Determining an individual's financial standing, often represented by their net worth, is a critical aspect of understanding their overall economic position. Net worth signifies the difference between an individual's total assets (such as property, investments, and cash) and their total liabilities (such as debts). This figure reflects the accumulated wealth of a person at a specific point in time, providing insight into their financial health and resources.

Publicly available information regarding an individual's financial status is limited and often subject to change. Estimating or verifying such figures requires access to comprehensive financial records and independent verification. There is no guaranteed definitive resource or single source for such precise information. The absence of publicly released data does not diminish the importance of understanding the concept of net worth. The concept is valuable in personal finance, business valuation, and investment analysis.

This understanding of financial standing is foundational to analyzing various aspects of an individual's life, career, or business ventures. The absence of easily accessible data regarding Tom Misners specific financial situation should not detract from the general principles of assessing net worth. A subsequent exploration of Tom Misner's career, contributions, or other relevant details could leverage this concept to better understand his place in history, industry, or broader society.

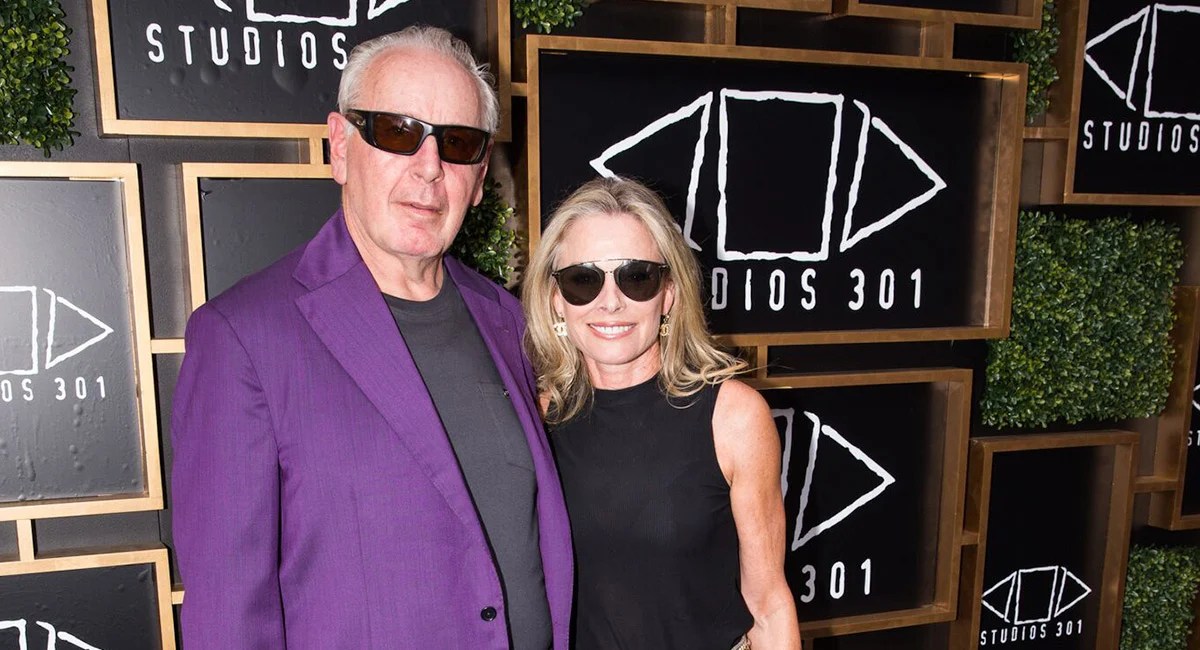

Tom Misner Net Worth

Determining an individual's financial standing, often represented by their net worth, provides insight into their overall economic position. This concept encompasses assets, liabilities, and the resulting financial status.

- Assets

- Liabilities

- Valuation

- Privacy

- Investment

- Change

- Resources

The aspects of assets, liabilities, and valuation are fundamental to understanding net worth. Privacy considerations often prevent public disclosure of precise financial figures. Investment decisions contribute to asset growth or loss, while recognizing financial fluctuations over time is vital. Limited resources for independent verification can make accurate estimations challenging. This complexity highlights the inherent limitations in assessing Tom Misner's (or any individual's) net worth without public data.

