A hypothetical agreement characterized by significant concessions and potential drawbacks, potentially involving a complex interplay of financial or material considerations. Such a deal might be perceived as disadvantageous or lacking sufficient benefit to justify the compromises involved. Examples might include trade agreements with unfavorable terms, or contract negotiations where substantial sacrifices are demanded in exchange for minimal gain.

The evaluation of such a deal depends heavily on the specific context. Factors like market conditions, long-term strategic implications, and the nature of the concessions made are crucial in assessing the overall value and potential risks. Understanding the motivations behind the agreement, and the power dynamics involved, is essential to a complete analysis. Historical precedent can also inform the potential success or failure of such a transaction, offering important insight into the potential outcomes. A comprehensive review of the surrounding details is imperative before determining the deal's ultimate merit.

This framework of analysis is central to understanding the dynamics of complex negotiations and transactions. The article that follows will delve into specific case studies, examining the conditions leading to particular outcomes in these situations and exploring the potential consequences and decision-making processes. These case studies will demonstrate how understanding the motivations, compromises, and potential risks in such deals can aid in developing more informed perspectives.

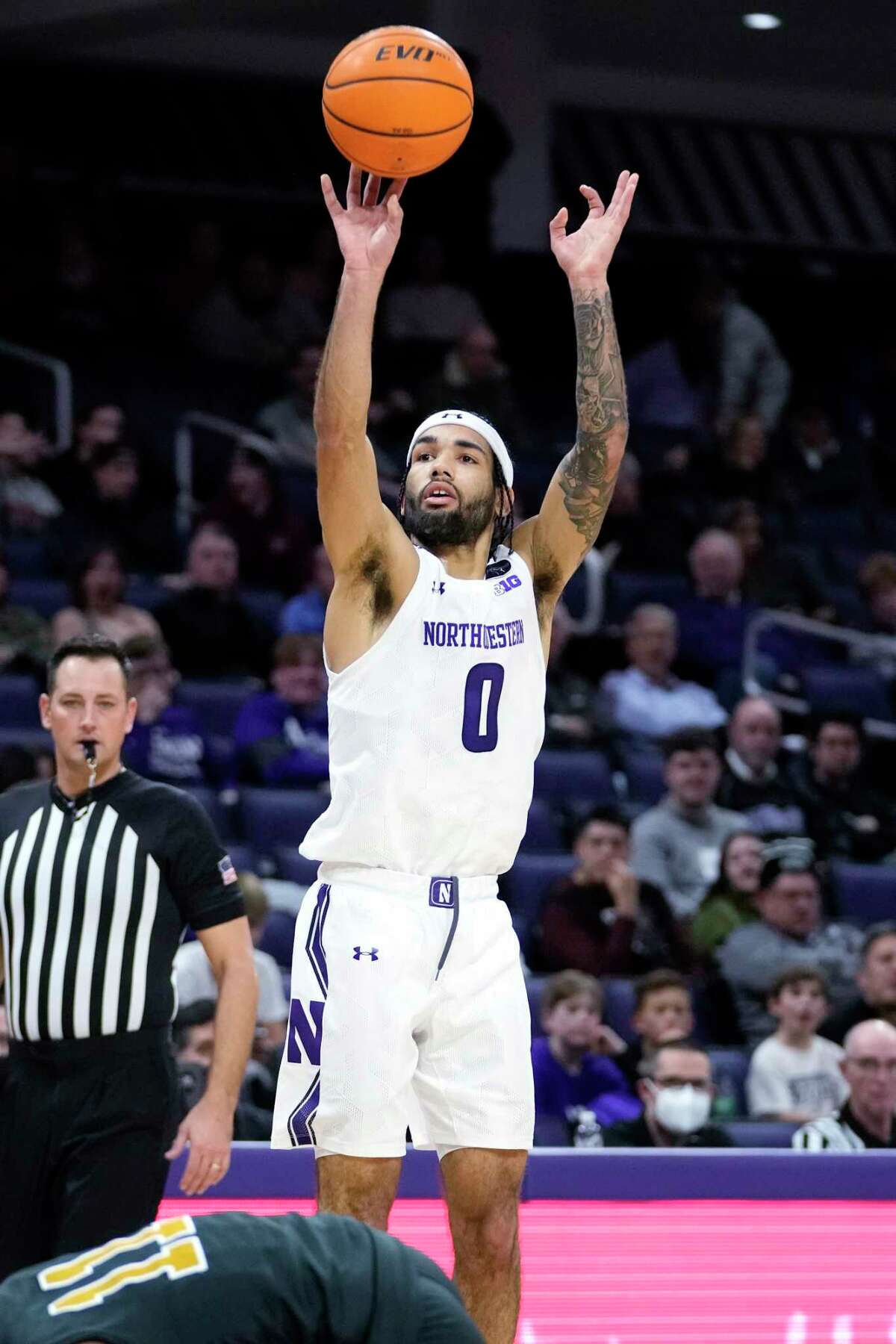

Boo Buie Nil Deal

Analyzing a "boo buie nil deal" necessitates a comprehensive understanding of its key components. This exploration focuses on essential aspects crucial for evaluating such an agreement.

- Unfavorable terms

- Significant concessions

- Potential risks

- Limited benefits

- Power imbalance

- Market context

- Strategic implications

These aspects highlight the multifaceted nature of a "boo buie nil deal." Unfavorable terms often lead to significant concessions from one party, exposing them to potential risks. Limited benefits, coupled with a power imbalance, can render the agreement strategically disadvantageous. Understanding market context and strategic implications provides a broader perspective, enabling a more informed assessment. Examining historical examples of such deals underscores their inherent risks and limitations. Ultimately, evaluating a "boo buie nil deal" requires an in-depth analysis of these factors to fully comprehend its implications and potential consequences.

1. Unfavorable Terms

