Determining an individual's financial standing, often expressed as net worth, provides a snapshot of their accumulated assets minus liabilities. This figure for Victor French, if available, reflects the total value of his possessions, such as real estate, investments, and other holdings, less any debts or obligations. It is a measure of his overall financial position at a specific point in time.

The importance of knowing French's net worth depends on the context. For investors, it can be a factor in evaluating potential investments or partnerships. For biographical purposes, it can offer a glimpse into his economic standing and its potential evolution over time. Public figures, in particular, often have their financial situation scrutinized, which can be a subject of public discussion in relation to their career or personal life. However, the value of this information needs to be considered within a broader framework of individual privacy and journalistic ethics.

The following article delves into aspects of French's life and career, touching on potential influences on his financial situation. It will explore factors that may have contributed to his financial standing. This will include an analysis of any notable career developments or achievements that might have played a role.

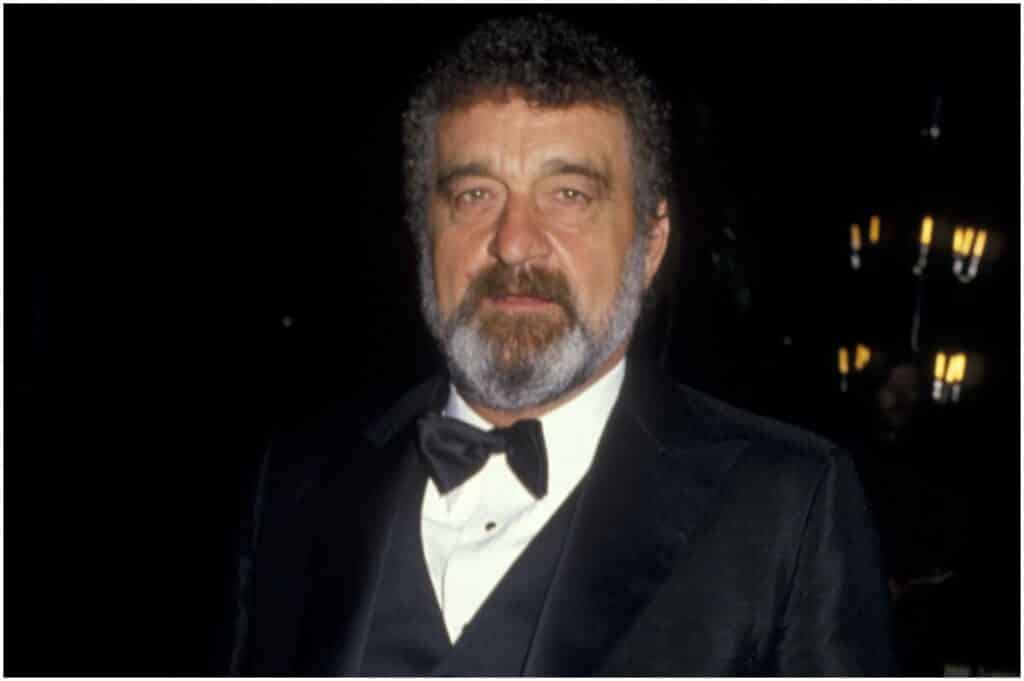

Victor French Net Worth

Understanding Victor French's net worth requires examining various factors contributing to his financial standing. This analysis considers key aspects of his life and career to provide a comprehensive overview.

- Career Earnings

- Investment Returns

- Asset Holdings

- Business Ventures

- Income Sources

- Debt Obligations

- Historical Context

- Public Information Availability

These aspectscareer earnings, investment returns, and asset holdingstogether paint a picture of his financial life. His income sources (salaries, dividends, etc.) provide context. Debt obligations, on the other hand, subtract from his net worth. Historical context (economic periods, market fluctuations) is crucial to understanding how these factors might have affected his financial situation. Public information availability, however, significantly limits the clarity of this analysis, often only revealing broad, general estimations. The specific values and relationships between these aspects would require in-depth analysis of available financial records.