1. Assets

Assets are crucial components of net worth. They represent the sum total of an individual's possessions, investments, and other holdings with monetary value. The value of these assets directly influences the overall net worth figure. A significant increase in the value of assets will demonstrably increase net worth, while a decrease will have the opposite effect. Examples include real estate holdings, investment portfolios, and liquid assets like cash and securities. The diversity and market value of these holdings significantly impact the calculation and overall health of an individual's financial standing.

Consider a scenario where an individual, similar to Tom Misner, increases their investment portfolio. This portfolio expansionrepresenting an increase in assetscan demonstrably result in a rise in their net worth. Conversely, if a significant asset like real estate is sold at a loss, this will reduce the individual's net worth. Understanding this connection highlights the direct link between asset management and overall financial well-being. Asset management is therefore critical for individuals in building and maintaining a positive financial profile.

In essence, assets are the foundation of net worth. Analyzing the types, values, and market conditions of these assets provides a critical understanding of an individual's financial position. This understanding is fundamental to personal finance management and investment strategy. While specifics regarding Tom Misner's assets remain unavailable, the general principle of assets and net worth remains universally applicable.

2. Liabilities

Liabilities represent financial obligations owed by an individual. In the context of net worth, liabilities act as a counterpoint to assets. A significant portion of liabilities directly impacts the net worth calculation. A higher level of liabilities reduces net worth, while a decrease in liabilities has the opposite effect. This inverse relationship underscores the importance of managing debt to maintain a favorable financial position. The extent of liabilities and the rate of their accumulation are critical factors in determining overall financial health.

Consider a scenario analogous to Tom Misner, where substantial debts accumulate. These debts, such as loans, mortgages, or outstanding credit card balances, act as liabilities. The amount of these outstanding obligations will directly reduce the calculated net worth figure. Conversely, successful debt repayment or reduction would positively impact the net worth. This demonstrates the crucial role of managing liabilities in maintaining or improving one's financial standing. The same principles apply regardless of the individual's profession or background.

Understanding the impact of liabilities on net worth is crucial for sound financial planning. Managing debt effectively through careful budgeting, loan repayment strategies, and responsible credit use is fundamental. The relationship between liabilities and net worth is a core concept in personal finance. While precise details regarding Tom Misner's liabilities remain unavailable, the connection between liabilities and financial well-being holds true across diverse personal and professional contexts. This connection illuminates the importance of prudent financial management in achieving a positive and sustainable financial future.

3. Valuation

Determining net worth inherently relies on valuation. Accurately assessing the value of assets and liabilities is fundamental in calculating this figure. Precise valuation is crucial to understand the true financial position of an individual like Tom Misner, as it influences the overall portrayal of their economic standing. This process considers various factors to arrive at a reasonable estimate of worth.

- Market-Based Valuation

Market-based valuation methods utilize prevailing market prices to determine asset value. For example, the price of publicly traded stocks or real estate in comparable locations is often used. This approach reflects current market conditions and can be influenced by supply and demand dynamics, market trends, and broader economic factors. In scenarios involving Tom Misner's potential holdings, this would entail researching comparable assets or similar investments in the market to gauge approximate values.

- Asset-Specific Valuation

Certain assets, such as unique artwork or intellectual property, may require specialized valuation methods. Experts in specific fields evaluate these assets based on factors such as historical precedent, condition, potential future earnings, or market demand for similar items. For individuals like Tom Misner, these assets would need expert appraisals to reflect their specific worth within their portfolio.

- Discounted Cash Flow Analysis

In cases where assets generate income streams, a discounted cash flow analysis might be employed. This method projects future cash flows and discounts them back to their present value. The analysis assesses the future profitability of assets like investments and businesses to determine their overall value. This method could potentially be relevant if specific income-generating assets are part of Tom Misner's portfolio.

- The Role of Transparency and Data Availability

The accuracy of valuation methods relies heavily on the availability of comprehensive and reliable data. Without transparent access to Tom Misner's financial records, a precise valuation would be challenging. This lack of public information underscores the limitations inherent in estimating net worth without appropriate documentation.

In conclusion, accurate valuation is the bedrock upon which a reliable net worth assessment is built. The diverse methods employed, from market-based estimations to asset-specific appraisals, highlight the complexities of assigning a monetary value to various holdings. The limitations of accessing specific data relating to Tom Misner further emphasize the challenges in obtaining a definitive net worth estimate without comprehensive information.