Unfavorable terms are a defining characteristic of a "boo buie nil deal," representing agreements where the terms are demonstrably detrimental to one party or parties involved. These terms frequently result in disproportionate concessions and limited benefits, underscoring the deal's potentially problematic nature. Analyzing unfavorable terms is crucial for understanding the inherent risks and potential pitfalls within such agreements.

- Excessive Financial Obligations

Unfavorable financial terms often involve disproportionately high costs, unrealistic repayment schedules, or excessive fees. These clauses can severely strain financial resources and negatively impact long-term viability. Examples include contracts with exorbitant penalties for minor infractions or agreements with inflated interest rates, creating an immediate and escalating financial burden on one party.

- Unbalanced Asset Transfers

Agreements featuring imbalanced asset transfers are frequently indicative of unfavorable terms. This involves situations where one party cedes a substantial portion of assets or valuable rights for minimal return. For instance, a company transferring crucial intellectual property in exchange for a limited equity stake in a significantly smaller entity exemplifies this imbalance. Such imbalances can dramatically impair long-term profitability and jeopardize the strategic goals of affected parties.

- Limited or Illusory Guarantees

Agreements lacking robust or credible guarantees signal potential difficulties and unfavorable terms. This involves scenarios where promises or assurances regarding future performance or outcomes are vague, unrealistic, or easily nullified. Consider agreements lacking legally binding warranties for products or services delivered, potentially leaving the buyer with no recourse should problems arise. This absence of dependable guarantees often exposes parties to significant risks.

- Impeded Future Opportunities

Unfavorable terms can curtail future opportunities, thereby restricting future growth or strategic flexibility. For example, contractual clauses that severely limit a company's ability to innovate, compete, or expand into new markets establish unfavorable terms. Agreements that prohibit pursuing alternative strategic options, or impede a party's ability to engage in similar pursuits in the future, constitute significant disadvantages.

These examples illustrate how unfavorable terms can manifest in various forms, leading to detrimental consequences in "boo buie nil deals." Recognizing these patterns of unfavorable terms is essential for anticipating risks and potentially avoiding detrimental agreements.

