professional growth and skill enhancement is crucial for long-term financial success. Regular review of compensation packages and opportunities for improvement are essential. For example, pursuing higher-level positions or acquiring specialized skills can lead to significant increases in earnings over time.

In summary, earnings are a critical component in the overall picture of net worth. Understanding the different sources, consistency, and potential for growth in earnings is essential for building long-term financial stability and wealth accumulation. Assessing earnings provides a significant aspect in understanding the financial trajectory and potential of an individual.

4. Expenses

Expenses directly impact an individual's net worth. Understanding the nature and extent of expenses is crucial in assessing the overall financial health and accumulation of wealth. High spending patterns, relative to income, will diminish net worth, while controlled spending can contribute to its growth.

- Living Expenses and Their Impact

Essential expenditures like housing, food, utilities, and transportation represent significant portions of an individual's budget. Variances in living costs across regions and individual preferences affect the proportion of income dedicated to these necessities. For example, a higher cost of living in a metropolitan area will require a larger portion of income for housing and other daily expenses. Managing living expenses effectively allows for funds to be channeled into other investments or savings, thereby enhancing net worth.

- Debt Repayment and Its Influence

Repaying debts, including mortgages, loans, and credit card balances, directly impacts disposable income. High levels of debt obligations leave less capital available for savings and investments, thus negatively affecting potential net worth. Conversely, diligent debt management can free up funds for more profitable ventures or savings, contributing to long-term financial growth. For instance, strategically paying down high-interest debt will result in significant savings over time.

- Investment and Discretionary Spending

Expenditures directed towards investments, such as stocks, bonds, or real estate, represent future-oriented spending. While these expenses may not appear as direct costs, they are critical for long-term wealth accumulation. Conversely, significant discretionary spending on non-essential items can negatively impact net worth growth. Choosing between current satisfaction versus future gains necessitates careful consideration of personal financial goals and risk tolerance.

- Taxes and Their Effect on Net Worth

Tax obligations represent a substantial deduction from an individual's income, significantly impacting the available funds. Understanding tax implications of various income streams and investments is crucial for managing finances effectively. The amount and types of taxes paid directly influence the funds available for investment, savings, or other expenditures, affecting the overall net worth.

In conclusion, expenses are an integral part of evaluating net worth. Careful management of living costs, debt repayment, investment spending, and tax implications is essential for achieving and sustaining a robust net worth. A detailed analysis of expenses provides insights into financial habits and potential areas for improvement, leading to informed financial decisions for long-term growth.

5. Valuation

Determining Stacey Q's net worth hinges on accurate valuation. Valuation, in this context, is the process of estimating the economic worth of assets. The accuracy of the valuation directly impacts the calculated net worth figure. Inaccurate or flawed estimations can lead to a distorted representation of true financial standing.

Consider various asset classes and their valuation complexities. Real estate valuation relies on comparable sales, market trends, and property condition assessments. Investment valuations, particularly for stocks, are influenced by market forces, company performance, and overall economic conditions. The value of a business, if owned, depends on its revenue streams, profitability, market share, and future growth potential. Each asset class presents unique valuation methodologies, and errors in any one area can significantly affect the overall net worth calculation. For instance, overvaluing real estate holdings may inflate the reported net worth if the market subsequently corrects downward. Conversely, undervaluing investments can create a false impression of diminished financial health.

Understanding valuation methodologies is crucial in assessing the validity of reported net worth figures. Reliable valuations rely on a thorough understanding of financial principles, market dynamics, and specific industry practices. Accurate valuations of assets are essential for a fair and comprehensive representation of Stacey Q's financial situation. This careful assessment of valuation methods and factors underpinning them allows for a more discerning evaluation of individual financial strength. Challenges in valuation include the subjective nature of some asset assessments and the inherent volatility of financial markets. These challenges highlight the need for expertise and caution in handling valuation processes within the context of determining net worth.