4. Privacy

Privacy considerations are intrinsically linked to the concept of net worth, particularly when discussing individuals like Tom Misner. The desire for personal financial matters to remain confidential is a fundamental aspect of modern society. Understanding the connection between privacy and net worth illuminates the complexities of financial data and public perception.

- Legal and Ethical Considerations

Personal financial information is often subject to legal protections and ethical standards. Regulations and laws around data privacy often dictate how financial details can be handled, stored, and disclosed. These considerations are paramount in cases involving sensitive personal finances and in relation to individuals like Tom Misner. Lack of transparency about specific financial details may reflect a conscious decision to safeguard personal information, driven by these legal and ethical frameworks.

- Financial Risk Management

Protecting financial privacy can serve as a risk management strategy. The disclosure of financial details might expose individuals to potential threats, including identity theft, fraud, or harassment. For public figures like Tom Misner, maintaining privacy surrounding finances can be crucial for mitigating these risks. Public visibility of financial information could potentially invite unwanted attention or scrutiny.

- Public Perception and Reputation

Financial information can significantly impact public perception. The portrayal of an individual's financial health or status in the media might affect their reputation or career. This consideration is especially pertinent for those in public life, such as Tom Misner, where public scrutiny is often heightened. Maintaining privacy surrounding specific financial details can help control how their financial status is presented and interpreted.

- The Impact of Limited Data Availability

The absence of readily available, publicly verifiable financial data for an individual like Tom Misner does not invalidate the value of understanding the concept of net worth. It highlights the fundamental tension between public interest in public figures and the importance of safeguarding financial privacy. Without public access to these details, direct estimation becomes impossible and the specific financial position remains largely unknown.

In conclusion, the interplay between privacy and an individual's net worth, especially in cases of figures like Tom Misner, underscores the delicate balance between public interest and personal confidentiality. The absence of definitive net worth information doesn't diminish the broader implications of financial privacy and how that affects personal and professional contexts, including public reputation and potential risk management.

5. Investment

Investment decisions are a significant factor influencing an individual's net worth, and this principle holds true for figures like Tom Misner. The choices made in investing capital, whether in stocks, bonds, real estate, or other avenues, directly impact the accumulation or depletion of wealth over time. Understanding the role of investment strategies in building or eroding net worth is essential for comprehending the overall financial picture of any individual.

- Types of Investments and Their Impact

Diverse investment options exist, each with its own risk-reward profile. Stocks, for instance, can provide substantial returns but also carry higher volatility compared to more conservative investments like bonds. The selection of investment types, their diversification, and the associated risk tolerance are integral elements in the growth or decline of an individual's net worth. Strategic allocation of capital across different investment vehicles is a key element in effective wealth management and can significantly impact the trajectory of an individual's financial position.

- Investment Returns and Growth Patterns

Investment returns are not uniform and vary significantly based on market conditions and the specific investment vehicle. Periods of market growth can lead to substantial gains, while downturns can result in losses. The timing of investment decisions and the strategies employed play critical roles in achieving desired financial outcomes. Fluctuations in the market significantly influence an individual's net worth trajectory. A sound investment strategy is crucial for navigating market volatility.

- Long-Term vs. Short-Term Investments

Investment strategies often distinguish between short-term and long-term goals. Short-term investments, such as high-yield savings accounts or money market funds, may prioritize liquidity and preservation of capital. Long-term investments, like stocks and real estate, may aim for higher returns but often involve a longer timeframe for realizing those gains. The approach chosen significantly affects the rate at which net worth grows or shrinks. The choice between short-term and long-term investment strategies, considering the expected timeframe for a return, is a critical element in personal finance.

- Diversification and Risk Management

Diversification is a core investment principle that spreads risk across different assets. By not concentrating investments in a single asset or sector, investors mitigate potential losses from adverse market events. A diversified investment portfolio is often viewed as a cornerstone of prudent risk management and can help maintain stability and consistency in an individual's net worth over extended periods. The principle of diversification holds true across various contexts and individual investment strategies.

In essence, investment choices are integral to an individual's net worth. The types of investments, their potential returns, and the investment timeframe influence the overall financial position. Strategic investment decisions are vital for building or safeguarding financial wealth, and this applies universally to individuals like Tom Misner, regardless of specific details surrounding their investments.