1. Career Earnings

Career earnings represent a significant component of overall net worth. The amount earned throughout a professional life, including salaries, bonuses, and other compensation, directly contributes to the accumulation of assets. Higher career earnings generally lead to greater financial resources, which can be invested or used to acquire assets like real estate or other holdings. Conversely, lower earnings may limit opportunities to build a substantial net worth.

Consider, for example, a high-earning professional in a rapidly growing industry. Consistent high salaries and potentially lucrative bonuses provide significant resources for investment and asset acquisition. These activities can yield a sizable net worth over time. In contrast, an individual with a career in a less lucrative field may find it more challenging to amass substantial assets, resulting in a lower net worth. Factors such as career trajectory, industry trends, and personal financial choices all play a critical role in determining the correlation between career earnings and net worth.

Understanding the relationship between career earnings and net worth is crucial for financial planning. Professionals can evaluate their career paths and income potential to determine their ability to accumulate wealth over time. This knowledge informs investment strategies and financial decision-making. Assessing career earnings in the context of personal financial goals can also aid in setting realistic expectations for future financial security.

2. Investment Returns

Investment returns significantly influence an individual's net worth. The gains or losses realized from investments directly impact the overall financial position. Understanding the nature and magnitude of these returns is crucial for assessing the potential contribution to total wealth, as seen in the case of Victor French. This analysis delves into specific aspects of investment returns and their role in shaping financial standing.

- Types of Investments

Different investment avenues yield varying returns. Stocks, bonds, real estate, and other instruments each carry specific risk-return profiles. The choices made regarding these investments directly impact the overall return. The diversification of investments can play a crucial role in mitigating risk and potentially increasing returns.

- Risk Tolerance and Return Expectations

Investors with differing risk tolerances often exhibit diverse investment strategies and, consequently, varying potential returns. High-risk investments, while potentially yielding substantial gains, also carry a greater chance of loss. Conversely, low-risk investments typically offer lower returns but greater stability. The appropriateness of an investment strategy hinges on the investor's risk tolerance and desired return profile. Understanding these factors is important for assessing their contribution to the financial situation of an individual like Victor French.

- Time Horizon and Compounding

The length of time an investment is held can significantly affect returns. Compounding, the earning of returns on prior returns, is crucial for substantial wealth accumulation over extended periods. Long-term investments, with their potential for compounding, often yield higher returns compared to short-term investments. The timeframe of investments and how they interact with compounding significantly impacts the ultimate net worth of an individual, including Victor French.

- Market Conditions and Economic Factors

External economic factors and market fluctuations exert considerable influence on investment returns. Periods of economic expansion generally correlate with higher returns, while recessions or market downturns can lead to losses. An investor's ability to adapt to these changes is crucial for sustained success. Market conditions influence investment returns across all asset classes, therefore impacting the overall net worth calculation for Victor French or any other individual.

Investment returns, in combination with other factors like career earnings and asset management, contribute to the overall net worth of an individual. The interplay between these elements, shaped by personal choices, market conditions, and economic trends, determines the trajectory of a person's financial standing. Analysis of specific investment strategies, combined with market data and economic forecasts, would provide a more accurate assessment of the contribution of investment returns to Victor French's net worth.

3. Asset Holdings

Asset holdings directly influence Victor French's net worth. The value of an individual's assets, such as real estate, investments, and other holdings, represents a significant portion of their overall financial standing. A substantial portfolio of valuable assets generally translates to a higher net worth. Conversely, a lack of substantial assets contributes to a lower net worth.

The specific types of assets held and their market values are crucial determinants. High-value real estate holdings, strategically placed investments, and ownership of valuable businesses can dramatically increase net worth. Conversely, holding assets of low value or in declining markets can decrease overall net worth. For example, an individual with a substantial property portfolio in a rapidly appreciating real estate market will likely experience a higher net worth compared to someone holding similar assets in a stagnant or declining market. The same principle applies to other types of assets, such as stocks or bonds, where market fluctuations significantly impact their value and consequently, the overall net worth.