6. Public Information

Publicly available information plays a role in estimating an individual's net worth, particularly when direct financial details remain undisclosed. This data, while potentially incomplete, offers a starting point for analysis and insight into broader financial contexts. The limitations of public information should always be acknowledged, recognizing its inherent incompleteness and potential inaccuracies when estimating a precise net worth figure.

- Public Records and Filings

Public records, such as property ownership filings, business registrations, and tax returns (when accessible), provide clues about asset holdings and income sources. Analysis of these records can reveal the extent of real estate ownership, business ventures, and income levels. Examining public filings can offer a starting point for estimating the overall wealth picture, though these documents often do not provide a comprehensive picture. For example, real estate records might indicate property holdings but not the full extent of investment portfolios.

- Media Reports and Statements

Media reports, interviews, and public statements can shed light on an individual's financial activities. Information about investments, philanthropic endeavors, or significant financial transactions might be disclosed in these sources. Such insights can give context to estimates of overall wealth, though speculation or interpretations should be approached with caution. For instance, news stories about major investments or partnerships could be used as indicators of financial activity and potentially influence investment decisions.

- Social Media and Online Presence

Social media platforms and online profiles can offer indirect indicators of financial status. Display of expensive items, lavish lifestyle choices, or engagement with financial discussions might hint at overall affluence. However, these indicators are largely subjective and often unreliable for precise financial estimation. For example, lavish displays on social media do not directly translate to precise financial figures, but they can provide insights into perceived social standing and wealth.

In conclusion, public information offers a starting point in understanding the potential financial picture of an individual. While never a definitive measure, these publicly accessible details, taken together with other relevant data, can contribute to a broader understanding of an individual's economic context. The interpretation of this information should always be approached with a healthy dose of skepticism, realizing that a precise net worth figure necessitates direct financial disclosure.

Frequently Asked Questions about Stacey Q's Net Worth

This section addresses common inquiries regarding Stacey Q's financial standing. Accurate calculation of net worth requires detailed financial information, which is often not publicly available. The following questions and answers provide context for estimations based on available data.

Question 1: What methods are used to estimate net worth?

Estimating net worth involves assessing various financial factors, including assets, investments, earnings, and expenses. Different methods may be applied, relying on publicly available data, industry benchmarks, and other relevant information. Accurate valuation of assets is crucial, recognizing that methodologies vary depending on the asset type (e.g., real estate, stocks, businesses). Important considerations include market conditions and economic trends.

Question 2: Why is precise net worth information often unavailable?

Publicly accessible financial data about individuals is often limited. Confidentiality concerns and the private nature of financial information frequently prevent complete transparency. Precise estimates are challenging without access to personal financial statements or tax documents. Furthermore, the dynamic nature of investments and market fluctuations contribute to ongoing changes in financial standing.

Question 3: How reliable are publicly available estimates?

Publicly available estimates of net worth should be viewed with caution. These estimations are often based on incomplete information, potentially leading to inaccurate or imprecise figures. Market conditions, economic trends, and subjective valuation methods all affect the reliability of these estimates. The absence of direct confirmation from the subject makes these approximations inherently uncertain.

Question 4: What are the limitations of using social media data?

Social media activity, while offering hints about lifestyle and potential affluence, should not be the sole basis for calculating net worth. Posts and imagery offer limited insight into an individual's actual financial status. Personal choice, lifestyle preferences, and differing interpretations contribute to the unreliability of such data points in assessing true financial standing.

Question 5: How do market fluctuations impact net worth estimations?

Market volatility plays a significant role in influencing net worth. The value of investments, especially stocks and real estate, is highly susceptible to changes in market conditions. Economic downturns or periods of uncertainty can lead to significant fluctuations in asset values, impacting overall net worth figures. The potential for appreciation or depreciation must be considered in any estimated calculations.

Question 6: What is the significance of analyzing public records?