2. Significant Concessions

Significant concessions, a defining feature of a "boo buie nil deal," represent substantial compromises made by one or more parties. These compromises, often in response to perceived pressure or strategic maneuvering, are frequently accompanied by limited or insufficient reciprocal gains. Analyzing the nature and extent of these concessions is critical in assessing the overall value and potential risks associated with such a deal.

- Compromised Long-Term Value

Significant concessions frequently erode the long-term value proposition of an agreement. These concessions might involve sacrificing future growth opportunities, limiting access to key markets, or compromising on essential aspects of technological advancement. For example, a company agreeing to substantial intellectual property limitations in exchange for a smaller market share reduces its future potential significantly. The emphasis on immediate gains at the expense of long-term advantages underscores the potentially problematic nature of such deals.

- Erosion of Competitive Advantage

Concessions can severely impact a party's competitive standing. Giving up market share, relinquishing control over key resources, or forfeiting strategic partnerships might diminish a company's ability to compete effectively in the marketplace. For instance, a company ceding crucial market territories or valuable production technologies to secure a short-term deal risks long-term erosion of competitive advantage. This loss of leverage in the long run can translate to significant disadvantages.

- Reduced Strategic Flexibility

Significant concessions often limit future strategic options. Commitments that tie a party to specific courses of action for an extended period might restrict agility and adaptability. These restrictions might hamper a company's response to evolving market conditions or opportunities. Agreements that impede expansion into new markets or limit innovation demonstrate how such concessions impact future strategic flexibility.

- Impact on Stakeholder Value

Concessions can affect the value perceived by stakeholders, both internally and externally. A company making extensive concessions might face criticism or disappointment from shareholders, employees, or customers who perceive the deal as detrimental to long-term interests. Negative public perception resulting from significant concessions can severely impact investor confidence and damage reputation.

In summary, significant concessions are a cornerstone of a "boo buie nil deal." They often lead to compromised long-term value, erosion of competitive advantage, reduced strategic flexibility, and diminished stakeholder value. Careful consideration and thorough due diligence are crucial in evaluating the implications of such concessions within a broader strategic context.

3. Potential Risks

Evaluating a "boo buie nil deal" necessitates a thorough assessment of potential risks. These risks, often intertwined with unfavorable terms and significant concessions, can significantly impact the long-term viability and strategic objectives of parties involved. Understanding the potential consequences of such deals is critical for informed decision-making.

- Financial Instability

Deals with unfavorable terms frequently expose parties to substantial financial risks. These might manifest as unexpected expenses, fluctuating market conditions impacting investments, or the inability to meet contractual obligations. For example, a company taking on excessive debt in a poorly structured acquisition significantly increases financial vulnerability. Such financial instability can threaten the long-term stability of the organization and its ability to fulfill future commitments.

- Operational Inefficiencies

Unfavorable agreements can lead to operational inefficiencies. This can manifest in compromised production processes, reduced productivity, or the need to redeploy resources away from core competencies. For example, acquisition targets often experience integration challenges which negatively affect operational efficiency, potentially reducing profitability and market share. These operational inefficiencies can lead to decreased profitability and diminished competitive advantage.

- Reputational Damage

Public perception and reputation play a significant role in a company's success. A "boo buie nil deal" perceived as disadvantageous by stakeholders can result in negative publicity, eroding public trust and affecting investor confidence. Examples include acquisitions perceived as overly aggressive or deals with poor ethical implications negatively impacting brand image and share price. Reputational damage has far-reaching implications, affecting future fundraising, investor confidence, and market standing.

- Loss of Strategic Flexibility

Commitments made within a poorly structured deal frequently limit future strategic options. This rigidity can impede adaptability to market changes and reduce opportunities for growth or innovation. For example, contracts with restrictive clauses can prevent a company from entering new markets or developing innovative products, limiting future growth potential. Consequently, loss of strategic flexibility restricts the ability to react to evolving market demands and opportunities, negatively impacting long-term success.