6. Change

Fluctuations in an individual's financial position, including those associated with Tom Misner, are inextricably linked to change. Changes in asset values, market conditions, and investment strategies directly impact net worth. An appreciation in the value of investments, or the acquisition of substantial new assets, directly results in an increase in net worth. Conversely, declines in asset values, such as market downturns or realized losses, will correspondingly reduce net worth. These dynamic alterations reflect the inherent volatility of financial markets and the impact of various internal and external factors on an individual's overall wealth.

Analyzing the relationship between change and net worth necessitates consideration of both short-term and long-term perspectives. Significant short-term changes, such as unexpected market fluctuations or substantial capital investments, can have a pronounced effect on net worth. Conversely, long-term trends, including consistent investment strategies, sustainable income streams, and prudent financial management, contribute to more gradual but potentially significant changes in net worth over time. The integration of diversification strategies is crucial in mitigating the impact of negative changes in specific assets. Real-life examples include the impact of economic recessions on investment portfolios or the substantial increase in net worth associated with successful entrepreneurial ventures.

Understanding the connection between change and net worth is critical for individuals and businesses alike. A keen awareness of market trends, potential investment risks, and the impact of external factors, such as economic shifts or regulatory changes, allows for proactive strategies to manage and potentially capitalize on fluctuations. For Tom Misner or any individual, comprehending how various changes affect financial standing empowers proactive adjustments to investment portfolios, financial planning, and overall wealth management. This understanding is crucial for both individuals seeking to improve their financial position and organizations aiming to optimize investment strategies to weather market volatility.

7. Resources

Understanding the resources available to an individual, like Tom Misner, is crucial when considering their net worth. Resources encompass various factors that contribute to financial standing, including assets, income streams, investment opportunities, and access to financial capital. Their availability and nature directly affect the potential for accumulating wealth and overall financial health.

- Financial Capital Access

Access to capital, such as loans, investments, or grants, plays a significant role in net worth accumulation. Individuals with robust access to financial capital can leverage these resources for investment opportunities, potentially increasing the value of their assets and thus their net worth. This is a key factor in the potential for growth and expansion. The availability of capital also significantly influences an individual's financial flexibility and their ability to weather financial storms.

- Investment Opportunities and Portfolio Composition

The nature and quality of investment opportunities available to an individual significantly influence the composition and growth potential of their investment portfolio. Access to diverse and high-growth investment avenues can lead to substantial wealth accumulation. Conversely, limited access to robust investment options may restrict the ability to build a significant net worth. Factors such as industry expertise, network connections, and market conditions greatly influence the quality of these opportunities.

- Income Streams and Financial Stability

Multiple, dependable income streams contribute significantly to financial stability and net worth. A diversified income portfolio helps an individual weather economic downturns or unexpected expenses. A strong foundation of consistent income allows for strategic investments and the acquisition of high-value assets. The types of income, their predictability, and potential for growth are critical factors in assessing long-term financial security.

- Asset Valuation and Management Expertise

Proper asset valuation and management are crucial aspects of maximizing net worth. An individual with access to competent financial advisors or internal expertise in asset valuation can make informed decisions to increase the value of their assets. This expertise is essential for navigating complex financial markets, assessing risk, and maximizing returns on investment. Professional advice can guide informed decisions and protect against potential losses.

In conclusion, the interplay of resources available to individuals like Tom Misner plays a vital role in shaping their net worth. Access to financial capital, a diverse investment landscape, stable income streams, and expert asset management are all critical components. Analyzing these resources provides a more complete understanding of the factors that can contribute to an individual's overall financial position. The presence and nature of these resources are crucial in understanding the factors that have shaped, or can shape, the financial landscape of an individual like Tom Misner.

Frequently Asked Questions about Tom Misner's Net Worth

Information regarding an individual's net worth is often complex and not always publicly available. This FAQ section addresses common inquiries about estimating or understanding financial standing, particularly as it relates to Tom Misner.

Question 1: Why is specific information about Tom Misner's net worth not readily available?

Publicly available financial information regarding individuals is often limited. This is due to factors including personal privacy, legal considerations, and the complexity of valuing assets.

Question 2: What are the fundamental components of calculating net worth?

Calculating net worth involves determining an individual's total assets (possessions of monetary value) and liabilities (financial obligations). The difference between these figures constitutes net worth.

Question 3: How are assets typically valued for net worth calculations?

Asset valuation methods vary depending on the type of asset. Market-based valuation often relies on current market prices for comparable assets. Specialized valuation methods may be required for unique or complex assets.