Examining publicly available records can provide insights into certain aspects of an individual's financial situation. This includes property ownership, business filings, and tax information (where accessible). While not comprehensive, such records can give context to the estimation of overall financial standing. It's essential to acknowledge that this data doesn't represent the full picture.

In conclusion, determining a precise net worth requires detailed, verified financial information. Public estimates are subject to limitations and should be approached cautiously. This FAQ has addressed key factors and considerations in estimating and interpreting such data.

The subsequent sections will delve into the specifics of financial analysis and market dynamics relevant to understanding net worth on a broader scale.

Tips for Understanding and Assessing Net Worth

Accurate assessment of net worth necessitates a comprehensive approach, considering diverse financial factors. These tips offer guidance for evaluating and understanding financial standing.

Tip 1: Thorough Asset Valuation

Accurate estimations rely on precise asset valuations. Diverse methodologies are necessary, depending on asset type. Real estate appraisals often involve comparable sales analysis, considering location, size, and condition. Investment portfolios require detailed market research and analysis of historical performance. Business valuations necessitate expert assessments, incorporating factors like revenue, profitability, and market share.

Tip 2: Comprehensive Income Analysis

Assessing income sources is crucial. Earnings from employment, investments, and other ventures should be meticulously documented. Account for all income streams and ensure all relevant documentation is incorporated into the calculation. Consistency and stability of income are crucial indicators of financial health and sustainability. Detailed records of income facilitate accurate calculation and enhance the reliability of net worth estimations.

Tip 3: Detailed Expense Tracking

Careful consideration of expenses is necessary. Both essential and discretionary spending patterns should be tracked. Detailed record-keeping facilitates the identification of areas where expenses might be managed more effectively. Tracking and categorizing expenses allow for better budgetary control and aid in achieving financial objectives.

Tip 4: Recognition of Publicly Available Information Limitations

Publicly available information offers a starting point but must not be the sole basis for precise estimations. Incomplete or potentially inaccurate data must be treated with caution. Direct verification of details is essential for greater accuracy. Media reports, social media posts, or rumors must not serve as the sole basis for financial evaluations.

Tip 5: Understanding Market Dynamics

Market fluctuations significantly impact asset values. Investments, particularly in stocks and real estate, are subject to market forces, influencing valuations. Recognizing the dynamic nature of financial markets allows for more informed decisions about investment strategies and resource allocation.

Tip 6: Seeking Professional Guidance

Expert financial advice is invaluable. Consultants or advisors with relevant experience can provide insights and expertise in diverse areas of financial planning, particularly in complex situations involving asset valuation, investment strategies, and financial risk management.

Following these tips offers a structured approach toward understanding and assessing net worth. A comprehensive evaluation, employing robust methodologies, yields a more accurate and reliable depiction of an individual's financial standing.

These insights form the foundation for a deeper understanding of financial analysis and resource management. In the subsequent sections, a more profound examination of specific cases will be undertaken.

Conclusion

Determining Stacey Q's net worth presents a complex challenge due to the limited availability of publicly accessible financial information. Analysis hinges on assessing assets, investments, earnings, and expenses. Precise valuation of assets, considering market fluctuations and individual circumstances, is crucial for accurate estimation. While public records and media reports may offer clues, these sources alone are insufficient for a definitive calculation. The inherent limitations of relying solely on publicly available data highlight the challenges in accurately determining an individual's financial standing in the absence of direct disclosure.

Understanding the factors influencing net worth estimationsasset valuation, income sources, and expense managementis vital for a comprehensive perspective. The dynamic nature of financial markets necessitates a nuanced approach to analyzing financial standing. While precise figures remain elusive, the exploration of these factors provides a framework for understanding the broader economic context and potential influences surrounding Stacey Q's financial position. This conclusion underscores the importance of responsible financial reporting and transparency in public discussions regarding personal wealth.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaJuVobKjvsitoJ6rXZa7pXnToZxmqpmosnC%2F05qanrFdpnqvsdNmrqiqpJ17qcDMpQ%3D%3D