The potential risks outlined highlight the critical importance of rigorous due diligence and comprehensive analysis before engaging in any "boo buie nil deal." Understanding the interconnectedness of these risks, including financial instability, operational inefficiencies, reputational damage, and loss of strategic flexibility, is essential for mitigating the potential harm associated with such agreements.

4. Limited Benefits

The presence of limited benefits is a key characteristic of a "boo buie nil deal." This feature underscores a fundamental mismatch between the perceived value of the agreement and the actual return for one or more parties involved. Understanding the various facets of limited benefits is essential in evaluating such transactions.

- Inadequate Return on Investment (ROI)

A "boo buie nil deal" frequently manifests as an agreement offering a demonstrably inadequate return on the resources invested. This might involve substantial financial outlays, commitment of human capital, or relinquishing strategic assets for minimal, potentially insignificant gains. The disproportion between input and output reflects the limited benefits characteristic of such a transaction. Examples include mergers where the combined entity fails to achieve anticipated synergies or acquisitions where the target's value is significantly overestimated.

- Short-Term Gains at Long-Term Expense

Some "boo buie nil deals" prioritize short-term gains at the expense of substantial long-term benefits. Parties might accept immediate advantages, such as swift market penetration, but potentially forfeit significant future opportunities. These transactions frequently represent a misalignment between short-term objectives and sustainable long-term strategy. Examples include short-term price reductions that erode profitability over time or rushed expansion into markets without proper market analysis.

- Negligible Competitive Advantage

Agreements with limited benefits often fail to confer a tangible competitive advantage. Such transactions might involve securing access to technologies or markets that do not materially enhance a company's position. The lack of a clear or demonstrable improvement in market share or profitability indicates limited benefits and the potential for diminishing returns from the deal. Examples include licensing agreements that do not grant access to novel technologies or partnerships that yield insignificant increases in market penetration.

- Uncertain or Unquantifiable Future Benefits

Deals characterized by limited benefits frequently lack clarity and quantifiable future benefits. The projected returns may be highly speculative or dependent on uncertain market factors or contingent events. This uncertainty significantly reduces the perceived value of the deal and exposes parties to significant risk. Examples include agreements with vague projections or partnerships predicated on ambiguous, future market conditions.

These facets highlight how the absence of tangible, sustainable, or demonstrable benefits is central to the characteristics of a "boo buie nil deal." The lack of clear return on investment, preference for short-term gains, absence of discernible competitive advantage, and reliance on uncertain future benefits underscores the potential pitfalls and risks associated with such transactions. Careful analysis is critical in mitigating the downsides associated with limited or illusory returns within the context of these agreements.

5. Power Imbalance

A significant factor contributing to the problematic nature of a "boo buie nil deal" is power imbalance. This disparity in negotiating strength often leads to agreements where one party makes disproportionately large concessions without adequate compensation. Understanding the dynamics of power imbalance is essential for assessing the fairness and potential risks embedded within such arrangements.

- Unequal Bargaining Positions

A fundamental aspect of power imbalance is the unequal bargaining positions of the parties involved. This disparity might stem from differences in financial resources, market dominance, or legal standing. A party with significantly greater resources or market leverage often possesses the ability to dictate terms, potentially extracting favorable conditions at the expense of the counterpart. This inherent imbalance can lead to agreements that appear one-sided and potentially detrimental in the long term.

- Exploitation of Vulnerability

A concerning aspect of power imbalance is the exploitation of a party's vulnerability. This might manifest through pressure tactics, threats, or the leveraging of a critical need by the more powerful party. A party in a precarious financial situation, seeking a critical acquisition or facing imminent threats might be compelled to accept less favorable terms. This vulnerability can contribute to the creation of a "boo buie nil deal," where the less powerful party is effectively coerced into a disadvantageous agreement.