Question 4: What role do liabilities play in determining net worth?

Liabilities, such as debts and financial obligations, represent deductions from net worth. A higher level of liabilities will reduce the overall net worth calculation.

Question 5: How might investment choices impact Tom Misner's (or any individual's) net worth?

Investment decisions have a direct impact on net worth. Wise investment choices and market conditions can increase net worth, while poor choices or market downturns can decrease it.

Question 6: If precise net worth data isn't available, what can still be understood about Tom Misner's financial position?

Even without precise net worth figures, understanding the broader financial concepts of assets, liabilities, and investment choices remains valuable. These concepts apply universally and help assess any individual's financial standing.

In conclusion, while precise net worth details remain elusive, the underlying principles of financial valuation and management apply to all individuals. Understanding these principles allows for a broader appreciation of the factors impacting financial stability, regardless of whether specific figures are available.

The following section will delve into Tom Misner's career and contributions.

Tips for Understanding Financial Standing

This section offers practical guidance for comprehending an individual's financial position, particularly when specific data, like net worth figures, are unavailable. Understanding these principles allows for a reasoned approach to assessing financial well-being regardless of the specific details.

Tip 1: Focus on the Fundamentals. Before delving into complex calculations, prioritize understanding the core elements of financial health. This includes evaluating assets (possessions with monetary value), liabilities (financial obligations), and the difference between the two, which constitutes net worth.

Tip 2: Analyze Income Sources and Stability. Assess the individual's income streams. Multiple reliable sources demonstrate financial stability, which is a crucial factor for building and sustaining wealth. A diverse income portfolio offers resilience during economic downturns.

Tip 3: Evaluate Investment Strategies and Practices. Examine the individual's investment strategies. A diversified portfolio, with appropriate allocation across various asset classes, reflects a nuanced approach to managing risk and seeking returns. Understanding the composition of investments provides a clearer picture of the potential for growth and resilience.

Tip 4: Research Similar Cases for Context. Look for comparable figures or situations in the same field or industry. This can offer insight into relative financial standings within a specific context. Studying trends in comparable situations provides valuable insights when direct information isn't readily available.

Tip 5: Respect Privacy Considerations. Recognize that financial data is often confidential and private. The absence of readily accessible data may stem from a conscious decision to safeguard personal financial details. Respecting privacy is essential, and this lack of transparency doesn't necessarily indicate a lack of financial well-being.

Tip 6: Understand the Limitations of Available Information. Recognize that a lack of publicly available data on an individual's net worth doesn't diminish the importance of evaluating financial principles. Limited data requires a focus on broader trends and contextual understanding.

Tip 7: Seek Professional Advice. Consult financial experts or professionals in related fields for guidance in interpreting financial data, particularly when dealing with complex situations or limited information. Professional advice can help fill gaps in information and offer valuable insights.

By employing these tips, one can develop a thorough and nuanced understanding of financial standing, even in the absence of definitive numerical data. Focus on the fundamental principles of asset valuation, income stability, and investment strategies to derive insightful conclusions about financial well-being.

The subsequent sections will delve deeper into the context of Tom Misner's career and the relevant principles outlined in these tips.

Conclusion

This exploration of "Tom Misner's net worth" reveals the complexities inherent in assessing an individual's financial standing. The absence of readily available public data highlights the delicate balance between public interest and personal privacy. Key considerations include the valuation of diverse assets, the impact of liabilities, and the intricate role of investment strategies. Without explicit figures, the analysis underscores the fundamental principles of financial assessment, including the valuation of assets, the management of liabilities, and the importance of understanding market dynamics. This exploration emphasizes the necessity of comprehensive information for a definitive valuation, demonstrating the limitations inherent in estimating financial standing without transparent disclosure.

While precise figures remain unavailable, the broader principles discussed provide valuable insights into the factors influencing financial health. The absence of specific data regarding Tom Misner's net worth should not diminish the importance of understanding the underlying principles of financial valuation. This examination underscores the need for transparency and responsible financial management, as these principles apply universally to individuals across diverse professional and personal contexts. Future research or public disclosures could offer a more complete understanding of Tom Misner's financial position, but the enduring value of these fundamental principles of financial assessment remains undeniable.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKSVlrGqusZmq6GdXZi1orrGnmatp51iuqq%2FzZ6pZqaVqXq4u9Gtn2egpKK5