Understanding the composition and value of asset holdings provides critical insight into financial health and potential. Detailed analysis of these holdings, considering their current market valuation and potential future appreciation, provides a more comprehensive understanding of Victor French's overall financial situation. This analysis enables a broader perspective on his financial position, offering a detailed view of his wealth accumulation strategy and potential future financial outlook. Recognizing the significance of asset holdings is crucial for anyone seeking to understand an individual's financial position and its potential trajectory. The link between asset holdings and net worth underscores the importance of sound investment strategies and prudent management of financial resources to build and maintain overall wealth.

4. Business Ventures

Business ventures undertaken by an individual significantly impact their net worth. The success or failure of these ventures directly correlates with the accumulation or diminution of wealth. This section explores the connection between business activities and the overall financial standing of Victor French, highlighting key facets of this relationship.

- Profitability and Revenue Generation

The profitability of ventures directly contributes to accumulated wealth. Successful ventures generate revenue exceeding operational costs, leading to profits that can be reinvested, increasing assets and ultimately elevating net worth. Conversely, ventures generating losses diminish net worth. Examples include profitable startups, successful franchises, or high-yield investments.

- Asset Creation and Appreciation

Successful ventures often lead to the creation of valuable assets. These assets, ranging from intellectual property to physical infrastructure, increase the overall value of the portfolio. Strategic acquisitions, for instance, can substantially elevate net worth. Examples include ownership of profitable businesses, real estate holdings gained through ventures, or valuable intellectual property generated through research and development initiatives.

- Risk and Return Considerations

Business ventures inherently involve risk. The potential for high returns is often accompanied by the possibility of substantial losses. Successful ventures require careful risk assessment and mitigation strategies. This aspect affects the balance between risk-taking and potential reward, impacting the trajectory of net worth. High-risk ventures could significantly boost net worth, but also potentially result in financial devastation if not appropriately managed.

- Financial Leverage and Debt Management

Business ventures often necessitate substantial financial leverage or borrowing. The effective management of debt is crucial. A debt-financed venture, while potentially offering rapid growth, can also significantly impact net worth if debts exceed returns. The ability to effectively manage leverage in a business venture directly influences the net worth of an individual. Successful venture capital strategies, for instance, demonstrate how leveraging finances can increase net worth; however, poor leverage management can lead to substantial financial issues.

In conclusion, business ventures play a pivotal role in shaping Victor French's net worth. The interplay of profitability, asset creation, risk assessment, and debt management are crucial factors. A thorough understanding of these components and their interaction provides a more complete picture of the influence of business endeavors on his overall financial position. Analyzing the historical performance and current state of these ventures provides critical insight into predicting future financial performance and potential for net worth growth.

5. Income Sources

Income sources are fundamental to understanding Victor French's net worth. The nature and magnitude of income streams directly influence the accumulation of wealth. Higher, more consistent income allows for greater savings, investments, and asset acquisition, all factors contributing to a higher net worth. Conversely, limited or erratic income sources constrain financial growth, potentially resulting in a lower net worth. The types and stability of these income sources are key determinants in assessing financial health. Consider a professional athlete, for example. A high-earning athlete with a well-structured career path and potentially lucrative endorsements builds significant wealth. Conversely, an individual reliant solely on low-paying employment or with intermittent income faces significant challenges in accumulating substantial assets. The principle is widely applicable; the correlation between income sources and net worth is evident in numerous professions and personal circumstances.

Analyzing income sources involves examining their predictability and potential for growth. Regular, predictable income from stable employment or investments offers a strong foundation for financial security and future wealth accumulation. A diversified portfolio of income sources for example, salary from employment combined with investment dividends or rental income often proves more resilient to economic fluctuations than a singular income stream. Fluctuations in various income sources salary reductions due to economic downturn, or stock market downturns are factors requiring careful consideration. Understanding how these dynamics interplay with other financial aspects, such as spending habits and investment strategies, is vital to evaluating the overall trajectory of an individual's financial standing.