- Information Asymmetry

Information asymmetry, where one party possesses significantly more information than the other, can also create a power imbalance. This access to privileged or undisclosed details enables the more knowledgeable party to structure the agreement to their advantage. The less informed party may be unaware of crucial details or potential drawbacks, resulting in a deal that is less beneficial than initially perceived. The lack of transparency or access to complete information compounds the power imbalance and contributes to the inherent risks within such a transaction.

- Influence and Control

The exertion of undue influence or control over the other party is another manifestation of power imbalance. This might involve manipulating the decision-making process, applying pressure through various channels, or strategically influencing other stakeholders. Such actions can lead to agreements that are not in the best interests of the less powerful party, effectively generating a "boo buie nil deal." The ability to influence external factors or stakeholders further exacerbates the disparity in negotiating power.

In summary, power imbalance is a significant factor in "boo buie nil deals." The disparity in negotiating strength, exploitation of vulnerability, information asymmetry, and the exertion of undue influence all contribute to the creation of potentially disadvantageous agreements. Rigorous analysis of these power dynamics is essential for evaluating the fairness and potential risks embedded within such transactions, highlighting the importance of considering factors beyond the immediate terms of the deal itself.

6. Market Context

Market context plays a critical role in the evaluation of a "boo buie nil deal." The prevailing economic climate, industry trends, and competitive landscape significantly influence the value and potential risks associated with such agreements. A transaction appearing favorable in a robust market might prove detrimental during a downturn. Conversely, a deal viewed with skepticism during a healthy period could yield positive results in a challenging market. Understanding the market context surrounding a deal is crucial to assessing its long-term viability and potential consequences.

Consider an acquisition in a rapidly expanding market sector. A strategic move deemed beneficial in that environment might prove less advantageous if the sector experiences a sudden downturn. Conversely, a seemingly unfavorable merger during a period of market contraction could yield unexpected positive results if the combined entity leverages the downturn to gain market share or exploit opportunities others missed. Market trends, including shifting consumer preferences, technological advancements, and regulatory changes, directly impact the success or failure of an agreement. A deal might be successful in one market context but prove ill-suited in another.

Furthermore, the overall economic conditions significantly impact the perceived value and potential outcomes of a transaction. High inflation rates, for example, may increase the cost of financing or the price of commodities, factors that must be integrated into a complete assessment of a deal. Analyzing competitors' actions, market share dynamics, and overall industry sentiment are essential to evaluating the full impact of a deal within its specific market context. Understanding the interplay between market conditions and the deal itself allows for a more nuanced assessment, mitigating the risk of overlooking crucial external factors that may drastically alter the deal's success or failure.

In conclusion, recognizing the significance of market context in evaluating "boo buie nil deals" is essential. The prevailing economic climate, sector trends, and competitive landscape all directly influence the outcome. Thorough analysis of market dynamics, encompassing economic conditions, competitor actions, and market sentiment, is imperative for mitigating potential risks and maximizing the likelihood of a successful transaction within its particular context. A robust understanding of the market context provides essential insights for navigating the complexities of complex agreements and mitigating potential negative outcomes.

7. Strategic Implications

Strategic implications, when considered within the context of a "boo buie nil deal," represent the long-term consequences and ramifications for the involved parties. These implications often extend beyond the immediate terms of the agreement, influencing future decisions, competitive positioning, and overall organizational strategy. A thorough evaluation of strategic implications is crucial in assessing the true value and risk profile of such deals.

- Erosion of Competitive Advantage

A "boo buie nil deal" can erode a party's competitive edge. Concessions made in the agreement, particularly concerning intellectual property, market access, or key personnel, can diminish a company's ability to innovate, adapt to changing market conditions, or compete effectively. For example, relinquishing crucial production technologies in a merger could compromise a company's long-term technological advancement and its ability to maintain a competitive advantage in the future.

- Compromised Future Growth Opportunities

Strategic implications often involve the limitation or outright elimination of potential future growth avenues. A "boo buie nil deal" might restrict a company's ability to expand into new markets, develop new products, or acquire critical resources for future expansion. This restriction on future opportunities directly impacts the overall strategic trajectory of the organization, potentially hindering long-term growth and profitability.

- Damage to Brand Reputation and Stakeholder Trust

A perceived "boo buie nil deal," especially one with unfavorable terms or significant concessions, can negatively impact a company's brand reputation and the trust of stakeholders. This loss of trust and unfavorable public perception can result in decreased investor confidence, diminished employee morale, and a decline in customer loyalty. The reputational damage caused by a poorly perceived transaction can have significant, long-term consequences on a company's overall strategic standing.

- Weakened Strategic Flexibility

Strategic implications often involve reduced flexibility in future decision-making. A "boo buie nil deal" might include clauses that restrict a company's ability to adapt to changing market conditions or pursue alternative strategic initiatives. For instance, overly restrictive contracts could hinder a company's response to emergent competitors or evolving customer needs, ultimately jeopardizing its strategic flexibility. This lack of adaptability can create significant long-term challenges.

Ultimately, assessing the strategic implications of a "boo buie nil deal" requires a comprehensive analysis extending beyond the immediate financial considerations. A thorough evaluation of potential future consequences, including the impact on competitive position, growth opportunities, stakeholder trust, and strategic flexibility, is crucial for accurately predicting the overall success or failure of such an agreement. Understanding these strategic implications provides a more holistic view of the deal's true potential risk and return.

Frequently Asked Questions About "Boo Buie Nil Deals"

This section addresses common inquiries regarding agreements often characterized by significant concessions and potentially limited benefits. The following questions and answers aim to provide clarity and insight into the nuances of such transactions.

Question 1: What defines a "boo buie nil deal"?

A "boo buie nil deal" refers to an agreement perceived as disadvantageous due to significant concessions made by one or more parties in exchange for limited or insufficient benefits. The term highlights situations where substantial compromises are demanded with potentially inadequate compensation. These deals may be characterized by unfavorable terms, a power imbalance, and limited future benefits, potentially posing significant risks for the affected parties.

Question 2: What are some common characteristics of such deals?

Common characteristics include unfavorable financial terms, disproportionate asset transfers, limited or illusory guarantees, impeded future opportunities, and a significant power imbalance between parties. These deals may prioritize short-term gains at the expense of long-term value and may involve concessions that compromise future growth or competitive standing. There may also be a lack of transparency or clear benefits.

Question 3: How can one assess the potential risks associated with these deals?

Assessing risks involves evaluating unfavorable terms, significant concessions, limited benefits, power imbalances, market context, and strategic implications. Analysis should encompass factors like financial stability, operational efficiency, reputational damage, and potential loss of strategic flexibility. Thorough due diligence and a critical examination of the surrounding circumstances are paramount.

Question 4: How does market context influence the evaluation of these deals?

Market context is crucial. Economic conditions, industry trends, and competitive landscape significantly impact a deal's evaluation. Favorable conditions in one period may not translate to success in another. The interplay between internal factors within the deal and external market forces must be considered.

Question 5: What are the potential long-term strategic implications?

Long-term implications extend beyond immediate financial gains. These deals can erode competitive advantages, limit future growth, damage brand reputation, and weaken strategic flexibility. A careful assessment of these implications is vital for making informed decisions.

Question 6: How can one mitigate risks associated with these transactions?

Mitigating risks involves comprehensive due diligence, thorough analysis of all terms and conditions, careful consideration of the power dynamics, understanding the surrounding market context, and seeking expert advice. Building a strong negotiating position, considering alternative options, and avoiding undue pressure are crucial preventative measures. A thorough and cautious approach is necessary when dealing with potentially problematic transactions.

Understanding the characteristics, risks, and implications of "boo buie nil deals" is critical for making informed decisions and minimizing potential negative consequences. This requires a nuanced and multi-faceted approach, considering both internal factors and the external market environment.