In conclusion, income sources are pivotal in determining net worth. Their stability, predictability, and diversification influence wealth-building potential. Identifying and understanding the components of income sources, along with the factors affecting their fluctuations, is crucial for developing sound financial strategies, and for comprehending the factors behind an individual's financial profile. This understanding is key to successful financial planning and prudent asset management, a crucial aspect for anyone aspiring to achieve long-term financial security and prosperity.

6. Debt Obligations

Debt obligations significantly influence an individual's net worth. Debt represents liabilities that reduce the overall value of assets, thus impacting the net worth calculation. The presence and magnitude of debt obligations directly affect the financial health and stability of an individual. Understanding the nature of debt and its impact is crucial for assessing the true financial position of Victor French.

- Types of Debt

Various forms of debt exist, including mortgages, loans, credit card debt, and outstanding business liabilities. Each type carries different terms and interest rates, impacting the overall financial burden and influencing the calculation of net worth. The type of debt and its terms play a crucial role in evaluating the impact on net worth. High-interest debt, for example, significantly reduces the net worth compared to low-interest debt.

- Debt-to-Asset Ratio

The debt-to-asset ratio, calculated by dividing total debt by total assets, provides a critical indicator of financial health. A high ratio suggests a greater financial risk, potentially impacting the ability to meet debt obligations and reduce the overall net worth. A low ratio generally indicates a healthier financial position and better ability to manage debt obligations.

- Interest Rates and Costs

Interest rates associated with debt directly impact the total cost of borrowing. High-interest debts increase the overall financial burden and contribute to a lower net worth. Understanding the interest rates on various debts is crucial for assessing the financial strain they impose. The impact on net worth is directly proportional to the magnitude of these costs, thus highlighting the significance of effective debt management.

- Impact on Liquidity

High levels of debt obligations can impact an individual's liquidity. Meeting debt obligations requires readily available funds. Limited liquidity can make it challenging to cover unexpected expenses or capitalize on opportunities. This effect on liquidity can directly affect an individual's ability to generate wealth and accumulate assets, indirectly impacting net worth.

The presence and magnitude of debt obligations, alongside the factors listed, are crucial considerations in evaluating an individual's net worth. Analyzing these facets provides a more comprehensive understanding of Victor French's financial position. Without accurate data on the specifics of his debt obligations, any assessment of his net worth remains incomplete. A holistic view, considering both assets and liabilities, is essential to a proper evaluation.

7. Historical Context

Understanding the historical context surrounding Victor French's life and career is essential for a comprehensive assessment of his net worth. Economic conditions, market trends, and societal factors significantly influence individual financial trajectories. Analyzing these historical dynamics provides valuable insight into the potential drivers and constraints impacting his accumulation of wealth.

- Economic Cycles and Market Fluctuations

Periods of economic expansion or recession profoundly affect investment returns and asset valuations. A surge in the stock market during a particular era, for instance, could significantly increase the value of investments held by Victor French, leading to a higher net worth. Conversely, a market downturn during a specific time frame might diminish the value of his assets, resulting in a lower net worth. Careful consideration of historical economic trends is vital to understanding the potential impact on his financial well-being.

- Inflation and Currency Fluctuations

Changes in inflation rates influence the purchasing power of money. Rising inflation erodes the value of savings and assets, potentially affecting net worth. Variations in currency exchange rates also impact the value of international investments held by Victor French, potentially altering his net worth depending on the currencies involved. Tracking historical inflation and currency trends assists in contextualizing the real value of his assets throughout different periods.

- Technological Advancements and Industry Shifts

Technological innovations and industry transformations can profoundly alter the value of certain assets and the profitability of specific ventures. New technologies or evolving industry demands may have created opportunities or presented challenges for Victor French, directly or indirectly impacting his financial success. Assessing the impact of technological or industrial changes on his career or business endeavors is crucial for understanding their contribution to his overall net worth.

- Government Policies and Regulations

Government policies, including tax laws, regulations, and economic incentives, directly impact individuals' financial situations. Changes in tax policies, for example, may have altered the after-tax returns of investments held by Victor French, impacting his overall net worth. Studying the evolution of government policies over time clarifies their influence on his financial standing and investment decisions, potentially illuminating the effectiveness of his strategies.