The subsequent sections will delve into specific examples and case studies, illustrating the practical application of these concepts in real-world scenarios.

Navigating Potential "Boo Buie Nil Deals"

This section provides actionable advice for individuals and organizations seeking to avoid potentially disadvantageous agreements. Understanding the characteristics of a "boo buie nil deal" is crucial for prudent decision-making.

Tip 1: Conduct Comprehensive Due Diligence. Thorough investigation is paramount. Examine all contractual terms, financial projections, market analyses, and associated risks. Scrutinize potential concessions and their long-term implications. Consult legal and financial experts to ensure a comprehensive understanding of the agreement's potential pitfalls. For instance, an acquisition target should undergo detailed financial analysis, independent legal review, and competitive benchmarking to evaluate its true worth and potential integration challenges.

Tip 2: Establish Clear Objectives and Benchmarks. Define precise goals for the agreement. Develop clear benchmarks for success, including measurable financial metrics, performance indicators, and anticipated benefits. Establishing these standards provides a framework for evaluating the agreement's effectiveness against intended objectives. An example is to quantify desired market share gains, revenue increases, or cost reductions.

Tip 3: Understand and Analyze Power Dynamics. Recognize and analyze the relative bargaining power of all parties involved. Identify potential vulnerabilities and assess the motivations driving the negotiation. An in-depth understanding of power imbalances can significantly aid in negotiating favorable terms. This includes considering the potential for coercion or exploitation of vulnerabilities.

Tip 4: Evaluate Market Context and Industry Trends. Consider the broader economic and industry environment. Assess current market conditions, industry trends, competitive landscapes, and potential risks or opportunities arising from market dynamics. For example, consider macroeconomic factors, specific industry disruptions, or evolving regulatory frameworks.

Tip 5: Seek Diverse Perspectives and Independent Opinions. Gather input from a variety of sources, including internal experts, external consultants, and legal counsel. Seek diverse viewpoints to obtain a comprehensive understanding of the deal's strengths and weaknesses. An external review of the deal by independent parties provides critical perspective and potentially identifies previously unforeseen risks.

Tip 6: Develop Contingency Plans. Anticipate potential challenges or unforeseen circumstances. Develop contingency plans for various scenarios, ensuring a level of preparedness to mitigate negative consequences and maintain strategic flexibility. This includes preparing for potential market downturns, regulatory changes, or unforeseen competitor actions.

Implementing these strategies enhances the likelihood of avoiding potentially disadvantageous agreements and ensures informed decisions aligned with long-term strategic objectives.

The following sections will delve deeper into specific case studies, illustrating how these principles can be applied in practice to real-world scenarios.

Conclusion

The analysis of "boo buie nil deals" reveals a complex interplay of factors that can lead to significant risks and potentially detrimental outcomes for involved parties. Key characteristics such as unfavorable terms, substantial concessions, limited benefits, power imbalances, and a challenging market context frequently contribute to the problematic nature of these transactions. Understanding the potential for erosion of competitive advantage, compromised future growth, reputational damage, and reduced strategic flexibility is crucial. The evaluation of such deals necessitates a comprehensive approach considering both internal and external factors. Thorough due diligence, clear objectives, and a nuanced understanding of power dynamics are critical in navigating these complexities and mitigating potential risks.

The significance of this analysis lies in its ability to provide a framework for informed decision-making. By understanding the potential pitfalls embedded within "boo buie nil deals," stakeholders can better evaluate the true value and risk profile of potential agreements. Careful consideration of market context and strategic implications are paramount in avoiding outcomes that compromise long-term success. Future research and analysis of similar transactions can enhance understanding, ultimately leading to more robust strategies for navigating complex negotiations and minimizing the likelihood of unfavorable agreements.

Article Recommendations

/cdn.vox-cdn.com/uploads/chorus_image/image/72010733/gallery_image__24_.0.jpeg)

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaK%2BforKvecCrq2agmajBsL7YaJmop12XwqqxjKegpWWUmq6tesetpKU%3D