Considering these historical facetseconomic cycles, inflation, technological advancements, and government policiesprovides a more nuanced understanding of the factors impacting Victor French's net worth. By examining these elements in context, a more accurate picture of his financial trajectory becomes possible, allowing for a more comprehensive evaluation of his wealth accumulation strategies.

8. Public Information Availability

Assessing an individual's net worth, particularly for a public figure like Victor French, frequently hinges on the availability and reliability of public information. The transparency of financial records, reported earnings, and publicized assets form a basis for estimations, but limitations in access to complete data often introduce significant uncertainty.

- Reported Earnings and Income Sources

Publicly available financial reports, such as those for companies Victor French might be associated with, could offer insights into income streams. However, these figures are often general, omitting specifics on personal income that contribute to his overall net worth. For example, if Victor French is a high-level executive, the company's financial statements might reveal overall compensation but not individual components, leaving considerable information gaps.

- Asset Holdings and Investments

Public filings or reports concerning real estate transactions, investments, or other holdings might be accessible, but frequently lack detail. Public record searches could uncover property ownership, but detailed valuations remain obscured. Similarly, information about investments might be fragmented, giving only partial views of portfolio diversification and total asset value. These limited disclosures significantly impact estimations.

- Business Ventures and Ownership

Details about business ventures and ownership interests, if publicly disclosed, can contribute to estimations of net worth. For instance, if Victor French is a part owner of a publicly traded company, the value of his stake may appear in publicly available financial reports. However, the lack of detailed disclosure on private businesses or complex ownership structures severely limits the accuracy of such assessments.

- Legal and Financial Records

Access to court filings, tax records, or other legal documents might provide additional clues, but usually involves complex research methods and often faces limitations due to privacy concerns and legal restrictions on public access. Without full access to these records, determining Victor French's precise net worth is difficult.

In conclusion, the availability of public information plays a critical role in estimating Victor French's net worth. While reported data can offer valuable fragments of the overall picture, limitations in access to comprehensive records introduce substantial uncertainty. Therefore, estimations of net worth often represent only educated guesses, not precise calculations, especially when dealing with private or complex financial structures.

Frequently Asked Questions about Victor French's Net Worth

This section addresses common inquiries concerning Victor French's financial standing. Accurate determination of net worth often necessitates detailed analysis of financial records, which are not always publicly available. These FAQs provide context for understanding the complexities involved.

Question 1: How is net worth calculated?

Net worth represents the difference between an individual's assets (possessions of value) and liabilities (debts or obligations). This calculation considers various components, such as real estate, investments, and other holdings, against debts and outstanding obligations. The accuracy of any net worth estimation depends heavily on the completeness and reliability of the data used in the calculation.

Question 2: Why is the exact net worth of Victor French not readily available?

Publicly available financial information for individuals is often limited. Privacy considerations frequently restrict access to detailed financial records. Furthermore, complex investment structures, private business ventures, and varying degrees of transparency in financial dealings can further hinder the determination of precise net worth figures.

Question 3: What factors influence net worth estimations for public figures?

Public figures, like Victor French, may face scrutiny of their financial standing. Considerations often include their career trajectory, investment choices, economic conditions, and societal context. The availability of publicly reported data on income, assets, and debt plays a role in shaping these estimations, but gaps in information may result.

Question 4: Can publicly available information reveal clues about net worth?

Publicly accessible information, such as company filings, financial statements, and reported earnings, can offer fragments of insight. These partial disclosures may provide a limited understanding of income streams and assets but may not reflect the totality of an individual's financial position.

Question 5: How do historical contexts impact net worth estimations?

Economic fluctuations, inflation, and other historical events significantly influence asset values and the overall financial landscape. Historical context provides crucial background information to interpret any estimated net worth figure for Victor French. Understanding these influences enhances the interpretation of the data.

Question 6: What are the limitations of publicly available estimations?

Public estimations often represent educated guesses rather than precise calculations. The lack of complete financial records and varying degrees of transparency in financial matters, especially for private individuals, create inherent limitations. These estimations should be viewed as approximations, not definitive measures.

In summary, understanding Victor French's net worth requires acknowledging the inherent complexities and limitations of available data. Public estimations serve as potential indicators but lack the comprehensive detail of complete financial records. Further exploration might illuminate more specific factors that have influenced his financial standing.

The following sections delve into Victor French's career, achievements, and potential factors impacting his financial situation.

Tips for Understanding Net Worth

Determining and understanding net worth involves a comprehensive evaluation of financial factors. These tips offer practical guidance for navigating this complex process.

Tip 1: Define Net Worth Accurately. Net worth represents the difference between total assets and total liabilities. Assets encompass items of economic value, including cash, investments, property, and other holdings. Liabilities represent debts, obligations, and outstanding financial commitments. This precise definition is fundamental to understanding any individual's financial position.

Tip 2: Identify and Categorize Assets. A crucial step involves meticulously identifying and categorizing assets. This process includes distinguishing between liquid assets (easily convertible to cash, like savings accounts and readily-sold stocks) and illiquid assets (less easily converted to cash, like real estate and certain investments). Accurate categorization enhances the precision of net worth calculations.

Tip 3: Document and Value Liabilities. Carefully document all outstanding debts, including loans, mortgages, credit card balances, and other financial obligations. Precise valuation of these liabilities is essential. Accurately assessing the total amount owed and the associated interest rates provides a comprehensive picture of the financial burden.

Tip 4: Research and Evaluate Market Values. Understanding the current market values of assets is critical. This involves research, expert consultations, and consideration of recent market trends. The value of assets, particularly investments and real estate, fluctuates, requiring up-to-date assessment for accurate net worth calculation.

Tip 5: Account for Potential Tax Implications. Tax obligations related to assets and liabilities significantly impact net worth. Thorough examination of potential tax liabilities linked to investment income, property holdings, and other assets is essential. Understanding the tax implications adds precision to the net worth assessment.

Tip 6: Utilize Reliable Data Sources. Publicly available information often provides limited insight. Consult credible financial professionals and seek expert analysis for a comprehensive understanding of an individual's financial position. Financial institutions, accountants, and investment advisors provide valuable perspectives.

Tip 7: Recognize the Limitations of Public Information. Accurate net worth calculations, especially for individuals whose financial dealings aren't publicly disclosed, often require a combination of research and direct communication with the individual. Public information, although sometimes available, may provide only partial information.

Following these guidelines provides a solid framework for understanding net worth calculations. Accurately and comprehensively determining net worth involves meticulous data collection, reliable valuations, and consideration of various influencing factors.

These tips lay the groundwork for deeper analysis, enabling a more thorough comprehension of individual financial situations. Further research and potentially consulting experts are necessary for individuals aiming for a highly detailed understanding of net worth in specific cases.

Conclusion Regarding Victor French's Net Worth

This analysis explored various factors influencing Victor French's financial standing. Key considerations included career earnings, investment returns, asset holdings, business ventures, income sources, debt obligations, historical context, and the availability of public information. While public information regarding specific financial details remained limited, the exploration highlighted the complex interplay of these factors in shaping an individual's overall financial position. The analysis underscored the substantial influence of economic cycles, market fluctuations, and individual choices on wealth accumulation. The analysis also stressed the crucial role of accurate data and comprehensive records in definitively determining net worth.

Ultimately, a precise determination of Victor French's net worth remains elusive without complete and verifiable financial records. However, the exploration provides valuable context, illustrating the multifaceted nature of individual financial situations. This analysis serves as a framework for understanding the elements contributing to financial success and stability. Further, it underscores the significance of responsible financial planning and the complexities inherent in evaluating wealth accumulation.

Article Recommendations

ncG1vNJzZmibkafBprjMmqmknaSeu6h6zqueaKSVlrGqusZmq6GdXZi1orrGnmavoZOpvLN5xaucp5uYYrumwIywpqusmGO1tbnL